Unlikely events do happen Examine your insurance policy

BY BNB MAGAZINE

Insurance provides you great comfort for your mind while running a business, but it might be considered a non-essential expense in usual times. However, it can be a great help when you encounter an unexpected accident. It not only provides a cushion for the unfortunate event but also lets you have a mindset that you can overcome any difficulty. Most businesses do carry business insurance, but not many know exactly what is covered when to make a claim, and so on. For those of you who will be renewing business insurance and considering a new coverage, we will broadly discuss the essential insurance coverage.

In May 2020, the death of George Floyd in Minneapolis, Minnesota has angered many African Americans, prompting an explosive protest across the country. While most remained peaceful, riots, looting and arson spread across the states targeting police departments, groceries, retail stores, and so on.

Aftermath at a Buckhead shopping center in Atlanta, Georgia.

Beauty supply stores located in Black communities were among the victims. A retail store owner in Chicago said, “I saw my store burning in front of my eyes but could not do anything because of the possibility of gun violence among others.” Another in Georgia said, “it reminded me of the 1992 Los Angeles riots.”

Nobody expected such an event and the riots that followed, and retail business owners who incurred great mental and financial damages looked for a way to support themselves. Business owners who had sufficient insurance coverage to repair and reopen their stores could open their doors soon, but those who had minimal coverage or lacked insurance altogether had to suffer significant financial damage.

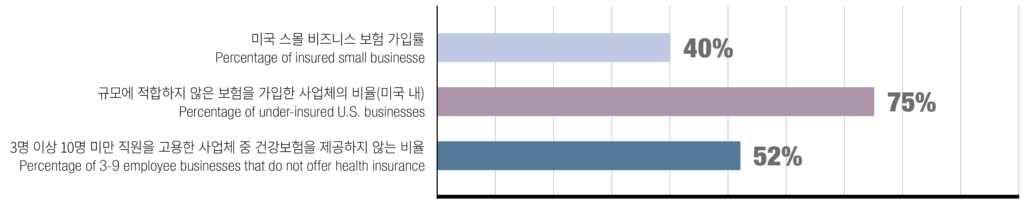

You pay insurance premiums for an event that may not ever happen, so it could be considered an unnecessary burden while it can be a great help when you encounter an unexpected accident. In fact, less than 50% of small businesses have business insurance.

2022 commercial insurance statistics ©Renolon

However, business insurance is not just for significant damages like riots. It offers coverage for personal injury, workers’ compensation, and property damages, so you need to take a close look and find right coverage for your business. In fact, 40% of small to mid-size businesses made an insurance claim in the past decade, and 20% of the claims were for robbery and theft, and 6.6% for fire, hurricane, plumbing damages, and other property damages.

Many beauty supplies have insurance. What coverage do you need?

Business Owners Package (BOP)

Also known as business owners’ policy, it provides basic coverage for many small businesses including beauty supplies. Mainly, it combines property damage coverage for the building and goods owned by the business and personal injury coverage for others.

They are packaged insurance, so many people overlook what is covered and what is not covered. In many property damage policies, theft is not covered, so if your business has a theft problem, you should make sure it is covered. You should be able to prove the ownership for a claim, so you want to take pictures of your goods and assets and keep them in a safe place. Also, you can hire security companies and deploy security devices to reduce theft.

How to determine compensation limits for BOP’s property damage coverage?

Insurance companies do not disclose the standard for calculating compensation amounts, so you need to determine based on your own asset evaluation. Generally speaking, you will be needing an amount to bring your business fully back to the before-the-accident state. If you have a hard time evaluating your business, your insurance company can help.

Important coverages for BOP

A. Employment Practices Liability Insurance

EPLI, or EPL, coverage protects the business from lawsuits brought by employees based on wrongful termination, racial discrimination, sexual harassment, and so on. Racial discrimination and sexual harassment are big issues in America, so you will need to take caution. You can make an insurance claim when your employee files a lawsuit against your business for unfair treatment. It usually goes up to $100,000 to a million dollars in coverage, and you can decide based on your business type and size.

B. Ordinance or Law Coverage

If your business owns a building, especially if the building is old, you will be required to make repairs and improvements in accordance with new building ordinances or codes, which can be covered by the Ordinance of Law insurance.

C. Business Income and Extra Expense

If your business is in trouble due to fire, theft or other accidents, the insurance provides coverage for business loss. It will cover for payroll and other business expenses. For example, if there was a fire, the insurance will pay for the building repairs, property damages incurred by the fire, and any lost business profit during the repair.

The business loss will be calculated based on annual revenue. Different insurance companies provide different coverage, so you will be wanting to make sure Business Income and Extra Expense coverage is included.

D. Cyber Liability Coverage

Even a small business has a few computers in the office. When you are busy running a business, you often overlook the importance of securing your computers and data storage, which are critical components of your business. Cyber Liability coverage can compensate you for damages incurred by cyber-attacks. It is reported that 31% of businesses have cyber liability coverage.

E. Abuse and Molestation Insurance Coverage

If a customer was wrongfully accused of stealing, they can sue the business for mental abuse. Abuse and Molestation Insurance coverage are for your protection when that happens.

Although it varies by the insurance company, the usual coverage limit is a million dollars per claim. Mental abuse claims are highly subjective, and it often looks into whether the customer felt disrespected rather than factual evidence as in sexual harassment cases. It is helpful to try not to cause discomfort to customers, and you should be always prepared for a lawsuit.

This coverage may not be included in the standard policy. If your insurance company does not include this coverage, you want to add the coverage by an endorsement, which requires an additional step.

F. Money & Security Coverage

Most business owners’ packages include this coverage. It is essential coverage for beauty supplies that handle a lot of cash. From cash to checks and money orders, various document having cash value is covered. If you are a cash business, you should estimate your daily cash transaction amount and notify the insurance company at the time of policy purchase.

This coverage extends beyond the business premise, such as when you get robbed on your way to your bank to make a deposit.

Workers’ Compensation Insurance

The insurance company pays employees’ medical costs for an injury suffered at the workplace.

When your employee gets hurt while working, you are legally required to pay their medical cost. Workers’ compensation covers the cost on behalf of the insured business.

How is insurance premium determined?

Workers’ compensation insurance premium is based on the projected payroll for the next year. If you have more than 5 employees, you need to disclose everyone’s job positions, which will determine the rate. You can exclude owners and officers from coverage.

In an annual audit, if the projected payroll exceeded the actual payroll, you get credit, and if it is the other way around, you will have debit.

Umbrella insurance

If your liability exceeds your coverage limit, the umbrella protects you.

If your liability exceeds your insurance coverage maximum, you will be personally responsible. In this case, umbrella insurance can help. You can place your business insurance and commercial auto insurance under an umbrella policy to protect yourself beyond the policy limits. Insurance can help business owners to prepare for danger and run a business smoothly, and all you need to do is to find out your business type and revenue for appropriate coverage.

Mostly, you can have coverage limit of two to five million dollars, but coverage for certain business types may be limited. To get an umbrella policy, you must have $1,000,000 or more business liability insurance and $500,000 or more commercial auto liability insurance.

In 2023, you can reevaluate your business insurance needs based on the coverage options and financial status of the business. If you already have an insurance agent, you can talk to them to find out how to secure your business in the future. It’s better safe than sorry. It will be better if you can realize potential dangers and prevent them.