The Age of Contactless Payment: Trend and Future of POS

Due to the fourth industrial revolution, we often hear news about how our lives will drastically shift in near future. Keywords for the fourth industrial revolution are autonomous automobiles, internet of things, 5G, artificial intelligence, and clouds, followed by fintech. Convenient payment service is a branch of fintech, and the contactless payment system market grew explosively owing to the consumers’ concern over the hygiene during the COVID-19 pandemic. Also, a widely shared perception of paper money being a medium of spread for the virus would continue to play an important role for the contactless payment to be widely used even after the end of the pandemic. We investigated the status quo of the payment systems and the upcoming changes with a POS expert’s view on the matter.

What is Fintech?

Being an abbreviation of finance and technology, fintech refers to computer programs and other technology used to support or enable banking and financial services. In old times, you would place an order for stock exchanges at a financial institution’s branch or through a phone call. Nowadays, you can easily buy and sell stocks on your computer and smartphone. Furthermore, you can open an account online without brining your documents to the bank, not to mention that you can send money to other people on your phone. Within our purview, fintech consists of P2P finance and quick payment system such as Apple Pay.

**P2P Finance: a fintech that connects lenders and investors online.

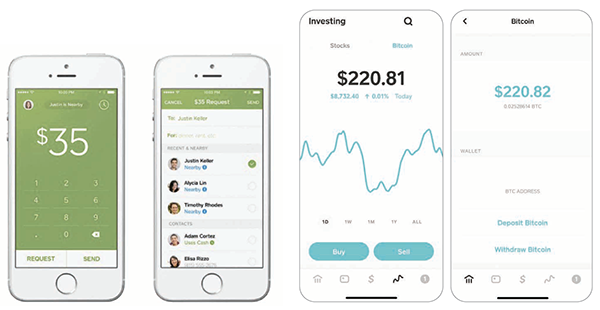

@square

A cash app in which you can buy and sell stocks or send money via the phone using email addresses and cell phone numbers for free.

Contactless Trend, Contactless Payment

Contactless payment system enables credit card transaction without swiping a plastic card or using IC (Integrated Circuit) chips by employing NFC (Near Field Communication) chips or mobile wallets such as Apple Pay and Google Pay. Hence they are better options for hygiene.

Before the pandemic, American consumers have used the credit cards and PIN pads to enter passwords without complaints, but nowadays many retailers are accepting only contactless payment or credit cards avoiding cash transactions. In fact, many retail storeowners reported more credit card transactions and less cash transactions in the last yearend season, so the trend will likely continue. If your store has POS systems enabling these types of transaction, you should post a sign on the front door or in front of the cash register to inform customers about accepted payment methods.

A retail store with mobile pay signage on the front door.

47% of Consumers Said They Would Only Shop At Stores Accepting Contactless Payment.

According to the survey conducted by VISA, only 20% of small to mid-sized businesses used contactless payment in June 2020, but now 82% of small to mid-sized businesses adopted digital payment method in response to the pandemic. In addition, 47% of consumers stated that they would only shop at stores offering contactless payment system, and 73% of the millennial, 61% of X-generations, and 50% of the boomers are disinfecting their physical cards to up their hygiene.

Diversifying Contactless Payment Methods

Experts anticipate the demand for contactless payment system should continue to rise in the future. There are increasing varieties of contactless payment devices, including tap-to-pay credit cards and mobile phones, wrist bands, watches, and smart clothes. Many wearable devices are launching with built-in payment methods. To explain briefly, if you simply hold up your devices near a payment terminal, your Apple Watch or wristband will use stored credit card information to make a payment.

In this regard, Payments Source, a source providing analyses about payment industry, reported that one of the selling points for wearable devices is mobile payment function. As the wearable market expands, the mobile payment technology is getting into the hands of many consumers and increasing the user experience. The report predicted that in 2023 the global wearable device sales would reach 260 million devices.

**Wearable devices: devices that can be worn by users such as glasses, clothes, and watches.

NFC contactless smart ring payment (Image credit: K Ring)

What Beauty Supply POS Experts Say About Payment Service and POS Trend.

— Goldenkey POS CEO Eric Kim

Contactless payment is not a trend but a necessity!

Two years before the outbreak of the Covid-19, Apple debuted its contactless payment system Apple Pay, and consumers realized the convenience. Starting from big chain stores, many stores started to accept it. Ever since the pandemic, even small retail stores are increasingly making shift toward newer payment methods replacing their old systems. In the beauty supplies, it is not too hard to find an old system that only functions as a cash register. For now, Apple Pay is the most popular contactless payment system, followed by Samsung Pay and Google Pay.

Mobile Pay has no Charge-Back.

