Seen through the Hot & New

How the Hair Market has changed over the Past Three Years

In the face of the unprecedented events of the pandemic, the beauty industry, especially the hair industry, has experienced a boom and a bust. Hair companies, large and small, have been constantly developing new products and promoting popular products while keeping an eye on market conditions, consumer needs, and manufacturing facilities. One place where you can see the trend at a glance is the Hot & New section that appears in every issue of BNB Magazine. What products have hair companies developed over the past three years, and which have been hits and which have been missed? As we look forward to next year’s rebound of the beauty supply industry, here’s a recap of the recent changes in the hair market.

Cover of BNB’s Hot & New tells a lot about the trend

Engaged readers often contact us by phone or email and ask, “How do you create a diagram for the Hot and New articles? How do you compute the numbers?”

The “Hot & New” section, which features new and popular hair products each month, is one of the favorites among retail business owners. Many of them pay close attention to what new products come out and decide whether or not they’d be a hit for their customer base, and then they try to order a right amount. In fact, vendors have told us that they often get orders from clients who refer them to the page number of the BNB Magazine where the products appeared. So hair companies put as much effort into their BNB’s product articles as they do their own ads. In other words, BNB’s Hot & New is like a catalog in a magazine, showcasing the “hot” and “new” products.

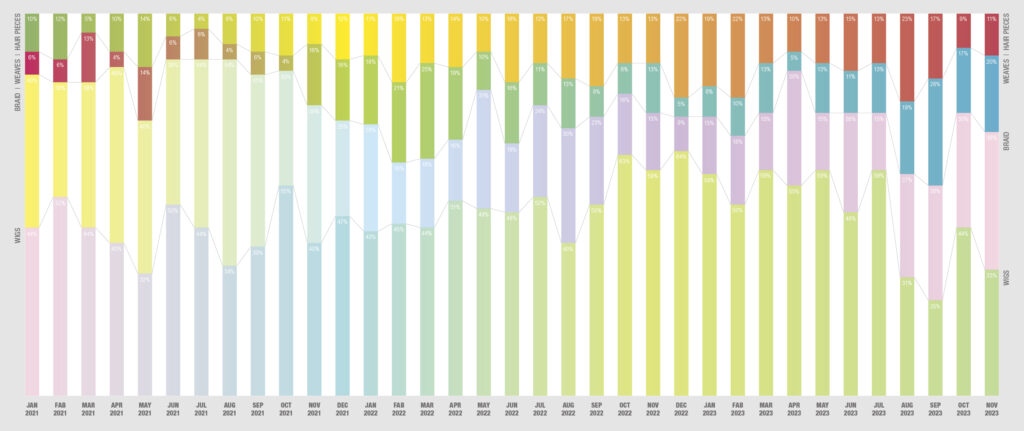

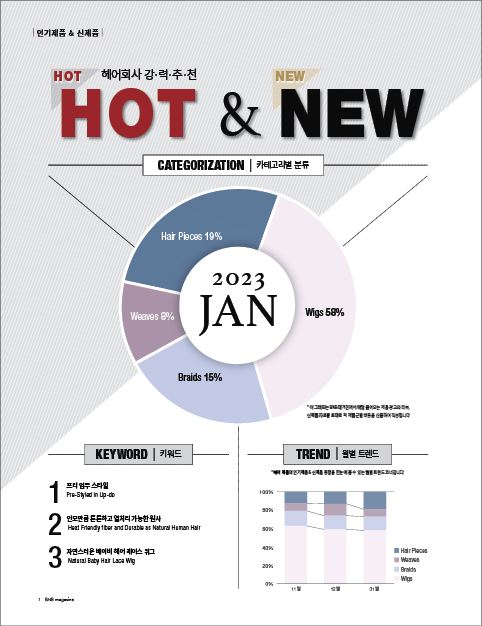

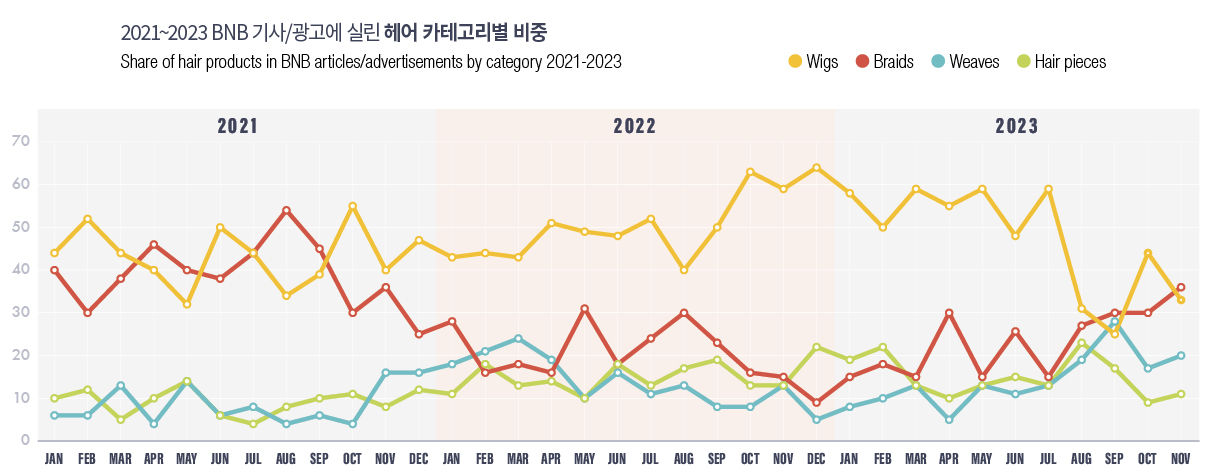

Of course, BNB also puts a lot of work into the articles. We don’t just introduce each product, but we analyze the hair products that will hit the market each month and create a cover. To answer the question above about the statistics included in the Hot & New graph, we categorize and count the 24-26 products that appear in Hot & New each month, and also, given the limited space in Hot & New section, we also count the hair products that appear in the ads and Product Review articles in the same month to compute the share of each category. We wanted our readers to be able to get a sense of where hair products are headed and what’s trending just by looking at the three diagrams that make up the Hot & New cover.

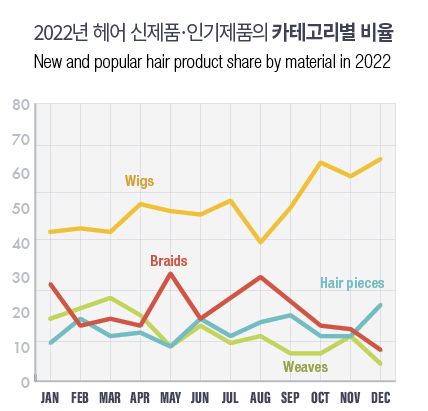

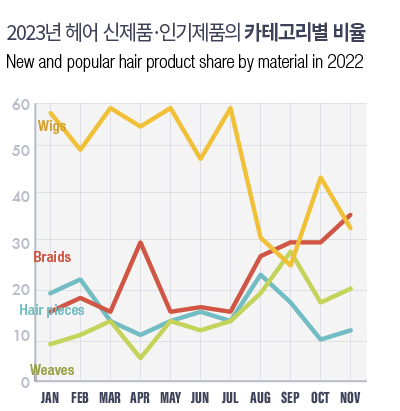

▸Categorization: We categorize all hair products featured in the magazine each month into four categories: wigs, braids, weaves, and hairpieces, and calculate the proportion of each category and plot them on a pie chart.

▸Keyword: It summarizes the features of hair products that appeared in the hot and new products and presents them in terms of keywords, so you can understand the trend of the hair market just by looking at the few keywords every month.

▸Trend: You can compare category breakdowns for the last three months presented in a bar graph to track changes in items that hair companies have marketed and promoted or have discontinued.

