Despite Price Hike Human Hair Will Stay Popular

It is already February and the tax return season. The great time to sell high-end human hairs has come. It is time when the anticipation of a huge tax refund brings the consumer confidence all the way up after sinking in the yearend, but the beauty supply industry that has enjoyed the quick burst of sales last year is forecasting a lesser degree of success this year. Not to mention the skyrocketing price of human hair, the supply chain remains strained. We analyzed the prospect of the human hair market in the first half of 2022, for which the supply and demand is highly unpredictable, and contemplated inventory strategies based on expert opinion.

PART 1. Human hair market in crisis

A red light on the price of human hair in 2021

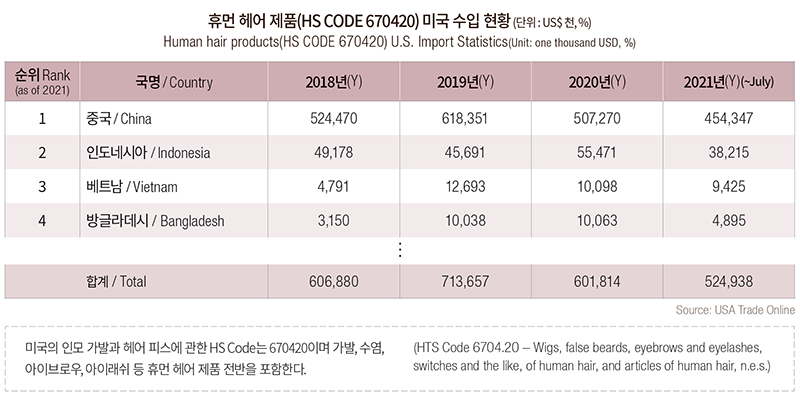

The U.S. is totally relying on the import for wigs and hairpieces. A significant share of import is from China and Southeastern Asia that have lower labor cost, and among them China has the majority of the share. The import of human hair products into the U.S. has increased gradually over the years, but in 2020, due to the Covid-19, it recorded $600M, which was 15.7% less than the previous year. However, in 2021, the import already passed the $520M mark in the first half alone, which is 87.2% of the total import of the previous year.

Last year, the dwindling inventory among many suppliers was intensified by the delays at the U.S. ports, but it improved since last November after measures like Biden administration’s push to open the Los Angeles port for 24 hours and temporary container yards opened in the Savannah port occurred in the second half.

Cargo ships and containers wait near the LA port in September 2021 ⓒGetty Images ⓐMario Tama

24-hour operation at the LA port in November 2021 ⓒsedaily.com

The real problem is price. The price of human hair products soared a few times during the pandemic and is not showing any downward movement. If you ask about human hair at a retail store, people shake their heads. The price is too high. “18-inch products that used to be around $149 or $159 are now around $300, and more expensive items like Remy are used to be around $259 but now $449 or $499. The higher retail price obviously reflects the soaring wholesale price. In fact, if you were to aim for the same margin of profit, no consumer can afford it. You sell with less profit because you can’t cling on to your inventory forever.”

The same goes for wholesalers. They are paying higher prices for goods while retailers are reluctant to place the orders because of the higher price. Thus, they are reducing the profit margin just like the retailers. It is a classic case of poverty amidst plenty. Last year, beauty supplies reported enjoying an unexpected economic upturn, but the highly profitable human hair products were not responsible for it as much as before.

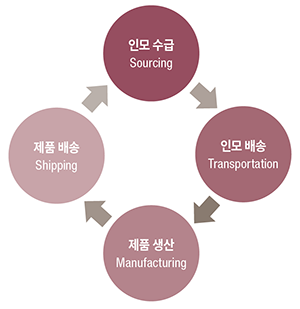

To understand why the price has increased so much, you must first understand the whole picture of manufacturing and supplying of human hair products. The price includes not only the cost of manufacturing but also all the cost-generating steps including human hair sourcing, transportation, manufacturing, and delivery.

