The Advent of the ‘New Normal’ Era Demands New Ways

The corona pandemic, which has caused global havoc, has reshaped our daily lives. A new method of everyday life, so-called ‘new normal’, has begun to work as a key value and standard in our lives. With the advent of this new normal era, where the fear of disease persists, the beauty industry is also required to seek new ways of management to promote sustainable growth.

Based on recently published consumer survey report, expert analysis, and media articles, the BNB editorial department summarized the new consumption paradigm of the new normal era and included it as cover story for this issue.

Key Points

- Pessimistic economic outlook: reduced purchase of expensive products

- Accelerated movement online: ‘digitization’ is essential, not optional

- Avoiding human contact: non-face-to-face/untact shopping preferred

- Avoid moving long distance: Shopping is also “localized”

- Importance of safe shopping environment: ‘cleanliness and disinfection’ inside store is top priority

- DIY trends: emphasis on ‘convenience’ and ‘cost-effectiveness’ of products

- Importance of product transparency and reliability: product’s material and origin are important considerations

- Well-being and health optimizing: ‘disinfect, nutrition, moisturizing’ functional products popular

Dark economic outlook, frozen consumer sentiment

Uncertain and pessimistic economic outlook

Americans are predicting that while the corona virus will be prolonged, the economy is likely to fall into recession and household finances will not be normalized for the time being.

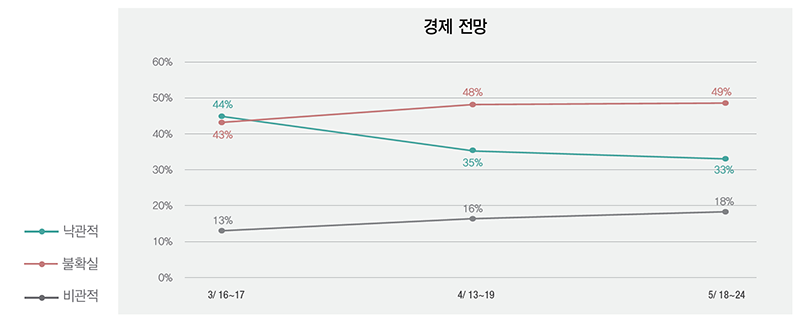

During the corona virus crisis, US consumers’ optimistic outlook on the economy is gradually decreasing and pessimistic prospects are rising. According to the ‘U.S. Consumer Report of McKinsey & Company (hereinafter McKinsey report), only 33% of American consumers expected economic recovery in 2~3 months. The remaining majority of Americans think the future economy is uncertain and pessimistic to the point where the outlook is uncertain.

- Optimistic: economy will normalize quickly in 2~3 months.

- Uncertain: corona will affect the economy for over 6~12 months and the economy will be in recession or low growth.

- Pessimistic: due to Corona crisis, economy will fall into long-term recession..

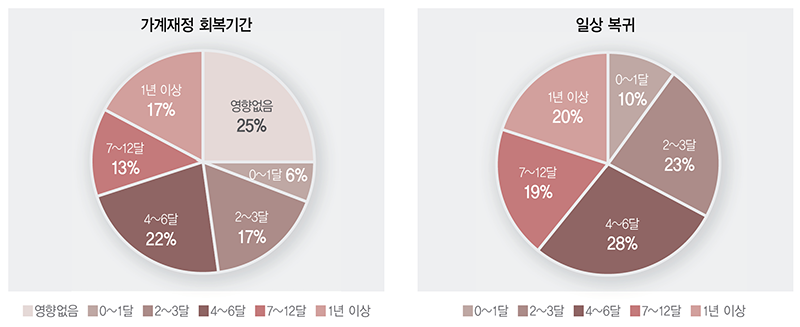

Also, more than a majority of Americans (52 percent) said it would take at least four to six months to more than a year to normalize the household’s finances (the McKinsey report).

In addition, about 90 percent of U.S. consumers expect a long-term battle with Corona, saying it will take at least two to three months to return to their daily lives. One in five people think that daily return will take at least a year. After all, most people have a great fear of virus infection, and they think daily return is fully possible only when vaccines or virus treatments are available.

Frozen consumer sentiment

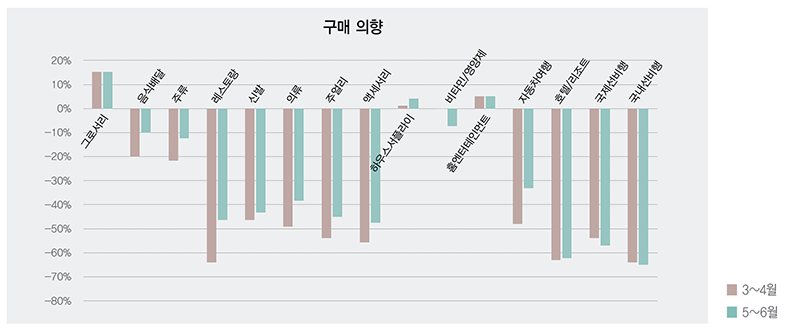

Corona has sent the economy into recession, unemployment soaring and household income plunging. The future economic outlook is also bleak for most people. As a result, consumer sentiment has also been frozen. During the Corona crisis, about 50% of consumers tightened their belts and reduced consumption (McKinsey Report). In particular, the consumption of expensive luxury goods such as jewelry has drastically decreased and the pattern of preferring low-priced products has been fixed.

