Predictions based on survey of various reports:

Hair product market prospect

“The future of the hair product market, how much potential do we have?” is a frequently asked question among industry insiders. Unprecedented boom during the pandemic and immediately following downturn, sky high inflation, and growing complexity and severity of the competition have made many to wonder whether the golden age of the hair product market has passed or will last till the next generation. The beauty supply industry is in a desperate need of a seer like Nostradamus. Fortunately, many institutions have produced 2022 predictions and reports based on past years’ data. We will examine them and discuss the prospect and goals for the hair product market.

Please note that each report discusses either the global or U.S. hair product market with varying monetary figures.

1. Reports on hair product market published in 2022

U.S. Hair Extensions Market Report – Fortune Business Insights (Feb 2022)

Fortune Business Insights provides forecast of the 2021-2028 U.S. hair extension market based on the research data through 2017-2021 with analysis of the impacts of Covid-19 and end-user analysis by hair types. This means that the report researched the entire U.S. hair product market including but not limited to the Black market.

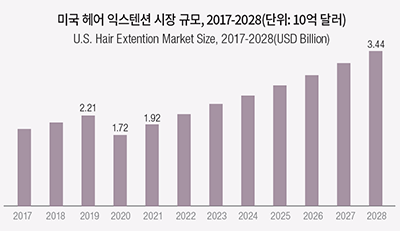

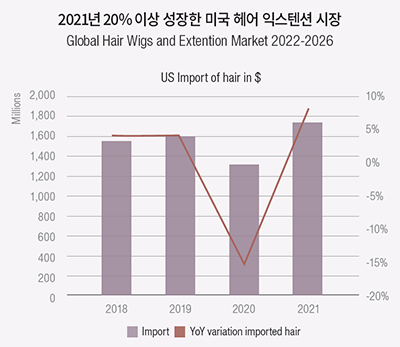

According to the report, the U.S. hair extension market was worth 1.72 billion dollars in 2020 reduced by 490 million dollars from the previous year. The pandemic brought a generally negative impact on the hair product market across the board.

ⓒfortunebusinessinsights.com

However, the market grew back to 1.92 billion dollars in 2021, and it is anticipated to have a Compound Annual Growth Rate (“CAGR”) of 8.71% through 2021-2028. In sum, the U.S. hair extension market is worth 1.72 billion dollars in 2020 and anticipated to grow to 3.44 billion dollars in 2028.

©www.fortunebusinessinsights.com

The market growth will be driven by, first, the consumer interest in remy hair. Remy hair differs from others in having intact hair cuticles, which makes it the top quality human hair available in the market. Growing consumer interest in it will accompany demand growth. The top supplier of the remy hair is India.

Second, hair loss and other illnesses caused by an aging population will boost the demand for hair products. According to a report published in 2020 by the U.S. Census Bureau, 15% of the population was over 65 years old in 2016, but it will be 25% in 40 years. In other words, in 2060, a quarter of the U.S. population will be seniors over 65 years old. The aging population will accelerate the likelihood of hair-related conditions, and for the coming years, many countries, including the U.S., will see the demand for hair products rise.

Analysis by end-user

The majority of U.S. hair weaving brands target female consumers. The market share of the women had been higher than of the men in 2020, and it will continue in coming years. Consumer demand increase of hair care products in addition to the increase of hair loss among women older than 30 is driving the market demand.

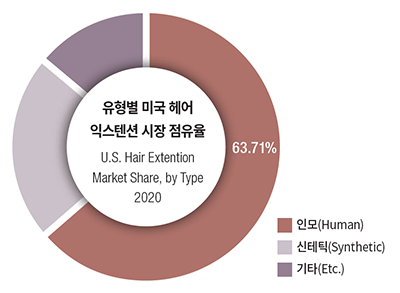

Analysis by type

The hair products can be divided into synthetic and human. Human hair dominates the market by accounting for 63.71% of the 2020 market, and it is predicted to show strong growth for a next few years.

Global hair wigs and extensions market value 2020-2026 – Statista (Feb. 2022)

©www.fortunebusinessinsights.com

글로벌 헤어 가발 및 익스텐션 시장 가치 2020-2026 –Statista(2. 2022)

©Starista 2022

The above statistics show the wig and hair extensions market value globally through 2020 to 2026.