Manufacturing and supply process of human hair products @heystacey.com

Sourcing: manufacturers pay service fees to human hair sourcing companies

Transportation: human hair sourced domestically or in Southeast Asian countries will arrive at factories in China

Manufacturing: hair extensions are manufactured through various processes including coloring, cleaning, and length sorting.

Shipping: manufactured goods are shipped to retailers in the U.S.

Most human hair wigs are made in China. Including the Wig Capital of the World, Xuchang in Henan, regions such as Anhui and Shendong in China are home to over 70% of wig factories of the world. The vast quantity of hair imported from nearby Asian countries including India, Thailand, and Bangladesh are processed, colored and cleaned in those factories and manufactured into various goods to be exported. In 2020, however, the strict lockdown policy against Covid-19 has not only strained human hair supply but also shut down many hair factories, causing manufacturing backlogs. The cost of raw human hair increased, followed by rising labor cost, resulted in price hike and quality deterioration.

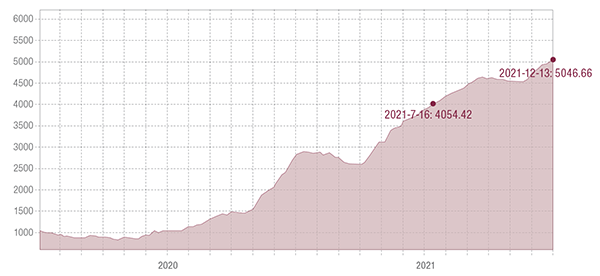

The rising cost of transportation is a big part of the rise of human hair product price during the pandemic. One of the major index for global shipping rates, Shanghai Containerized Freight Index (SCFI) was below 1000 before the pandemic. Since the early 2020, the index went up continuously and was quadrupled in a year. Last July, it broke 4,000 for the first time, which was shocking to many, and in the end of 2021 it passed 5,000.

Shanghai Shipping Exchange, SCFI

Complex factors, including delays at the port, rising fuel cost, shortage of raw materials, shutdown of manufacturing, border closures, and rising labor cost, made ways at the same time, resulting in the record-high prices of human hair products last year. Subsequently, it is anticipated that the high price will not dip easily in 2022.

Red light on human hair sourcing in 2022

Supply shortage will obviously lead to price increase, and human hair sourcing for the production of wigs and hairpieces is getting harder.

Many collectors of human hair in China and India travel from town to town looking for people who want to sell their hair or trade it for other goods. For a woman to grow hair to over 10 inches, which is typically the shortest length that can be sold, it takes about two years. As many local communities progress, there are fewer women who want to cut their hair. Consequently, the hair collectors were traveling further into undeveloped countries such as Myanmar, Laos, Mongol, and Indonesia, but the Covid-19 related restriction made the travel harder for the last two years.

The main source of human hair in India is the temples. In many Hindi temples, thousands of pilgrims offer their hair to gods according to the tradition of “tonsuring”, the practice of cutting or shaving some or all of the hair on the scalp to show religious devotion or humility.

ⓒBalaji Tour Packages

The cut or shaved hair is collected and sold at auction, which accounts for 10% of the temples’ over 200 billion annual incomes. Before the Covid-19 pandemic, Tirumala Tirupathi Devasthanam(TTD) of India placed 70 tons of hair for auction monthly, but the temples were closed during the pandemic or opened in limited capacity in pursue of social distancing. Then, a lot smaller volume of hair came up for auction. It directly led to the soaring human hair price. Before the pandemic, 19 to 26 inches long human hair was traded at 16,500 rupees (about $222) per kilogram, and now the price for the same is 25,000 rupees (about $336) per kilogram.

The shortage of human hair in a long term as well as the temporarily dire situation of today is not a surprise. As the cost of rare resources will certainly rise, there are companies who moved first to secure human hair supply. One of them is Rebecca, the biggest wig company in China.

