Tariffs on Hair Products from China

The US President Trump announced that tariff rate, currently 10%, will raise to 25% on the $ 200 billion of Chinese imports through Twitter on May 10. On the same day, the United States Trade Representative announced that it would impose a tariff of up to 25 % on Chinese imports worth about $ 3,000 in residual imports, which were not subject to customs duties until as of May 10, 2019. Let’s take a look at the various media reports and experts’ opinions on what the background of this sudden movement of the United States is and how the situation will develop in the future.

When will additional tariffs be imposed?

The items and rates will be reviewed on June 10 at the public hearing and the results will be submitted to the International Trade Commission on June 17 to finalize the tariff items and rate. The decision to impose tariffs on additional products will be final-ized after the results of the US-China summit which will be held during the G20 summit in Osaka, Ja-pan, on June 28-29,

Has it included human hair and wigs?

Yes. The problem is that the US Trade Represen-tative’s tariffs include HTS 6703 and HTS 6704. The HTS6703 is a code that includes the human hair product line, and the HTS6704 is a code that includes a wig product and artificial eyelashes. Al- most all hair products, including wigs and bundled hair, are included in this USTR additional tariff plan.

Why are tariff rates increased and tariffs imposed on additional items?

What is the reason why the US-China trade nego-tiations, which seemed to be well underway, sud-denly fallen into turmoil? It was reported by the Japanese economy newspaper that the contents of the bilateral negotiations were changed sud-denly by the Chinese side. The Chinese side has unilaterally reduced the 150-page long consensus agreement reached by the two sides to 105 pages in the working-level negotiations. The most important problem here is that the US demanded legalization for issues such as the protection of intellectual property rights, the release of obligation to establish a communist par-ty in a foreign company, the prevention of forced transfer of technology required by the Chinese government. The Chinese side changed its posi-tion to replace it with the administrative order of the State Council instead of legalization. As a retaliation against this, President Trump gave instructions on raising tariff rates and announced the addition of USTR additional tariffs.

When will the trade war end?

This trade dispute is not a simple issue only re-lated to trade issues. Because there is some sort of hegemonic competition between the United States and China, it is likely that either side will continue un-less either side surrender. It is expected that the US-China summit will be held during the G-20 held at the end of June, but the possibility that the two will reach a dramatic agreement is not so high. The media, such as South China Morning Post, also expect tensions to persist after the G-20 talks. Internet media Axios has quoted a senior official as say-ing, “It is hard for the US to reach a conclusion by the end of the year.” Akhsios told a former bureaucrat that President Trump has little room for persuasion because the tariff is like faith. “President Trump thinks he is a ‘customs man,’ and he thinks tariffs are a key means of punishing other countries’ economies and growing America.” Taking into account the information transmitted through various media, it is unlikely that the trade dispute be-tween the United States and China will be settled within 2019. However, the imposition of a tariff on $ 300 bil-lion of additional products may be deferred through the US-China summit during the G-20 period. This is be-cause the leverage of negotiations disappears once the tariffs are imposed on the US.

Will 25% tariffs be imposed on hair products?

It is not the 25 percent tariff rate set by the US Trade Representative for additional tariff lines. Up to 25% by item. Therefore, the final tariff rate for each item is not yet determined. For hair products, there are some pos-sibilities that are even lower.

What are the consumer prices if tariffs are im-posed on additional products?

Wal-Mart said its analysis would increase Wal-Mart’s retail price by 15% if Wal-Mart does not diversify its supply lines when the tariff is imposed at 10%. This means that Wal-Mart will pursue a policy of diversifying its supply lines in preparation for tariff imposition. Mark Bain, a former Newsweek reporter, said that if the tariff is imposed at 25%, the importer and export will absorb some portion and the imports will be changed to India or Vietnam. The increased retail price is expected to be lower than 25%.

What are the implications for the beauty industry if tariffs are imposed?

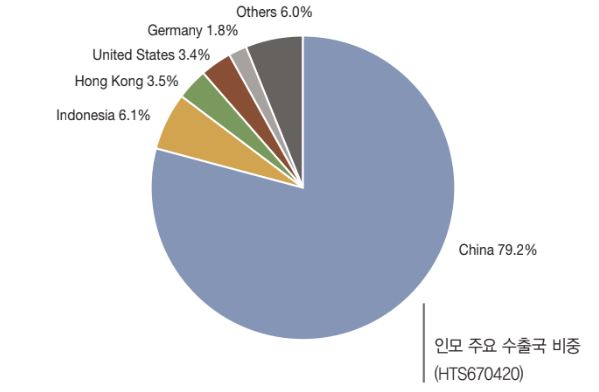

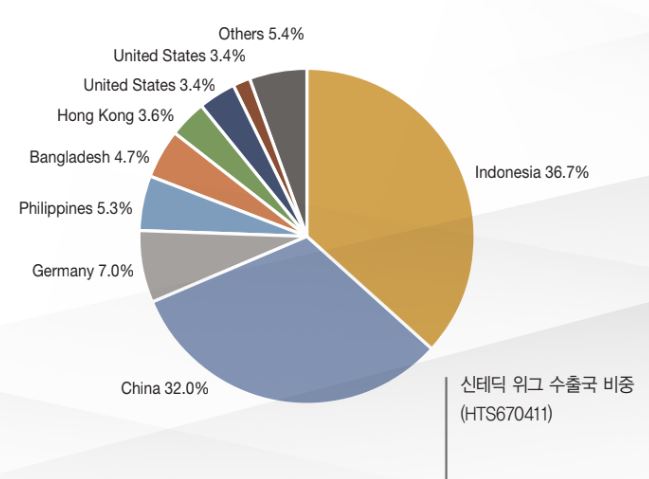

Among the products sold in beauty supply store, Chi-nese products, including hair and miscellaneous goods, will all be affected. Looking at China’s share of hair products exports, China’s synthetic Wig accounted for 30% of global exports, ranking second, and human hair products accounting for more than 70% of exports. If a tariff of up to 25% is imposed on Chinese products, which account for a high percentage of hair product exports, the impact on the beauty market will be very large. In the case of synthetic wigs, the supply capacity of the Indonesian plant is the largest in the world, which may accelerate competition to secure production at the Indonesian plant. Frederik Gronkvist, an e-commerce professional blog-ger, Frederik Gronkvist, says US customs authorities are not imposing tariffs on small value package below $800, even if the US tariff rate is currently 10%. He also points out that the large scale importers for 10% duty-imposed products imported from China and sold in the US through Amazon are experiencing disadvantage on selling price due to they pay 10% tariffs but the cross-border e-commerce companies in China are not paying tax. If this phenomenon is applied to the hair industry, even if the tax rate is raised to 25%, if the non-tariffs practice on the small cargo continue, the price competitiveness of the hair sa-lon or cross-border e-commerce companies with a small amount of imported goods will be strengthened. Wholesal-ers can be disadvantaged.

Management

BNB Magazine 2019, June ©bnbmag.com

ABOUT US / SUBSCRIBE / ADVERTISE WITH US / PARTICIPATION / CONTACT /