Mobile pay is more secured than credit cards because it does not expose the credit card number, and the next advantage is hygiene. For the retail storeowners, the greatest benefit is no chargeback. Even if the customers make a claim, you win 100% of the times. Mobile pay utilizes a unique token randomly generated for every transaction, and it also requires Face ID or fingerprints on the smartphone.

**Chargeback: refund to the consumers authorized when a customer disputes an approved transaction.

Cloud POS frees you from physically being at the store.

Previous POS stores data in the hard disk drives inside a computer, including customer data and sales records, but cloud-based POS system stores them in a place like Google Drive and One Drive where you can access anytime anywhere. This makes the system quicker and lighter on your computer.

First, it is secure. Beauty supplies, like many retail stores, have no separate security team, so the security is vulnerable. Cloud POS automatically locks up the hosting when there is emergency or theft of the computer system. Like in case of a lost iPhone, you can preserve all the data as long as your have an account information to access systems like iCloud. Goldenkey utilizes the cloud servers of Oracle, a global cloud service provider. The server and data is 24-hour secured.

Secondly, the transaction records are accurate. Generally, beauty supplies use two to three POS terminals, and traditional POS systems rely on private servers, which are buggy and error prone. In many cases, you would not find the sales recorded from the Register No. 1 in the register No. 2. On the other hand, web-based cloud systems store all the information in the network of servers that are organically synchronized 24/7.

Thirdly, even if you are not present at the store, you can access the POS system. You can use mobile apps or laptops to access all data off the computers. As many storeowners do not physically stay within the stores anymore, you can greatly benefit from accessing transactions recorded in the register from anywhere and accessing multiple store locations at the same time.

Lastly, the cost saving and automatic updates for newer versions. While cloud-based services require monthly fees via subscription, you can save the cost associated with POS system updates that happen every 3 to 5 years. At this time, Goldenkey charges $60 a month for its cloud service, and the subscription fees are tax deductible. In addition, many premium features that are offered at additional costs from other providers are included in the $60 monthly subscription of Goldenkey.

Hybrid POS system allows continuation of business at the time of server down and no internet.

The worst nightmare for retail storeowners who use POS system is store shutdown caused by internet service or server disruption. For credit cards, you would think you cannot process them without internet, but Goldenkey’s hybrid POS can operate on phone line network of towers to store the information offline and transmit the data when internet service is back on. You can use the system up to 15 days without internet.

Goldenkey recommends the following essentials for beauty supplies.

There should be distinctions in functionality for beauty supply POS system. Goldenkey fully appreciates the need and developed an optimized POS tailored to beauty supplies. Many POS systems are marketed by distributers who purchased a system developed by a single developer. They are more like dealerships. In this situation, there lies a gap between the developer and the storeowners. To eliminate the gap, different software is provided to different types of business.

First, you need employee management system. As beauty supplies become larger, you have more employees. As the minimum wage increases, it is harder to manage human resource, you say. Today’s POS systems help you analyze sales revenue data for specific days and hours at a single glance, so you can increase employees for busy hours and reduce the numbers for slow hours.

Secondly, beauty supplies tend to have many customers who bring their items including wigs from the wig section to the cash registers for a hold and continue to shop for more items. For these situations, you can hold items from unlimited number of customers.

Thirdly, you need discount functionality. Grocery stores have products that have various prices per weight, and the discount rules largely differ from beauty supplies. Especially, Korean business owners tend to come up with brilliant discount rules of many kinds. For example, you would run Buy 2 Get 1 Free deals for low-cost items such as accessories, and you might want to exclude chemicals in beautician discount. These beauty supply specific discount rules are included in the software.

Lastly, you can receive a warning of suspicious activities at registers. Time is money for many business owners, and owners cannot attend the stores and monitor registers 24/7. When there is irregular activities like voided transactions or big discounts applied, you can opt to receive notification. As POS technology advances, it is hard for employees to find a loophole to take advantage of the system.

You cannot survive unless you are a multiplayer.

Diversification is the common ground for the fourth industrial revolution. Simply put, in old days, athletic people would play sports, and artistic people would make a living by playing music, but younger people have to do everything well. The same goes for the POS system. POS is an abbreviation of Point Of Sale, and it used to work like a cash register. However, nowadays most POS system has multiple functionalities like sales analysis, inventory management, human resource, customer rewards program, and gift card programs. As the demand grows from the retail stores, more hours are invested into developing smarter and up-to-date systems.

Your life gets easier when you adjust to changes.

Second-generation storeowners tend to adopt new technology easily once they inherit the business from their parents. However, older storeowners tend to be the slowest at adopting new technology. Because you have no problem paying bills, you reluctantly keep the old systems. This certainly limits your access to easier and more convenient services. Although changes can be difficult and complex, you would actually find that newer systems tend to be more user-friendly.

You might have had been ripped off by sales people, which would make your resistance to new things even harder. However, I hope more business owners adapt to new trends to make their business much easier for their lives.