In the first half of 2022, the domestic situation of China, the biggest manufacturer and exporter of human hair wigs, is also an issue. During Spring Festival, the biggest holiday in China, up to 3 billion people makes their way back to home. For about 1-2 weeks before and after the Lunar New Year, many factories stop operation altogether, and the price hike after the Spring Festival has been a recurring theme. This year’s Spring Festival is February 1, and the restriction on travel by the Chinese government will not erase the impact of the holiday completely.

A train station during the Spring Festival in China ©m.post.naver.com

Furthermore, Beijing Summer Olympics will be held from February 4 to 20. Approaching the Olympics, Chinese government is implementing Zero Corona policy that locks down an entire region whenever a single case of Covid-19 is confirmed. This strong measure will restrict a lot of activities till the end of the Olympics. The industry experts estimated that the goods manufactured by the Chinese human hair wig companies in the late February will arrive at the U.S. market in April and March. The trade conflict between the U.S. and China is also playing an important role.

As discussed above, the prospect of the human hair market in the first half of 2022 is not bright. For suppliers, the shortage of raw hair and the soaring transportation cost make the future of the supply chain unpredictable. The price has gone up too high, the retailers are hesitant to place orders or make sales aggressively. In the midst, the Covid-19 situation is not getting any better due to variants, and the last year’s various government aids and programs may end up erasing this year’s tax return season. Despite all these, there is a reason that the industry is paying attention to the human hair.

PART 2. It is still human hair

At the end of last year, the social media was buzzing with a strange appetite of Koreans who insist on iced Americano in the middle of winter. In the same way, many customers who are familiar with wigs and continued to wear them tend to stick with human hair despite the high price. Premium products including virgin and remy(or remi) hair products are still sought after by some and leaving the shelves while many are wondering whether they would sell at such high price.

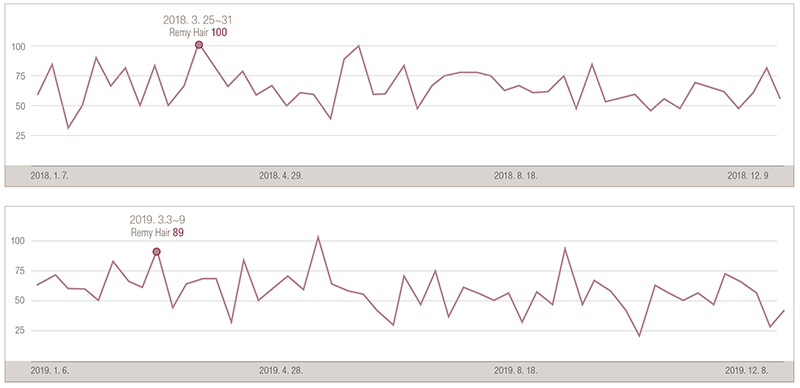

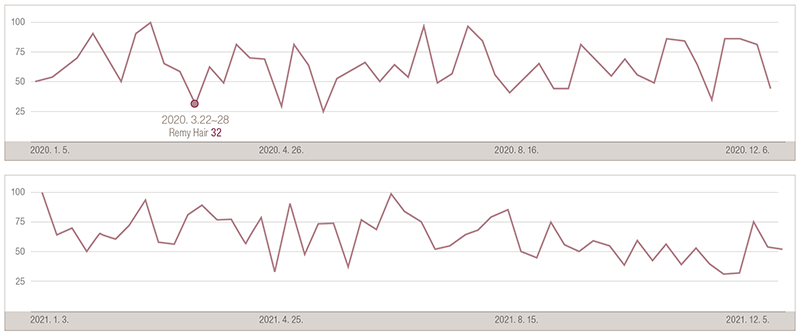

Especially, in the first half of the year around the tax return season, consumers have a large sum of money to spend which leads to desire to purchase premium products that they previously had their eyes on. Actually, if you search “remy hair”, generally considered the high end of premium products, on Google Trend, you can see the consumer interest by period. Although interest does not always end up with purchase, you can make predictions as to when most consumers look for high-end human hair products.