The global hair wig and extensions products will grow more than 13% by CAGR from 2021 to 2026, resulting in 13.2 billion dollars of total global market value in 2026.

For last couple years, consumer demand for hair extensions and wig for aesthetic or practical purposes has grown to cause the market to grow. For Black consumers who are the largest consumer demographic, wig and extensions demand are virtually inelastic. Although high quality human hair wig and extensions are high in demand, the affordability of synthetic hair has led the market growth. Besides, the increase of hair loss among men and women and increase of wig uses in the fashion and entertainment industry, among others, have been additional growth factors. Note, this report overlooked the expansion of Hispanic and White market.

North American market share by age

In 2020, the North American wig and hair extensions market dominated the global demand by its 40% market share. The U.S. market is highly divided among age groups: 25 or less consumers choose practical wig and extensions while the age group of 35-44 occupies the largest share of the market. The second largest share was the consumers over 54, with 23% market share as of 2020, and they can possibly become a main target segment.

The hair wigs and extension market analysis report – Technavio (Mar. 2022)

Technavio, a global research and consulting company, predicted the global hair wig and extensions market will grow by 5.26 billion dollars from 2021 to 2026, and for the same period the CAGR will grow by 9.82%, which is about the mid-way between Fortune Business Insights’s and Statista’s prediction. The year of 2022 would see 9.12% year-to-year growth.

Global Hair Wigs and Extention Market 2022-2026)

Analysis by region

43% of the market growth will be accountable to the Asia Pacific market, among which Japan, China and Korea will emerge as a main wig and extensions market.

Analysis by product type

Human wig and extensions accounted for the biggest market share in 2021. Human hair products are more similar to natural hair than synthetic hair, and they are higher in quality and durability, and thus they lead in popularity and have a substantial market share. The human hair is mainly sourced from China and India.

Market growth contributors/inhibitors

The report mentions an Indian startup Hair Originals, who is expanding the direct-to-consumer (D2C) market based on artificial intelligence technology as an example of advance in hair wig manufacturing and design driving the market growth. Also, it focused on the importance of celebrity and social media influencers who are taking an increasing role. Kylie Jenner, Kim Kardashian, and Ariana Grande are only a few example of celebrities and social media stars who are fueling the growth of global hair product market demand by setting wig fashion trend. However, the manufacturing time of 40-120 hours for handmade wig and resulting high labor cost were pointed out as growth inhibitors.

Global hair wigs and extension market, industry trends and forecast to 2029 – Data Bridge (April 2022)

Data Bridge’s market research is based on the global hair wig and extensions market. According to the report, the hair wig and extensions market was estimated for 2.8 billion dollars in 2021 and forecasted 3.74 billion dollars in 2029, during which the CAGR will grow by 3.7%.

ⓒData Bridge Marker Research

Hair wig and extension market growth will be driven by the followings:

- Manufacturing and design advancement of synthetic products

- Increasing influence of celebrities and social media influencers

- Increasing number of hair loss sufferers

- Increased individual disposable income

On the other hand, the market competition and product stiffness were considered the inhibitors of hair wig and extensions market. The Covid-19 pandemic made a big impact on the raw material, distribution channel, and import/export negatively. However, the yield for the raw material and use/management of wig and extensions have increased, providing a boost to the upcoming post-pandemic hair wig and extensions market.

2. Takeaways from 2022 hair market reports

– Turning the crisis into opportunity, beauty supplies dream of another turnover

The first year of the pandemic, many people in the beauty supply industry thought that the beauty supplies were done immediately following the government mandated business retail shutdown. However, the dark age did not last long. Hair products for beauty supply customers are daily essentials not luxuries. While people started working from home and avoided going out, the consumer demand for hair products did not subsided but grew with increased spending on hair care products.

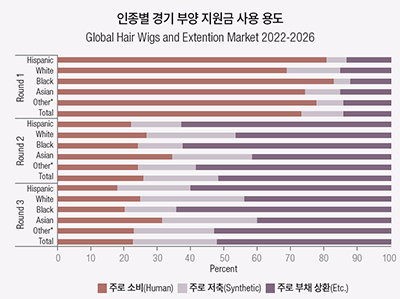

In addition to this trend, the government’s economic stimulus package played a great role in market recovery. According to the U.S. Census Bureau, the first economic stimulus payment was mostly used in consumer goods by 73% of Americans. By more than 10% Black and Hispanic consumers spent money mostly on consumer goods than White consumers.