As can be seen in the graph of the McKinsey report below, consumer sentiment did not fully recover in May-June after the economic resumption. In addition, with the exception of products such as groceries, laundry products, soap, shampoo and home entertainment, almost all items still show significantly lower purchase intentions than before the Corona crisis. Despite this, consumption of necessities such as food products, personal care products (shampoo, soap, etc.) and cleaning and laundry products has rebounded.

New Normal Age Changed the Consumption Paradigm

Online shopping expected to expand even after Corona, and digitization is not an option

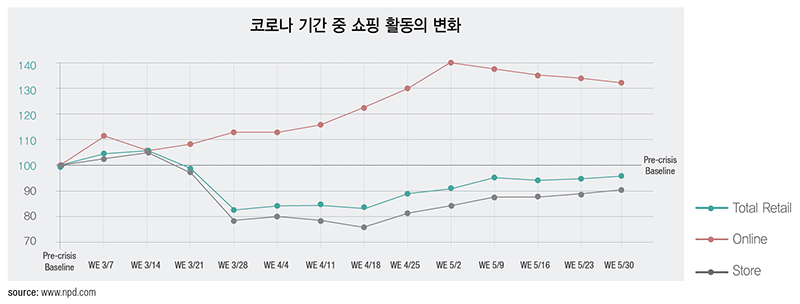

The results of a survey and analysis of changes in consumer spending during the Corona Period, were published by NPD, an international consumer survey period. According to the survey results, consumers’ offline shopping decreased by up to 25 percent compared to before Corona crisis, while online shopping increased by up to 40 percent.

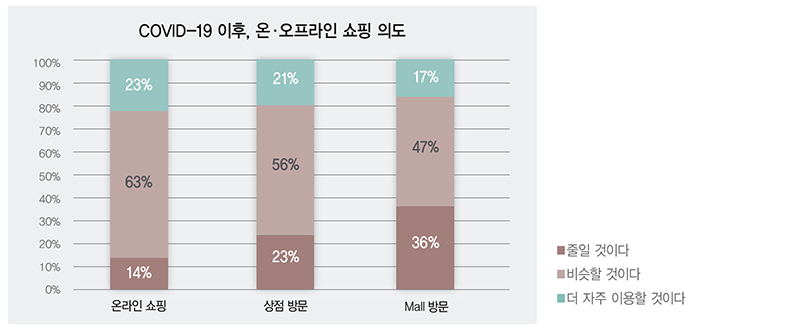

The trend is not expected to disappear after Corona. According to McKinsey’s report, the percentage U.S. consumers said they would increase the number of online shopping more in the post-Corona era (23 percent) were 9 percent higher than the percentage said they would reduce the number of online shopping(14%). On the other hand, the percentage of people who said they were going to reduce offline and large mall shopping were higher than that of people who said they will go, by 2% and 19%, respectively.

Combining these findings, it is possible to predict that consumers’ preference for online shopping and purchasing behavior through offline store visits will continue after Corona. Thus, this drastic change in the environment is forcing the difficult task of ‘introducing e-commerce’ to retailers.

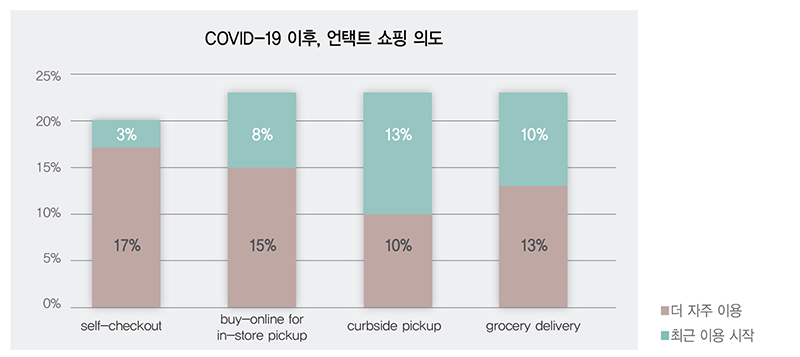

Prefer ‘non-face-to-face’ shopping to avoid human contact as much as possible

The tendency to avoid crowded places such as large malls, movie theaters, and concerts has increased. Accordingly, the new term “untact” or “non-face-to-face shopping,” which is opposed to “contact,” will continue to be preferred after Corona. Consumers will try to visit un-contact shops that combine online and offline methods.

According to the graph in the McKinsey report below, 56 percent of the respondents said they would continue to shop using the online/offline combined method n addition, 76 percent said they will continue to use self-checkout to avoid face-to-face contact at stores. However, 71% of the respondents said they would not use the curved side pick-up service after Corona, so the curve side pick-up rate is expected to drop sharply. In the end, consumption patterns that further overlap online and offline, which strengthens the link between the real world and the virtual world, will continue to be utilized after the corona.

