Tax Refund, the “Bonus of the 13th month”

How much will your customers get?

It’s time for boosting the morale of recession-weary retail business owners. It’s the season of tax return, which many consider the peak season for beauty supplies. Even if the mood isn’t quite the same, the beauty supply industry puts more effort into product launches and marketing during tax return season than Black Friday or the holiday season. For retailers, the question is, “How much will my customers get in tax refund this year?” And “how much would they spend on beauty supplies?” Prepare yourself for this year’s tax return season by learning about various tax refunds, and get ready to face the turning point that will bring some relief in the tough economy.

Tax return in 2024, what’s new?

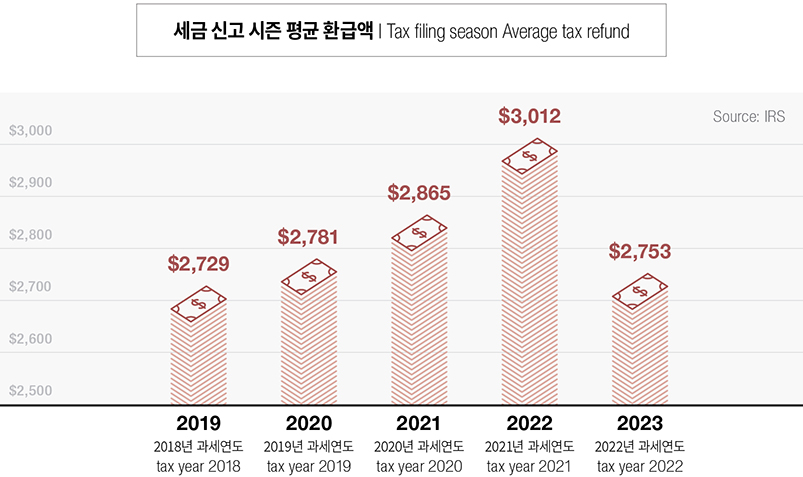

The IRS releases filing statistics at the end of each tax season. According to the data, in the last tax season (tax year 2022), about 64% of tax returns resulted in a tax refund*. Here’s the five-year average of tax refund published by the IRS.

*You are entitled to a tax refund for taxes overpaid, called a tax refund or tax rebate, if you made an overpayment based on records such as business expense. While we’re talking about tax refund, it’s commonly referred to as “tax return” season in the industry. They are used interchangeably here.

The unusually high tax refunds for tax year 2021 are due to the pandemic relief-related tax cuts. To sum up, according to the official IRS data, the average American gets over $2,700 in extra money during the tax return season. Of course, this is a refund of income taxes that taxpayers already paid (i.e. they get back excessive payment only), but it still feels like a “bonus” in the 13th month.

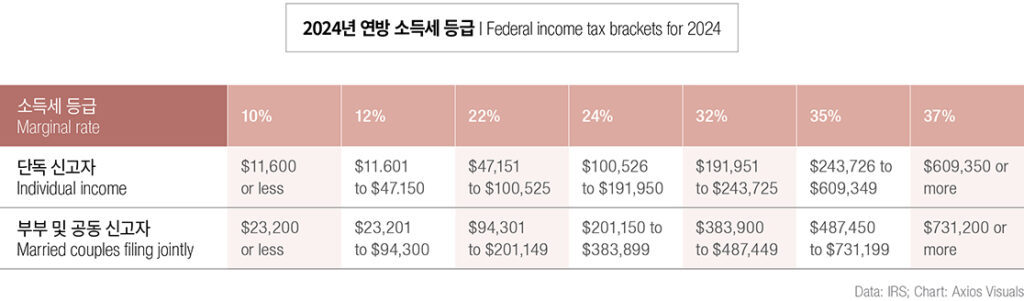

Of course, without all the stimulus checks and tax breaks that were handed out during the pandemic, this year’s tax return season will not feel the same. However, there are some favorable changes in 2024 for taxpayers. This is because the IRS has made some major changes to the tax law to account for inflation.