For the pre-pandemic period, specifically in 2018 and 2019, the graphs show similarity in trend. In the first half, March within the tax return season and May with many celebration days ranked high, and after the summer, it generally stays lower than the first half except for a few short bursts.

Consumer interest trend on remy hair in 2018 and 2019 ©Google Trend

However, the typical trend disappeared after the pandemic began in 2020. As the Covid-19 situation got worse and the pandemic was declared in March, the interest in Remy hair stayed at almost the lowest point, despite being usually one of top performing months. Ironically, the following months showed the opposite of the previous year’s trend. Although there is substantial fluctuation, it recorded higher interest than previous years through 2021. It is understood that the interest in remy hair corresponded to the timings of federal emergency aids and unemployment payouts.

Consumer interest trend on remy hair in 2020 and 2021 ©Google Trend

In the end, the human hair enjoyed the temporary boom during the Covid-19 period. The answer: human hair products are must-have items for the beauty supply customers.

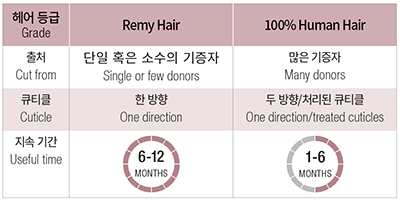

In fact, many consumers are looking for human hair for many reasons including a natural look, easy styling, possibility of coloring, and comfort fit, and the quality of human hair products is improving to satisfy the popular demand. Among those, remy hair is especially on the hot spot during the tax return season. Remy hair products (sometimes promoted as virgin hair) are made with 100% human hair that is sourced from a single individual, resulting in the unidirectional cuticles, less prone to tangle, and outstanding shine.

Remy hair not only boasts soft texture and shine but also retains good quality for six months, and up to a year if maintained well, after multiple washes. Other human hair has damaged cuticle layers due to the processing and will dry up and tangle after a while. In fact, some manufacturers coat the hairs with silicone to appear healthier.

The consumers of today know too well that you get what you paid for. While the multiple issues due to the pandemic and difficulties in procuring are anticipated, there is a simple reason why wholesalers and retailers cannot give up on the human hair. It is the demand. However, for the unprecedented difficulty in predicting the market prospect, your strategy for upcoming first half of the year should be different.

PART 3. 2022 First Half, how much to order and how to sell human hair?

Weaving inventory strategy

Earlier this year, more than 40% of the advertisements and new products published in the January issue of BNB ahead of the tax return season were human hair products. From “100% human hair” to “Virgin” and “Remy”, a lot of promotional phrases emphasize the high quality. This reflects that during the high tides of human hair products, you bet on the premium weaving market.

For wearers, weavings are harder to have them on while costing more than wigs. In addition to the purchase price of weavings, you need to pay $200-300 for hair weaving procedures at salon. Typical weaving session lasts three to four hours, and even with good maintenance, they need to be detached, washed, and reattached every three months. For a more economical and easier alternative, you can go with clip-in weavings, but they are limited to partial applications. Nonetheless, weavings are preferred because they do not show like a wig and are more suitable for style changes.