So how has the hair market changed over the past three years, which have been as eventful as ever? Using BNB’s own analysis as a guide, we’ll survey the major trends in the hair market.

Changes in hair trends over the years seen through monthly keywords

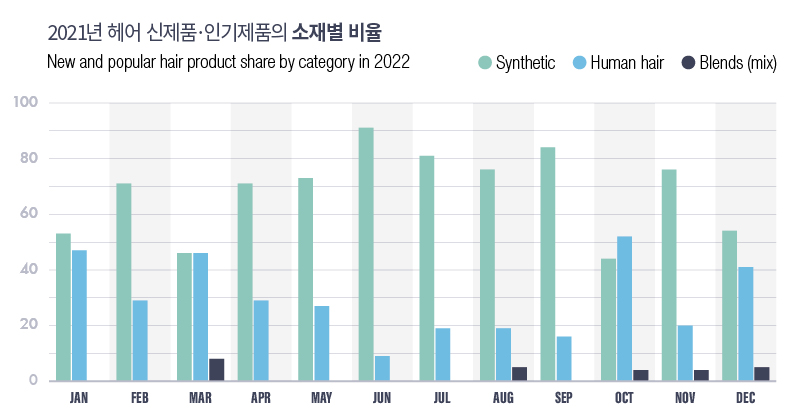

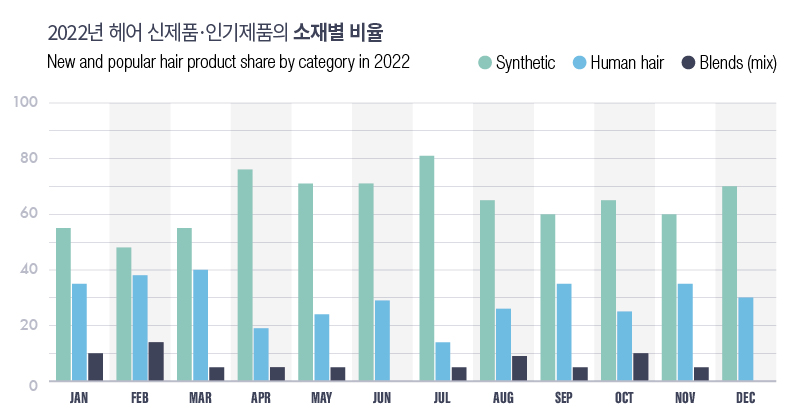

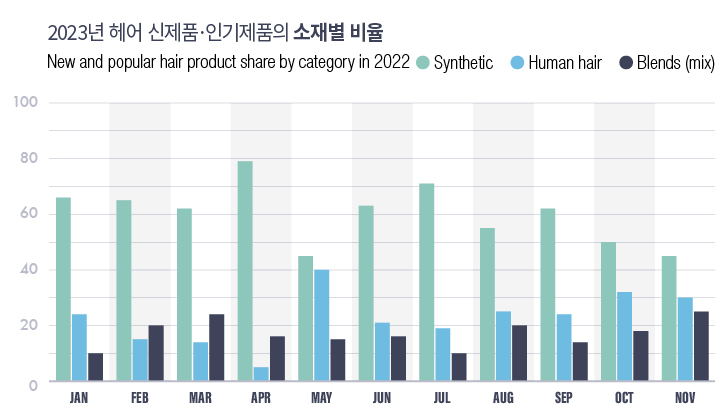

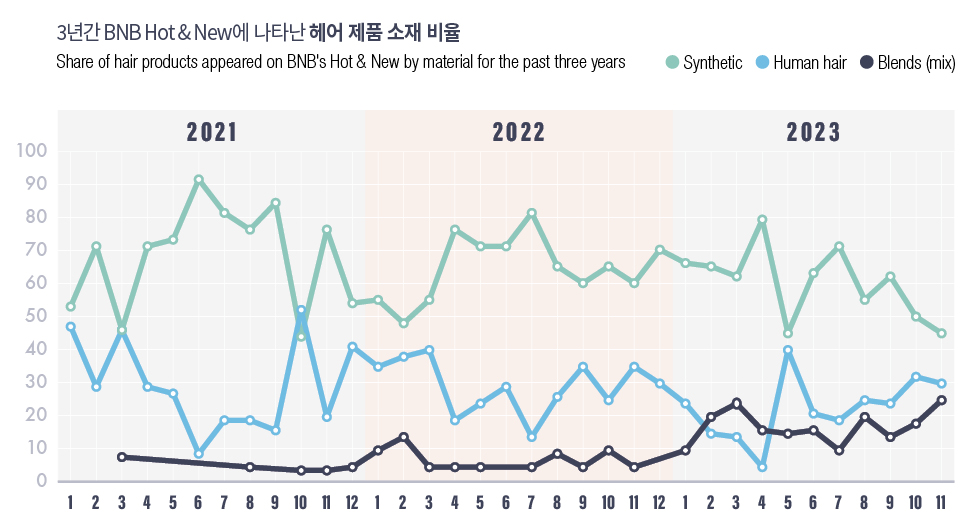

Product launches are heavily influenced by the state of the hair market, economy, material supply, consumer demand, etc. So it’s helpful to see how the share of each product family (category) has changed, and what features have newly emerged over time. How the share of different hair materials has changed is also closely related to the market condition, so we calculated and made a graph about the share of human hair, synthetic hair, and blends separately in this survey. Please note that the data utilized here is based on the product packaging labels provided by the hair companies.

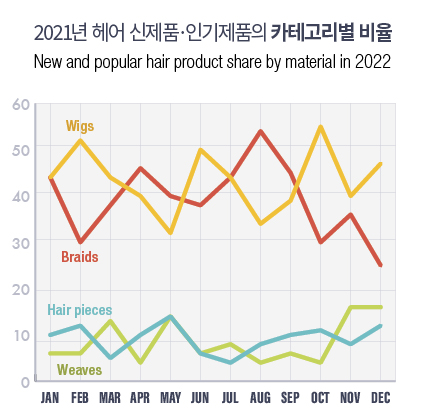

2021: Human Hair Wigs on the Rise, Braids on the Decline

In 2021, the U.S. experienced its strongest economic growth in 37 years as the roll-out of COVID-19 vaccines rebooted the economy. The hair industry also boomed as it experienced the influx of huge amounts of money from government aids.

Since the beginning of the year, the human hair bundle market has made a resurgence, with a steady stream of newly released high-end wigs like “Indian/Brazilian/Virgin Remy”. HD lace, invisible knotting, and wigs with natural hairlines have been in the spotlight, and in the wake of COVID-19, we’ve seen a steady stream of products made with antibacterial braids and antibacterial caps. As we headed