In 2024, both federal income tax brackets and standard deduction amounts increase. For example, if you earned $45,000 in 2023, you would be in the 22% tax bracket for that tax year, but in 2024, the same income would fall into the 12% bracket. This means you’ll pay less in taxes and have less taken out of your paycheck for the same amount of income.

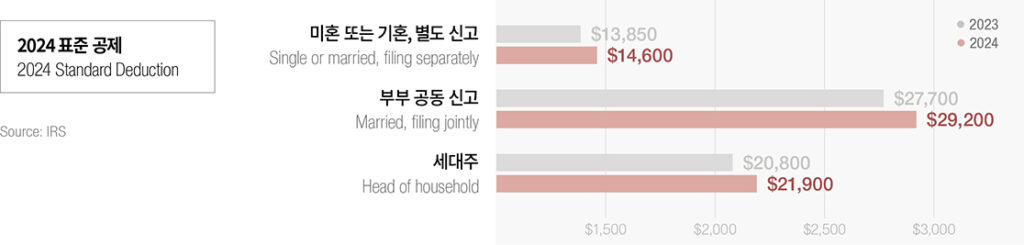

The standard deduction is set at $14,600 for single filers, a $750 increase from the previous year, and $29,200 for married joint filers, a $1,500 increase.

The following are some of the other key deductions.

-Earned Income Tax Credit: A tax credit that certain filers may qualify for if they earned less than $59,187 in the tax year 2023.

-Saver’s Credit: A tax credit for low- and middle-income filers who contribute to retirement accounts.

-Child and Dependent Care Credit: A tax credit for filers who support a child under age 13 or a dependent (including someone outside the family) who can’t care for themselves. Families with three or more qualifying children can get $7,830. This is an increase from $7,430 for the tax year 2023.

But when we asked beauty supply retailers about their anticipation ahead of the tax return season at the beginning of this year, we noticed something unusual. Some say, “Tax season? We’d barely make a profit.”, “Bumps in sales during tax season are long gone.”, “Our customers barely worked last year, so we don’t expect much”, “Tax return season sales are among the highest, so we’re hoping the economy will pick up.”, “Even if there’s no pandemic relief measure this year, should they still get some refund because a lot of them went back to work last year?”, “Still, tax season is the best season for beauty supplies!”, and so on, showing a wide range of differing sentiment. Why is there such a disparity within the same industry? As you can see from the answers, it may largely depend on whether your customers are working or not. Also, we can’t ignore regional differences.

The amount of tax refunds varies by region.

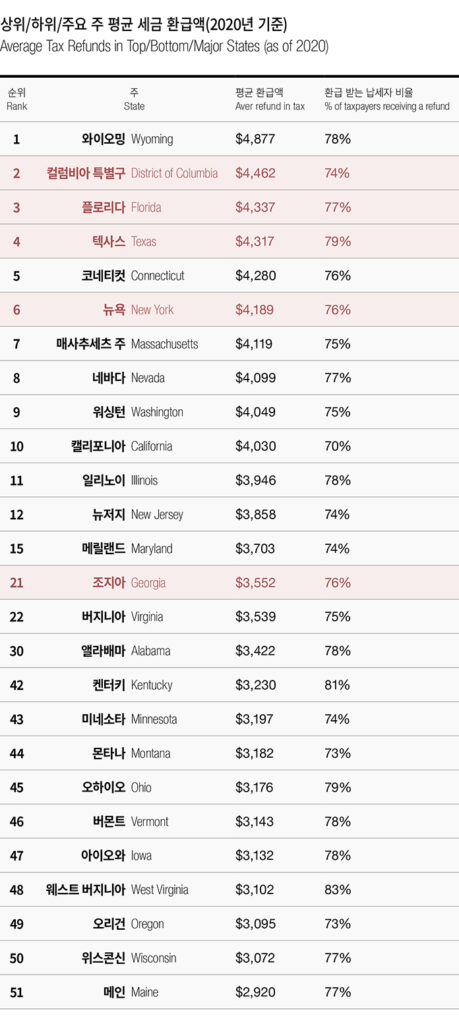

States have differences in tax refund. This is because each state sets its own state income tax rate, which affects the amount of tax you owe and the amount of your refund. States with higher tax rates may issue larger refunds for an average taxpayer in a given year. So, let’s take a look at how much customers in your area are typically getting back, in other words, the average tax refund in your state. Online lending platform Lending Tree has ranked all 50 states and the District of Columbia based on average tax refunds for the 2020 tax year.*

*The rankings are based on tax year 2020, the most recent year for which complete data is available. The information below is based on an analysis of individual income tax returns as reported by the IRS’s Statistics of Income (SOI).

