Part 2

What is usual markup for beauty supply retail stores?

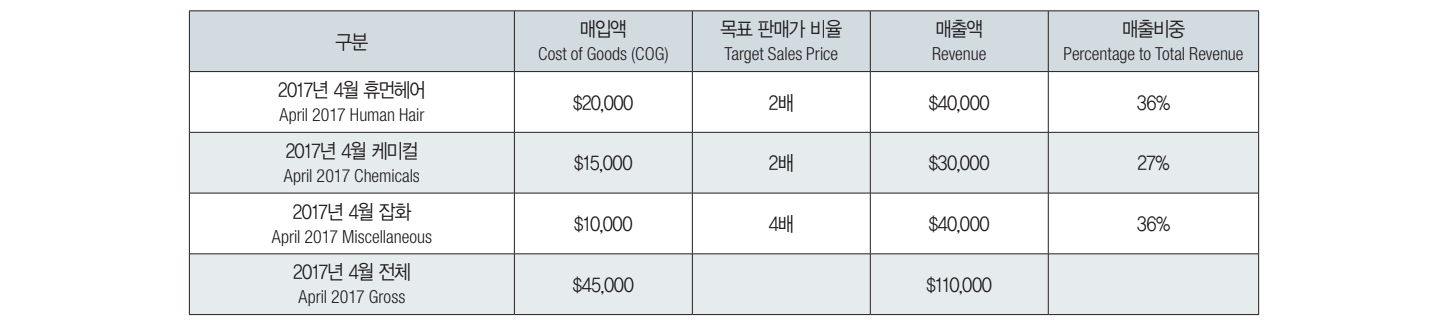

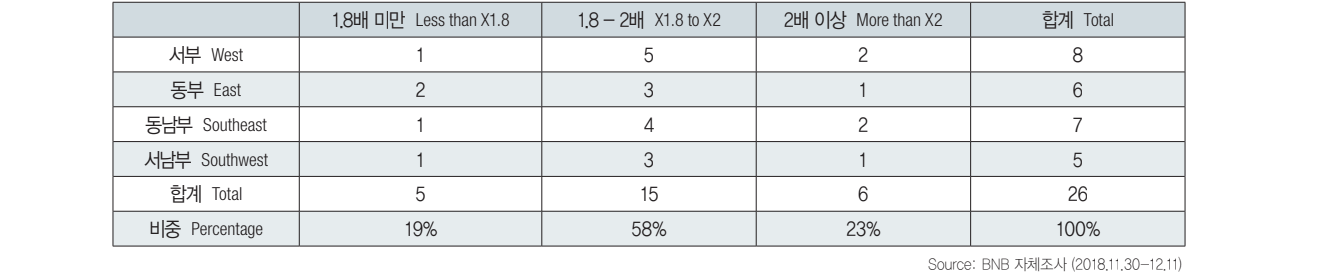

Now, take a look at how beauty supply retail stores are determining markups for human hair products and thereby sales price. A retail store run by an individual has a different sales price policy than a retail chain running numerous retail stores. Below are the survey results from telephonic interviews with retail stores run by individuals regarding human hair pricing. Most retail stores sold their merchandise at from 1.8 times to twice the cost of goods with exceptions to retail stores with competing stores nearby whose markups were lower. Many of retail store owners responded that they would set sales prices of name brand goods at 1.8 times the cost of goods while at twice the cost of goods for exclusive items. In addition, there were retail stores reporting sales price of more than twice the wholesale price. Among all 26 beauty supply retail stores run by individuals, seven of them were using POS system, but none of them managed inventory for all merchandise including miscellaneous items. It turns out most stores having POS system only utilized it for sales performance anal-ysis, and only few retail stores utilized it for inventory management and limited only to hair and chemical products. The reason behind the limited POS system utilization will be discussed later in this article. For beauty supply retail stores run by individuals, a good pricing pol-icy should take inventory turnover into account. In reality, no beauty supply retail store run by an individual had regularly run discount promotions for human hair products showing slow turnover. Some of them had sales event for old stocks but they were limited to stocks lasted more than hundred days in the inventory and they were ir-regularly held.