into the summer months, we’re starting to see an increase in new braid products, especially pre-fluffed and pre-stretched braids, which made the consumer application easy by fluffing the curled strands and wrapping/twisting them at the factory. Due to the special circumstances of working from home, headband wigs, also known as “Zoom fashion,” have been trending from spring to winter. The fall semester, when in-person classes resumed, brought a boost to the back-to-school seasonal product lines, and the lace front wigs that create a natural hairline were released continuously despite their high price tag because of the loyal customer base. October and December saw more unprocessed luxury human hair product launches than ever before, and by the end of the year, human hair bundles, extensions, and wigs were riding the momentum.

However, at retail, the skyrocketing prices of human hair products were squeezing margins. To explain, starting in the second half of 2021, a combination of rising fuel costs, port delays, border closures, manufacturing disruptions, and rising labor costs pushed the price of human hair products to unprecedented levels. High-end human hair products dominated the Hot and New as well as advertisement pages during the holiday season, but retailers entered 2022 with a feeling of unease.

2022: Red light for human hair

In early 2022, ahead of the tax return season, more than 40% of the items were human hair products and related goods. Many were labeled on packages with phrases emphasizing high quality, such as “100% Human hair,” “Virgin,” and “Remy”. The share of weaving products has also increased significantly. This means that during peak human hair season, everyone bet on the high-end weaving market.