As of the 2021 Census, Texas is the state with the largest African-American population, at nearly 4 million. Florida is a close second with 3.8 million, and Georgia is third with 3.6 million. Among metropolitan areas, the New York City metropolitan area, which includes parts of New Jersey and Pennsylvania, has the largest number of black residents (3.9 million), followed by the Atlanta metropolitan area (2.2 million) and the Washington, DC metropolitan area (1.8 million). The regions mentioned above are mostly at the top of the average tax refunds list. In other words, tax payers in areas with a lot of beauty supply stores get “substantial” refunds on average. Of course, these are just averages, and an amount of individual refund varies widely depending on a number of factors, namely income bracket and household type.

How much refund they get, by income amount

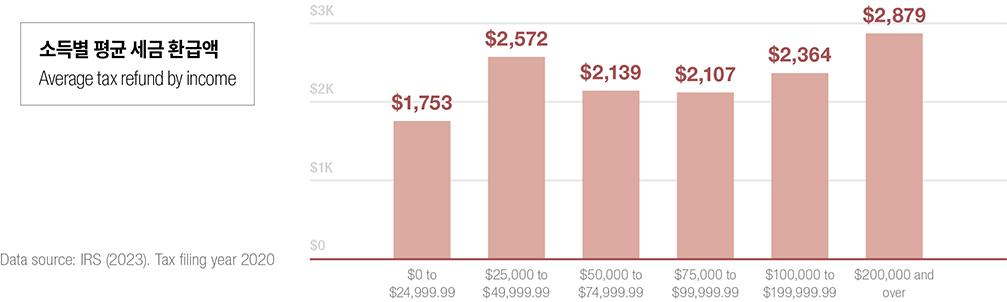

Higher earners typically receive a larger refund because the employers withhold more from their income over the course of a year. So, when we look at the average tax refund by income, high-income taxpayers ($200,000 or more) had the largest total refunds. On the other hand, low-income taxpayers ($10,000 to $24,999 brackets) received the largest refunds as a percentage of income. The larger refunds for those in the $25,000 to $49,999 bracket are likely due to the fact that they have more taxes withheld or take more deductions in proportion to their income.

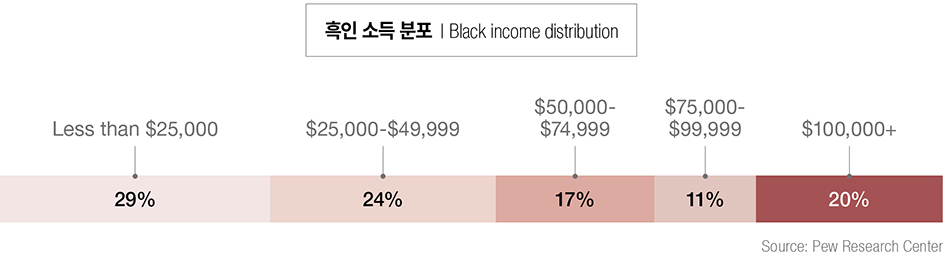

As of 2021, the average income for black households in the United States is $46,400. This means that half of black households will receive an average tax refund of $2,572, according to the data on the average tax refund by income. 48% of black households earn more than $50,000, with three in 10 earning more than $75,000, 20% of which earning more than $100,000. Of course, the largest share (29%) of the black households still belongs to those earning $25,000 or less. If they work and file a tax return, they could get a refund close to their monthly income during the tax return season. They also get some refundable tax benefits available only to them.