ⓒCensus Household Pulse Survey

This coincides with the boom of the beauty supply industry. As opposed to the early shutdown period, the next two years from mid-2020 brought an unexpected golden age for the beauty supplies with government stimulus payments. While supply chain disruption following the logistics crisis have caused some hardship, the gross revenue skyrocketed causing many to expand business by adding more stores or increasing store size.

ⓒhowtosellhairextensions.com

After two years passed, many countries including the U.S. are relaxing the Covid-19 restrictions and rolling back to the pre-pandemic status. However, the beauty supplies are rather experiencing a downturn. Government stimulus money has dried up, and the inflation is accelerating. This is viewed as an illusion due to the past year’s highs by many, but the stiff competition and revenue drops have to be dealt seriously in the midst of inflation. The industrial consensus is that the hardship of beauty supplies will last till next year.

However, in a long run, the hair product market, which is a substantial part of beauty supplies, has high growth potential. Aforementioned reports have estimated 3% to 15% market growth, and the market is moving toward the direction indeed. There are many positive signs such as younger generations who always seek newer esthetics in style are embracing wig and hair pieces, increasing social events and activities driving more demand for beauty products, and so on. The aging population of the U.S. will give medical-use demand for wigs a bump, so does the wig purchase by alopecia sufferers, people without hair due to genetic predisposition, and people suffering permanent hair loss. Lately, certain health insurance policies are covering wig purchase for hair loss. In view of the trend, the global hair product market in addition to the U.S. market can grow indefinitely.

The problem lies with how much of the hair product market can be guarded. As hair product requires highly specialized management and insight, it is considered a difficult area to engage for big-box chains and franchises. Hence, the hair product segments should be continuously guarded by the beauty supplies. Of course, a new strategy and shift must be made.

1. Prepare for racial diversity

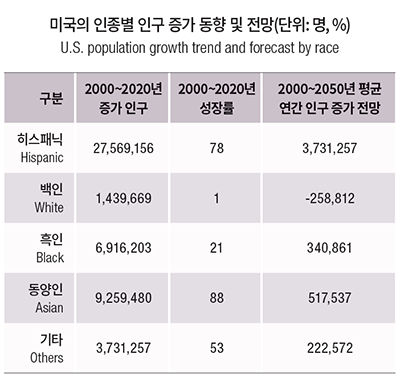

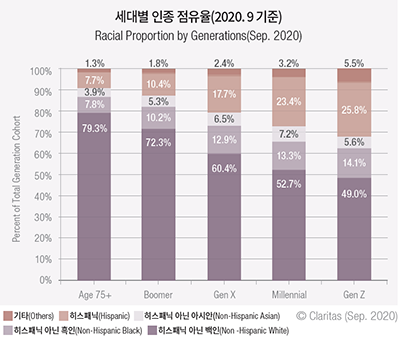

According to Claritas, a market research firm, the average consumer of the U.S. market will change significantly in near future.

ⓒClaritas(2020.9.)

ⓒClaritas(2020.9.)

By 2025, the Gen-Zs in the U.S. will be more diverse than any other generations. Non-Hispanic White population will be 47.4% while the Hispanic population accounts for the biggest portion among minorities with 27%, Black 13.9%, Asian 6.2%, and other races 5.5%. Racial and customer diversity must be taken into account for marketing and product development. For example, the quickly growing Hispanic customers are highly sensitive to beauty and fashion, vivid and bright colors, and bold design. To lead the entire hair product market in the U.S., an effort to shift from the African American centered business model to expand client base into Hispanic and White market is needed.

2. Scale-up (or specialize)

Many agree that beauty supplies need to scale up to survive. As trend is so fast and the products are diversifying, many say smaller stores will not survive the fierce competition. If scaling up is not an option, a store must identify and invest in a specialty to survive.

3. Grow the next gen

Amongst the beauty supplies, including the hair product industry, the generational tide is shifting. Many second generations had a head start, and next generation leaders are popping up in many areas. On the other hand, some first generation business owners say, “I don’t want my kids to inherit my business in which I experienced so much hardship.” If the future of the industry is bright, there is no need to discourage new comers. Beauty industry is one of “never retreating” industries. You should have a vision that goes further than the current struggle.