However, in the middle of the peak season, the human hair market, which was doing well, hit a brake. The skyrocketing price of human hair was one thing, but the shortage of raw hair and rising logistics cost have led to an unstable supply situation. In April, we started to see a clear decline in the share of human hair products, which continued into the fall. The void created by human hair products has been filled by high-quality synthetic products. “Human hair texture, Brazilian natural human hair touch, superior quality organic hair as an alternative to human hair,” popped up in the packaging labels. Blends of synthetic and human hair are also starting to make a name for themselves.

Braids enjoyed a shiny summer, but the rate of new product launches was low. In the aftermath of the pandemic, the hair extension market has seen the introduction of various products such as tape-in, clip-in, and clip-on, and glueless wigs, which do not require glue. The glueless wigs were a particularly hit item.

In the second half of the year, the human hair category rebounded as the logistics situation improved, and human hair extensions, lace front wigs, and so on made their way onto the new product pages. However, the economy has already entered a downturn, and only the demand for braids was increasing in the market. The gap between new flagship products and the actual market demand widened, leading to inventory buildup and price cut backs.

2023: Braids domination

The year 2023 was marked by lamentations from all corners of the beauty supply industry from wholesalers to retail. High interest rates, inflation, and financial market turmoil have caused household consumption rates to plummet, and in the hair industry, the bust after a boom has created an even greater sense of grief.

It’s the hair industry’s golden rule that braids sell well in an economic bust. Braids are easy to maintain, don’t have strict maintenance requirements, and can be worn for a long time, which means you have a lot of styling options, including updos, ponytails, and buns. As a result, hair companies launched more varied and unique braids than ever before. Box braids, goddess braids, boho braids, faux locs, cornrows, and more have become all-year staples, with French curls joining the party in June and July. There were also a number of items released in hot colors, which were rare previously.

The hair industry, however, isn’t exactly welcoming the rise of the braids. This is because braids are a low-cost item, and the more you expand the market for braids, the less room you have for other hair products, including wigs. In particular, wigs are said to have a much lower margin than in the past, but they are not comparable to braids. Various solutions have been introduced to take on the low margin. Wigs with thinner and more transparent, skin-like lace, breathable caps, and natural hairlines have been developed, and glueless wigs, with their glue-free ease of wear, have become all the rage, accounting for one-third of newly released wigs. Tape-in/clip-in extensions have also become a new trend, as they allow you to easily add length and volume to your hair.

Meanwhile, more premium synthetic materials featuring human hair-like texture and handling, closest to human hair, premium synthetic, or Remy Fiber were used, and more products with high heat fiber that was free to curl, dye, and style were welcomed by the consumers who were uneasy with the price tags on human hair products. We’ve also seen a steady increase in human hair blends. High-quality but with focus on the value-for-money, human hair blends have gradually gained ground in the hair market, including 100% Human Hair & Premium Mix providing bundle hair texture and feel at a fraction of the price, Human Hair Style Mix, Master Mix, 100% Human Hair Hybrid, and a blend of upgraded synthetic fibers and premium human hair in optimal proportions to give you the touch and feel of Remy hair.

Nevertheless, Braid’s dominance continued throughout 2023. As we approach the end of the year, the rate of new product launches for wigs continues to decline, with braids outpacing wigs in November, defying the saying “winter is the season of wigs.

Lessons of history: 3 years of hair market trends to predict the year to come

The hair market is not simple to understand. Basically, seasonal factors such as wig season and braid season come into play, but it is not only seasonal fluctuation but also the circumstances surrounding the economy, global trade, and production location. So you can have unexpected booms, you’ll be stuck with backorders in a boom, or you’ll sit on a pile of unsold goods in an economic downturn after you predicted a boom. Product launches have also changed accordingly, and a look at the category and material trends in product articles and ads in BNB Magazine over the three-year period provides context.