Avoiding long-distance travel and crowded places; shopping also ‘localized’

During the Corona pandemic period, there was a tendency to avoid visits to large malls far from home and shop at accessible shops in the neighborhood. In May, CNBC reported that 68 percent of consumers were found to have used local stores more frequently than in the past. Moreover, as corona has caused difficulties in shops in communities near their residences, there has been a community movement to save local stores. Many cases have also been witnessed in which shops that had made good relationships and coexisted with local residents overcome the difficult crisis.

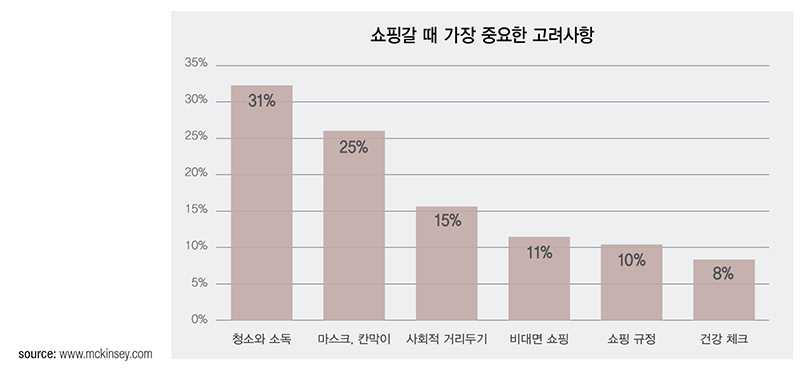

The most important thing for safe shopping is ‘cleanliness and disinfection’ inside the store

Fear of the disease will not easily disappear. Consumers want to shop assured without worrying about infection. What should retailers do in order to ensure that shoppers can shop with without worrying about infection? According to the analysis of the McKinsey report below, the most important thing consumers consider for safe shopping after Corona is ‘hygiene and disinfection’ (cleaning conditions of stores, air purification, disinfection, etc.). The next important factor is whether guests and employees wear masks and gloves and whether or not transparent plastic “barriers” are installed on the counters.

The DIY trend focuses on ‘convenience’ and ‘cost-effectiveness’ of products

Because of the corona, “Do-It-Yourself” trend is now a new beauty normality. According to a survey released by McKinsey on how Corona affected the purchasing behavior of beauty consumers (see the graph below), sales of most beauty products decreased, but sales of products related to DIY or self-care increased; nail care products by 218%, dyeing-related products 172%, bath products (65%) and men’s beauty products (56%) than last year.

What’s unique here is that while overall sales of DIY items have increased, the unit price of consumer purchases for DIY items has decreased (except for some products, such as nail care products and men’s beauty products). This means that DIY-related products were sold more mainly on low-priced products, or so-called “cost-effective” products rather than high priced products.

In the DIY era, videos which provide consulting on how to use products, has become an essential marketing tool. In this era, cost-effective beauty products that are easy to use, easy to wear, and easy to use will become popular.

Importance of consideration of origins and materials of products

The era of uninterrupted consumption and high growth has gone. In the New Normal era, growth rates were lowered, and social morals and environmental issues emerged as core values. Thus, sustainability based on transparency, ethics and reliability in the industry has become a key goal. One of the key factors determining consumer purchasing behavior in the new era is transparency and reliability of the raw material and country of origin of the product.

In particular, maybe because the Corona virus started in China, it is highly likely that the mass sentiment of anti-China, which implies the meaning of non-transparent and unreliable, will spread greatly ahead of the U.S. presidential election in November. According to consumer opinion analyst Boaz Grinvald (CEO of Revuse), more consumers reacted negatively and sensitively to Chinese products during the Corona period, and more positive attitudes were found to be taken toward products made in USA.

Three keywords for beauty in the post-corona era: “sanitizing, nutrition/vitamin, moisturizing”

Consumer research and analysis experts expect that beauty products that are hygienic but can nourish and hydrate will continue to be popular due to the Covid-19 crisis. With the growing fear of disease, consumers’ high interest in hygiene or disinfection-related products or products containing their ingredients will inevitably continue.

According to consumer research expert Boaz Grinvald, related products that moisturize and nourish dry skin due to washing it frequently for personal hygiene and cleanliness are drawing attention. According to his report, the increased value of moisturizing, disinfection and nutritional products has led to increased consumer interest in facial, skin and scalp care products, particularly in vitamin C and vitamin B3.

In conclusion, in the New Normal era, our Beauty Supply should also seek drastic change and innovation. Social values are changing and the rules of the game are changing. It should no longer be complacent about the” Old Normal” in the high-growth era. The utility of past success experiences and methods of success is fading. It is now a digital era where black beauty products also done by mobile shopping. It is time for the Korean beauty industry to actively seek a paradigm shift in a way that captures new values from this strange era.