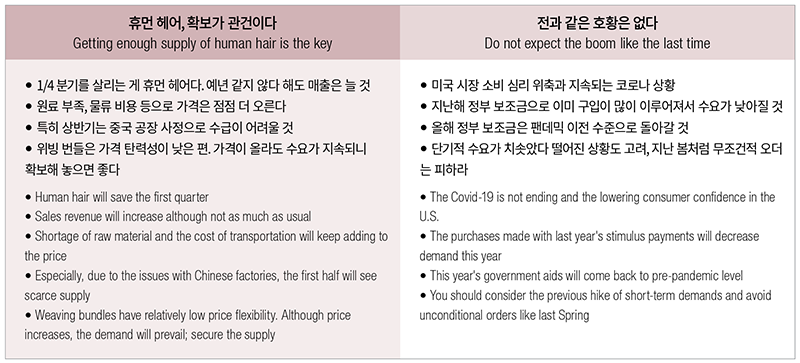

Of course, the retailers are hesitant to place orders or make sales aggressively on human hair because of the price. However, it is expected that it will be even harder to procure them. Should you stock up as much as possible for the tax return season while you can? Wouldn’t the price goes up and comes down again like the closures did last year? Wouldn’t you sit on a pile of unsold items in the end? For these tough decisions, we solicited opinions from the experts in the hair market.

Despite the conflicting views, the common ground is that you should secure the inventory wisely. As discussed above, raw materials are getting harder to find, the labor and transportation cost is skyrocketing due to the Covid-19, and the February output of Chinese manufacturers are expected to dwindle. In conclusion, the price of human hair products will rise. At the same time, government aids and tax returns will not be as much as the past years, so the economic bubble might burst. Hence, you should make wise decisions based on the size of your business for varying price ranges, avoiding stretching your budget. Specifically, it is advisable that you stock up weavings in basic colors and curls as well as human hair wigs that can be freely styled in various ways including coloring and curling.

Lastly, experts say, “you should follow your business instinct honed over many years.” It is an unpredictable, tough time. Nevertheless, there will be certainly a way to turn adversity into opportunity. More than ever, you need your own judgment and strategy.

Strategies to sell human hair wigs

By Jaylord Ryu

Selling high-end wigs

When it comes to high-end wigs, prom season, wedding season, cooler non-summer season, yearend and holiday season, and tax return season are the better times to sell. In the tax refund season, more customers look for expensive wigs and buy without much of negotiation, so it is relatively favorable season for the sellers. Consequently, in anticipation of the season, you should carry human hair wigs starting at $300 and up and additionally a minimum amount of high-end wigs at around $1,000.

As the premium wigs can be a burden regarding cost, you don’t need to overstock them but having an extra #1B is advisable. As the price is high, you can meet the minimum order amount with a small number of items. Therefore, you can place small orders to replenish the inventory after you make sales. For premium wigs, many companies guarantee a return or exchange if the wigs do not sell. You can stay updated with the relevant polices and utilize them well to carry those items with less burden. Especially, fast-growing wig companies like Hair Republic (Eve Hair) and R&B are aggressively marketing high-end wigs so that retail stores can approach them more easily. Namely, they are providing perk and benefit like giving out new products for free to receive feedbacks from customers to high volume accounts.

Wig inventory management

All retail stores have old inventory of wigs. Some stores consider those long-sitting wigs as a problem, but others sell them through various promotions in order to improve their cash flow. Retail stores running under a single ownership can pool their old inventories and sold the merchandise at a newly opened store for a clearance event at 70-80% discounts. These big discounts including other events such as one-plus-one events, reward points for wig products, and so on can strongly appeal to the customers.

One caveat is that old wigs may have deteriorated in condition. As a result, you should not place them as-is on mannequins out of the box but after preparing individual items with care. When you prepare the old wigs for sale, avoid heavy oil sprays but apply light serum type products and water-based detangle sprays in order to provide shine. Flat ironing in combination with heat protectors can transform a $5 item into a $50 worthy item. If the damage is severe, you can use sulfate free shampoos or wig shampoos to clean and place them on mannequin for an easy sell.

Discounted products should get special attention in display. You should make them like a new item and place them in a single space, using an entire wall or an entire aisle of gondola shelves, for the maximum effect. You can place a big sign that can be easily seen when a customer enters the store to lead them to quick purchase. Try doubling the benefits of this tax refund season by first increasing margin by selling high-end wigs and selling old wigs at discount to clear the inventory and improve cash flow.