Earned Income Tax Credit (EITC)

The EITC is a federal tax credit that provides financial assistance to low- and moderate-income workers. The EITC is a “refundable” tax credit, meaning that if an eligible person’s credit is more than the tax they owe, they will receive a cash payment of the difference. The amount depends on your income, marital status, and number of children. For tax year 2023 (return due in 2024), the EITC can be up to $600 for families with no children and up to $7,430 for families with three or more children.

The IRS lists the basic qualifications for claiming the EITC in 2024 as follows:

- Have worked and earned income under $63,398

- Have investment income below $11,000 in the tax year 2023

- Have a valid Social Security number by the due date of your 2023 return(including extensions)

- Be a U.S. citizen or resident alien all year

- Not file Form 2555, Foreign Earned Income

- Meet certain rules if you are separated from your spouse and not filing a joint tax return

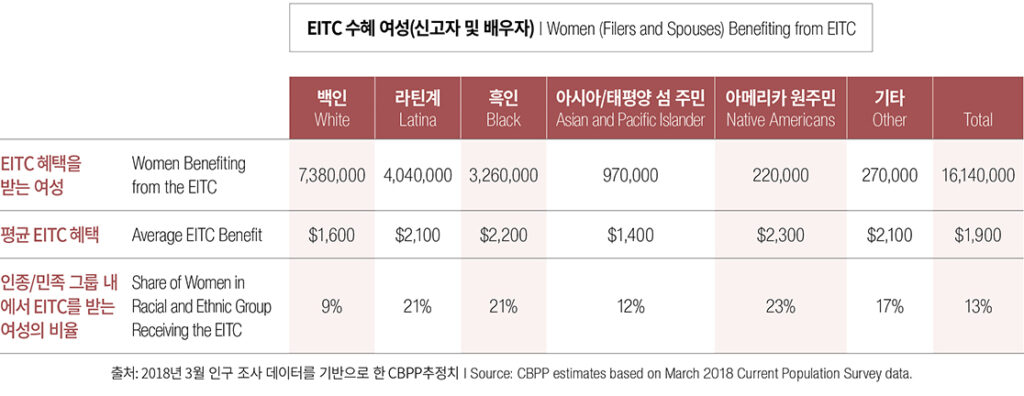

The Center on Budget and Policy Priorities (CBPP), which analyzes the impact of federal and state budget policies, published data on women receiving the EITC by race in a 2019 report. The study found that 21% of Latina and Black women received the EITC, more than double the rate of white women (9%). This is primarily because people of color are more likely than whites to work in low-wage jobs, to work hourly or part-time rather than a salaried position, and to earn lower wages in certain occupations.

The EITC provides more benefits for families with lower incomes and more children. Here are some examples of how much you’ll get based on your income, marital status, and number of children based on this year’s filing.

*You can easily calculate your EITC estimate at taxoutreach.org.

- ► Imani is a single mother of two children who works as a cashier and earns about $25,000 per year. She is entitled to a credit of $5,874.

- ► Jada is a married woman with three children. The couple’s combined income is $30,000, which is below the 2024 federal income poverty threshold. Her family is eligible to receive $7,028.

If you think, “Oh, my customers are low-income, so they’re all going to take advantage of the EITC,” you may be wrong. Some low-income individuals are not eligible for the EITC at all, or only receive a very small amount. For working singles and married couples without children, you must earn $17,400 or less to qualify for the EITC, and you can only receive a maximum of $600. You must also be between the ages of 25 and 65.

- ► Aliyah is a single woman without a child who works in retail and earns about $18,000 per year. She can’t get the EITC because her income is over $17,400.

- ► Kiara is a 22-year-old woman who works as a store clerk and earns about $12,000 per year. She has been living independently since her age 18, and she did not receive any support from her parents since then. Based on her income level, she would receive $430, but she doesn’t get the EITC because of the age requirement (25 or older).

- ► Nia is a 67-year-old childcare worker who earns about $10,000 per year and plans to continue working. She would be eligible for $583 based on her income, but she is not eligible for the EITC because she is over 65.

