Beauty Market Global Supply Chain Collapse, Taking a Turn for the Worse

Industry Expert Says, “Supply Crisis and Price Increase Will Last Throughout the Year”

Beauty Supplies are now clamoring that they can’t get any of the goods even though business is going well. This is because the supply chain of the global beauty market is on the verge of collapse under the direct influence of COVID19. Import prices are soaring sharply because of the collapsed supply chain and the U.S. dollar significantly losing its value. The same goes for almost all other beauty products as well, not just in the hair product lines. It is also unpredictable when the collapsed supply chain will recover again. Beauty industry experts expect the shortage of products will continue until the end of the year- “at the least.” This applies to most businesses, but ample inventory management of the store is more important than ever now that we are undergoing a supply crisis.

Logistics Crisis Deteriorating! Shipping Container Cost Increase Up to 4 Times

The supply chain collapse began with the global logistics crisis that emerged when the COVID19 blockade was lifted in the U.S. in the middle of last year. It became difficult to find containers to ship goods, and the shipping schedule was delayed one after another in the main suppliers of beauty products of China and East Asia. After that until now, the situation continues to deteriorate. According to BNB coverage last February, wholesalers said that the cost of sea transportation had doubled compared to before-COVID. However, since that, the price had doubled again, which means shipping container costs had jumped by four times. “The shipping price per 40-foot container, which was $5,000 before Corona, has now risen to up to $20,000,” a beauty industry official said.

To make things worse, unloading of containers arriving at U.S. ports is being delayed by one to two weeks. In addition, land shipping is also facing a major setback due to the lack of long-distance truck driver personnel. This is because truck drivers avoid leaving their homes and driving long distances, preferring to work as short-haul shipping drivers, such as UPS, FedEx, and Amazon.

At present, it is impossible to even vaguely guess when the domestic and international logistics crisis, which overlaps with such unfavorable factors, can be normalized.

Falling Dollar Value- Leading to Rising Import Prices

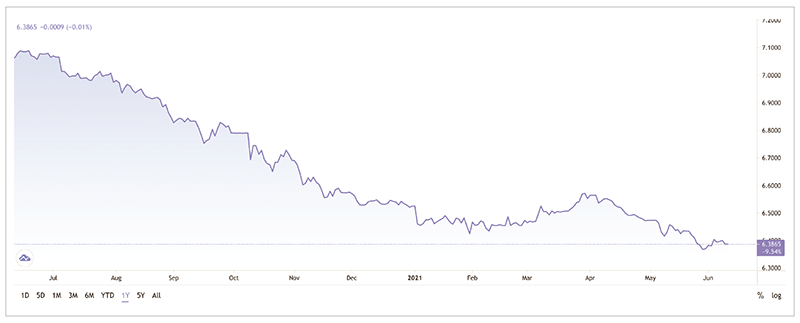

In addition to logistics, the recent decline in the value of the dollar has been a major factor in the rise in import prices. Over the past year, the dollar-yuan exchange rate has fallen by about 10%. As of 7 June 2021, the yuan-per-dollar exchange rate stood at 6.4 yuan, about 0.7 yuan less than 7.1 yuan last year. Undervalued dollar values are gradually being reflected in the rise in product import unit prices.

Dollar-Yuan exchange rate, 06/20 to 06/21; source: tradingview.com

Shortage of Human Hair Raw Materials

Hong Kong’s South China Morning Post (SCMP) reported on May 24 that its hair factories in China are receiving little to no hair, the raw material of human hair products, from India and Myanmar. India and Myanmar are the largest suppliers, accounting for 70% of the world’s human hair supply. This is because in India, COVID19 infections and deaths are surging, and in Myanmar, a military coup has caused political unrest. Due to the difficulty of securing human-hair raw materials, the price of human-hair raw materials, which has been around 220 yuan(about $37) per kilogram last year at factories in China, has more than quadrupled recently. In China, it is also said that the price of human hair has become like gold, and there are even human hair smugglers seeking profit.

North Korea’s Original Equipment Manufacturing of Wigs Suspended Since COVID Outbreak—Price Jumps and Quality Falls

Wigs are one of North Korea’s main means of earning foreign currency. This is because wigs are not export-prohibited items under the United Nations’ economic sanctions on North Korea. North Korean workers have excellent hands-on skills, and labor costs are reported to be less than half that of China. High-skilled, low-cost, and labor-rich, North Korea’s handmade wig manufacturing technology is the best in the world. Before COVID19, most of China’s wig companies had entrusted North Korea with original equipment manufacturing.

However, when the Pandemic broke out in January last year, North Korea, which was underdeveloped in its quarantine system, completely blocked its borders to prevent the virus from entering the country, halting all exports of cheap, high-quality North Korean wigs. There is no official record of wig-related trade between North Korea and China since February last year. According to SCMP reports, wig material shipped from China to North Korea in January 2020 was about 14 million yuan(about $2.2 million), but in February it dropped to about 450,000 yuan(about $70,000), and since then wig trade has been completely suspended.

After that, Chinese hair factories hired their own workers instead of North Korea to produce wigs, but the results were said to be below expectation. This is because the labor costs of Chinese handmade wig manufacturers are high, but due to their poor proficiency, prices have risen, and quality has fallen. There is a national campaign in China to cultivate skilled handmade wig manufacturing technicians.

Industry Response by Product Category

Hair

A representative of a small hair company that mainly handles handmade lace wig products said that “the supply has recently been reduced by 1/10”, and that “the business would go well if there were things to sell, but it’s difficult to get items,”and that “this situation will last at least until the end of the year.” “The increase in logistics costs will further affect the rise in the price of synthetic products, such as low-priced braids, rather than human hair,” and said, “according to the recent trend of consumer braid preferences, it would be recommended to secure as much braid products as possible in advance in retail stores.”

Chemical

“The price of chemical products has risen by 10-15% due to logistics crisis, and it is expected to rise by an additional 10% by September,” said a CEO of a company that produces and supplies chemical hair care products. “It would be wise to secure as much inventory as much as possible,” they also said, highlighting the importance of inventory.

Miscellaneous Goods

An official from a miscellaneous goods company also said, “We are in a state where we can’t even dream of developing new products, and it’s very difficult to secure the most basic bead products, especially transparent clear bead products.” ”Prices rose by 5-10% overall for goods, including edge gel, eyelash, nail products, etc.,” they added.

Cosmetics

An executive at a cosmetics company said that “COVID19 has significantly reduced product production, delayed transportation, and increased costs in factories in China and Indonesia,” and that “we can’t dare dream of new trends in cosmetics,” and also said “it will be possible to try to launch new products only after August.”

Clothing

An executive of a clothing product supplier said, “The shipped goods have not been able to get into the port and are floating in the sea. We can’t even ask for product quality management and are basically compelled to put in additional orders to maintain our relationship with the factory we are dealing with.” “In the beauty industry as a whole, because goods are accumulated in the transportation process and circulation is not good, it will be quite difficult for companies that do not have enough capital,” he said, delivering the difficult situation. He also said that customers prefer the “top-and-bottom cohesive fashion trend” and that “securing this type of clothing will help sales for beauty supplies that handle clothing.”