Wigs, which have accounted for the largest share of hair products, have been on a steady upward trajectory since 2022, before plummeting in the second half of the year 2023. Ironically, the second half of 2022 through 2023 was actually a downturn for the hair market, with braids dominating. Why was there a flock of new wig products around that time?

The answer lies in the time it takes to manufacture a wig. Hair companies typically place production orders with factories in China, Indonesia, and so on 4-5 months in advance. In other words, orders placed in anticipation of a boom were rushed into a sluggish market, and inventory and price-destroying sales ensued, leading to a decline in wig products later this year. Industry experts predict that the “bubble is still a long way from completely bursting.” Some hair companies are selling to retailers at half the cost to clear inventory and free up cash, and it can take a long time to recover especially in an economic downturn like this.

Braids have been shown to increase their share of the hair market each summer and then decrease as we move into the fall/winter months, so the “summer item” moniker makes sense. This year, however, was an exception. It’s way past summer, but braids are still going strong. The high-end braid market is emerging. While synthetic braids have been the mainstream for a while, human hair braids are making a comeback, and early birds are already developing and launching human hair braids.

Weaves and hairpieces are less sensitive to trends than wigs and braids. Weaving slowed down a bit during the recession, but with a fixed customer base, there was no noticeable decline. Once the braids sales peaks, the weaving market will become more active, but that seems unlikely for a while. Hairpieces also have a steady market. Extensions, in particular, are not typically a fast cycled item, but the development of easy-to-use tape-in and clip-in products is driving the hairpiece market.

When we look at the numbers by material, we see a more pronounced shift in the hair market. In general, synthetics are the most cost-effective, but human hair tends to be popular in booms, and synthetics in downturns. In summer, when it’s braid season, the share of human hair decreases, and in winter, when it’s wig season, it goes back up. However, as braids continued to grow in popularity and the human hair wig and weave market shrank, human hair continued to lose the market share, and in this year’s case, it did not recover around the tax season either. Stepping into that niche were human hair blend products.

A notable change this year is that human hair blends have taken over a significant portion of the hair market from the human hair/synthetic divide. The graph shows that blended products are on the rise, and the relevant market is expected to be even bigger next year. Even hair companies that have been selling exclusively 100% human hair products are realizing that they can no longer insist on human hair alone and are turning to blends. The success of blend products will rely on how close you can get the texture of human hair with the mix of human hair and synthetic. Finding the ideal mix ratio will be a new challenge for the hair market.

Who’s shaping the hair market and trends

Looking at the numbers by category and by material, there is a common theme running through the second half of 2023. Hair products and materials don’t lean to one or the other, but rather a similar ratio with no significant differences persists. In other words, there is no clear trend, and hair companies seem to be diversifying their product production favoring various types of items and materials. It’s literally the “Warring States Period” for the hair market, and this trend will probably continue through the first half of next year. In a time when it’s hard to predict which product lines will prevail and which will be the saving grace of the hair market, it’s up to the consumer to deliver the verdict.

So, is it really the consumer who sets the hair market and trends? Consumers, as the “end users,” have the power to choose the products on the market, but it’s up to the hair companies and beauty supply retailers to decide which products to release in the market and which products to their stores.

Hair companies are constantly conducting market research and developing new products by working with hairdressers, following the fashion trends among celebrities and influencers, and attending beauty shows. However, given the production lead time, it’s impossible to see a trend and incorporate it right into the products to be released. So, they have to take a long shot to predict the trend. The retailer receives the result of the prediction and sells it to the consumer. If the product becomes popular, it will lead to increased sales; if it doesn’t, it will lead to loss.

As such, hair companies and retailers are in the same boat. Therefore, retailers who are in contact with actual end users need to keep an eye on the direction of the hair company’s product launches as well as to share consumer feedback with the hair companies. As the saying goes, “If there’s no way, make a path,” and if it’s unpredictable, shape it yourself. This is possible if the hair companies and the retailers work together. Of course, BNB Magazine will play a role as a medium for such collaboration. We wish a smoother sailing for everyone in the new year.