Child Tax Credit (CTC)

The child tax credit is a tax credit that covers up to $2,000 per child if you have children under the age of 17. Starting this year, the age limit has been raised from 16 to 17, and the child tax credit has been increased from $2,000 to $3,000 for children 6 and older and from $2,000 to $3,600 for children under 6. If a family with two working parents earns $112,500 or a married couple earns $150,000, they will, in both cases, receive the full credit. While the CTC is a nonrefundable tax credit, there are also refundable kinds. Additional Child Tax Credit (ACTC) is such, and if you qualify for the CTC but owe no tax or less than the credit amount, you can claim the ACTC to get a cash refund.

For tax year 2023 (2024 tax return), if your modified adjusted gross income is $400,000 or less (married filing jointly) or $200,000 or less (all other filers), the CTC is $2,000 per qualifying dependent child and the amount refundable as ACTC is up to $1,600. For tax year 2024 (filing tax return in 2025), the ACTC increases to $1,700.

For Jada in the previous example (married woman with three children, combined income of $30,000), assuming all three children are under the age of 17, her family could receive a combined EITC of $7,028 and ACTC of $1,600 for a total refund of $8,628 for the tax return. If you’re a multi-child, low-income household, tax return season might be the time you smile.

Tax refund, where the money goes?

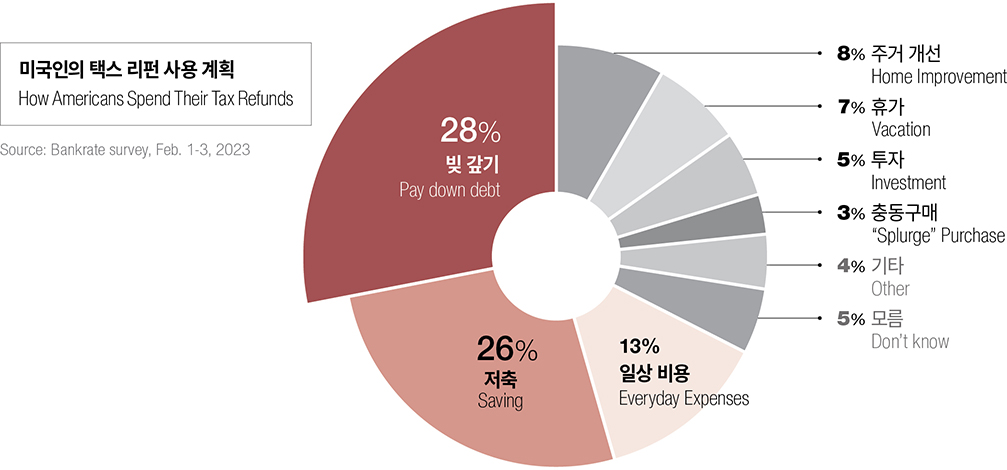

In 2023, the financial services company Bankrate conducted a survey asking “What do you plan to do with all or most of your federal tax refund?”.

One-third of Americans expecting a tax refund say they will use it to pay down debt, while those saying they will save (26%) are fewer than last year (32%), suggesting the economy is feeling the pinch. They are followed by everyday expenses like groceries and gas, home improvements, vacations, and investments, while 3% said impulse purchases.

We don’t have race-specific data, but it’s likely that African-Americans use tax refund in a bit different way. This is reflected in the overall increase in beauty supply sales around tax return season. According to a survey by All Things Hair (2003), 21% of African American women spend more than 25% of their monthly budget on hair care.

Most retailers would agree that tax return season, even if it’s not the same as it used to be, is usually a good time for beauty supply business. Tax return season shopping starts at the beginning of the year and continues through Easter, so you’ll want to stock up popular products in advance. More specifically, this is a good time to increase your order of quality human hair products and stock up on natural oils, expensive tools, and high-end chemicals.

You’ll also need to be aggressive in your strategy to make sure you’re securing regular customers when they tend to be more generous. A rewards program is also a good idea to attract customers who want to stay on top of trends while saving money.

In the same way that tax refund has been a breathing room in many taxpayer’s tight budgets, we hope it will become a breathing room for the beauty supply business in general. Anyhow, it’s the time of tax return, which is like the holiday season for beauty supplies.