Target Sales Price to Cost of Goods Ratio

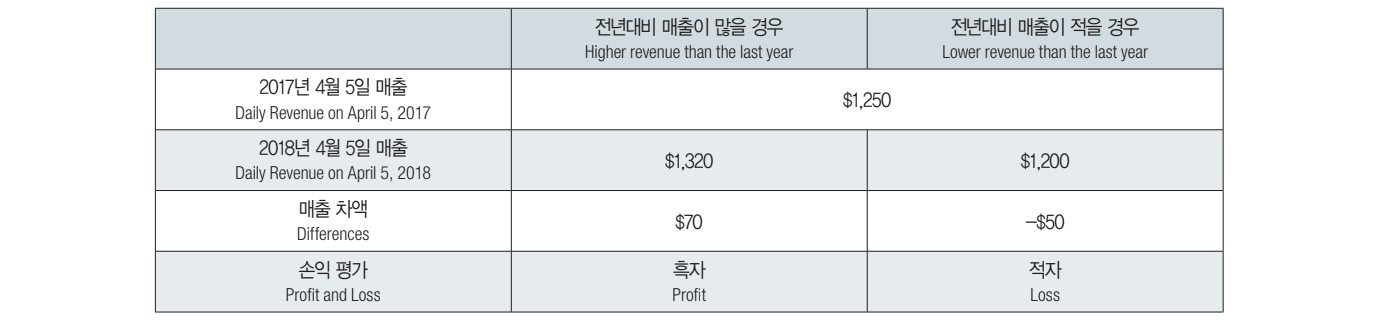

In the case of beauty supply chain stores, a different pricing policy was established. They were similarly using a fixed markup benchmark with variations for brand consideration, but in addition they would re-flect inventory turnover to the sales price. Another critical difference is that they have a much flexible pricing policy based on the turnover, customer preference, and so on. It was possible through an estab-lished profit and loss goal for a store and for a product category. Let’s consider an imaginary store with the following performance stats. 20, 15, and 12 pieces of Company A’s human hair product #1B, #27, and #613, respectively, were bought at $20 apiece and sold at $40 each with 50% markup. Eventually, these products were not sold out in the first year, and some were left in the inventory for Year 2. Most of #1B was sold leaving only 25% of the original inventory remaining, but #27 that was expected to have a high demand did not sell as much leaving 73% of the original inventory remaining. About 50% of #613 was sold. In a cursory look, every item was sold at profit because the gross margin was preset to 50%, meaning half of the sales revenue must be profit. However, the total cost of goods for Company A’s human hair products was $940, and in that year the total sales revenue for company A’s human hair products was $1,000. Hence, the retail store merely had $60 profit despite having sold more than 20 pieces at $20 profit apiece. The missing money is locked up in the inventory. If Company A’s human hair #27 sales trend remains the same, it would take four years to clear the inventory. In the same course, #613 inven-tory will clear up by the end of the second year. The problem is that at this speed, your money will be locked up as inventory for a couple more years. Furthermore, human hair products lose their product value due to the natural loss of moisture in the hair. Therefore, by the fourth year, 27 product might become obsolete. By introducing discounts on the second year, Company A’s human hair inventory can be cleared up and thereby improve cash flow as well as the inventory cost. Then, how much discount should be applied? #1B has a good sales performance, meaning no need to discount. #613 is anticipated to sell out in the first half of the year considering the current sales performance and with a 15% discount. #27 has a weaker sales performance, so the discount rate is set to 30% to move the inventory more quickly. Now, let’s compare the case of no discount and the case of discount. The expected revenue from no discount case will be twice the cost of goods. #613 was subject to a deep 30% discount in the year 2, likely result-ing in a much lower gross margin. However, if you compute the re-sult, the gross margin is 45% of the cost of goods, which is only 5% less than the no discount scenario. Beauty supply chain stores can lure more customers with deep discounts which is available through a flexible pricing policy that is based on the target gross margin. As such, newly introduced items are priced with a fixed rate markup just like retail stores run by individuals, but for products that last longer period in the inventory chain stores would apply a deep discount under which the overall target gross margin can be still achieved. For example, beauty supply retail store chain X set a target gross margin of 40% for hair products. Depending on the brands, newly launched products will be sold at 1.5 times or 2.2 times the cost of goods. A very popular human hair product can be a loss-leader sold at $3 per pack per customer because at the end of the day, you only need to meet the 40% gross margin through sales of all hair products. We will discuss it further later in the article. If you expand this pricing policy across the board in a retail store, you can set the store-wide gross margin at 35% and sell hair, chemical, and miscellaneous products at varying markups.