July 15, $3,600/$3,000 Split Advance Child Tax Credit Payment Begins!

“Will Be a Great Refreshment for Off-Season Business…” Industry Expectations Going Up!

Summertime is low season, when beauty supply business is somewhat stagnant. However, good news brings hope to the industry. Starting July, the vast majority of American families raising children will be funded again by the government’s massive economic stimulus. One industry-savvy official expressed the expectation that, “Given that the annual tax return is our highest peak season, the money that will be released again from July will have a positive revenue increase effect for the beauty supply business in the second half of the year.”

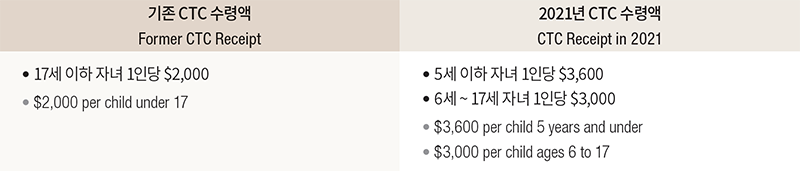

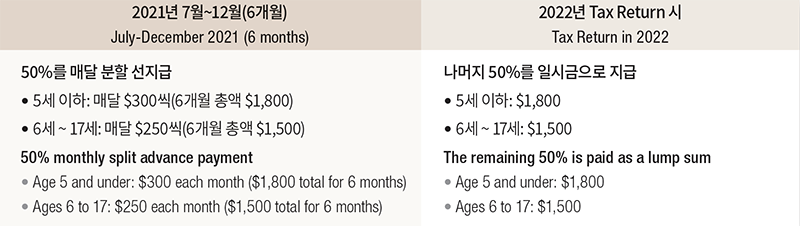

The IRS announced that it will increase the Child Tax Credit(CTC) in 2021 to $3,600/$3,000 from the existing $2,000 for U.S. families struggling with COVID-19. This is prior to the 2021 tax return, but they will advance $250 or $300 per child each month for six months from July to the end of the year, giving 50% of the 2021 CTC in advance. About 88% of U.S. families raising children under the age of 17 are eligible for payment. The decision to draw and pay the child tax credit in advance is a method designed to regularly pay the living expenses that are needed right away for families who are experiencing economic and children-raising difficulties during the pandemic.

This is part of the ‘American Rescue Plan(ARP), a $ 1.9 trillion COVID-19 pandemic economic stimulus bill signed by President Biden this March.

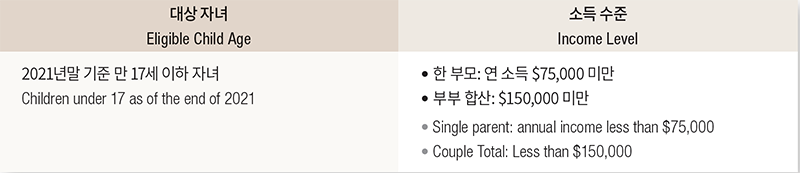

Eligibility is for families with a total income of less than $75,000(single parent) or less than $150,000(as a couple) raising children under the age of 17. If one’s income exceeds $75,000 and $150,000, respectively, their CTC receipt will decrease slightly, and if one’s income exceeds $95,000 and $175,000, they will not be eligible for CTC benefits.

For example, a family with three children under the age of 6 and whose income level meets the eligibility criteria can receive up to $10,800 of CTC. $5,400, 50% of the total receipt, will be paid by $900 each month for six months, July-December 2021, and the remaining 50%, $5,400, will be received as a lump sum upon Tax return next year.

The increased CTC is currently only in effect in 2021, but the Biden government is pushing for an extension of the law until 2025. Republicans have also said they are pushing for an indefinite extension of this increased CTC, and the prospect that it will likely continue to be implemented for at least the next few years prevails.