Possible recession in 2023

What can be done in retail business management?

BY BNB MAGAZINE

©ucf.edu

We called a few beauty supplies and asked, “how is your business?” Most of them answered, “tough”, “not as usual”, or “very slow.” During the Covid-19 pandemic, beauty supplies enjoyed a boom of business by comparison, but things have certainly changed. The end of government stimulus and high-interest rates as well as high prices is carrying weight, and many people are concerned about the possible economic recession in 2023. What is the economists’ forecast? How can retail businesses prepare for themselves?

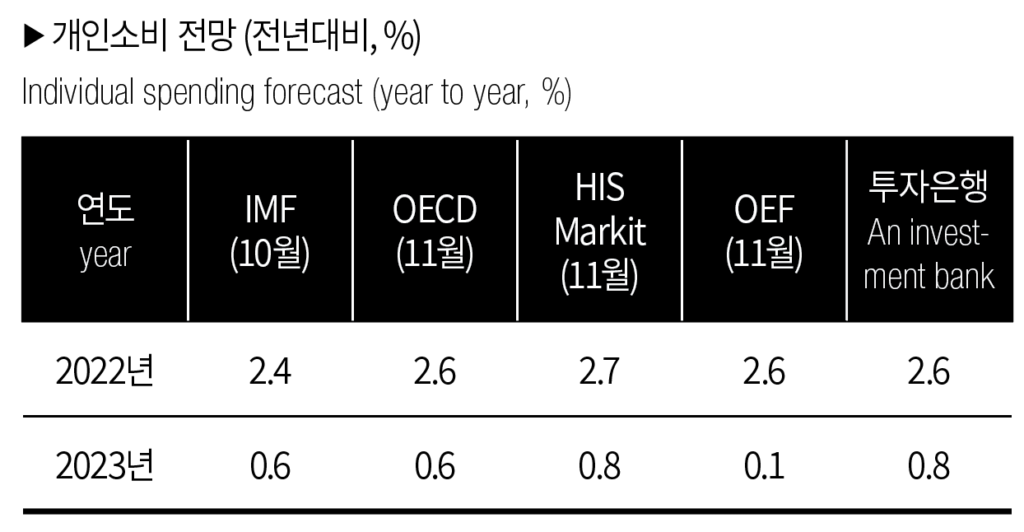

#2023 US economy outlook by experts

The U.S. Bureau of Economic Analysis (BEA), and International Monetary Fund (IMF), and other major institutions predicted that the US economic growth rate in 2023 will fall short of 1% due to the high-interest rates and consumer prices.

Some experts say the economy is rebounding in the middle of the tightening monetary policy of the Federal Reserve. Others believe although the possibility of recession is high, considering the labor market situation, economic conditions of the private sector, and so on, the progress will be gradual. Nonetheless, most of them raised concerns about the recession.

Bloomberg asked economists last December, and 70% of the surveyed economists predicted an economic recession in the U.S., and the Wall Street Journal’s survey last October received similar answers where 63% of 74 economy experts responded affirmatively to the possibility of a recession.

Most respondents pointed to the potential contraction of consumption due to an increase in interest rates as the main cause, and they predicted the vicious cycle of high-interest rates, high consumer prices, reduced government stimulus spending, and weak export, leading to less hiring by companies and less investment in inventory and manufacturing capacity.

#Labor market is still “tight”

©capestylemag

The labor market is deemed a major contributor to inflation. Still, the labor market has more jobs than people seeking jobs. Around November 30th last year, FRB Chair Powell announced that as of October 2022, the number of vacant job positions exceeded the number of unemployed people by 4 million, which translates to about 1.7 job positions for an unemployed person.

Voluntary resignation is also on the rise. It could be interpreted as many workers switching to job positions with better pay and benefit, which may lead to overheating of the labor market and wage increases in turn, resulting in long-lasting inflation.

In February 2020, the economic activity participation rate was 63.4%. In November 2022, it was 62.1%. The supply of labor will stay tight. This imbalance in the labor market will not be resolved in near future, so the wage will likely go up accompanied by consumer prices.

The beauty supply industry is no exception. The government provided a variety of financial aid including unemployment benefits, and it became hard to find a person who wants a job. Retail business owners are trying various methods to find workers, but it is a tough situation. Many expected that former employees will return after the government spending on economic stimulus ended, but they never returned.

During the pandemic, workers who left the workforce or transitioned to part-time work did not feel the need to return to work because they received more unemployment payments than their previous paycheck in addition to the concerns about viral infection.

A former employee of a beauty supply was placed on a part-time schedule instead of full-time and received a pandemic unemployment benefit from the government for the lost work hours. The $600 a week federal benefit was on top of $300 a week from the state. The newly given free time and better financial situation allowed them to pursue education, with which they obtained a better job opportunities.

#Minimum wage rises and burdens employers further

Minimum wages by state in 2023 ©Coloradotimesnews

The minimum wage is on the rise. The federal government has announced that by 2025, the federal minimum wage will be raised to at least $15. In California, the minimum wage is $15 in 2022 and $15.50 in 2023. In Washington DC, it is $16.10, to be raised once again in the second half. Massachusetts raised the minimum wage to $10 as of the new year, and Connecticut embraces a raise on June 1, 2023. It means that the employer’s burden is going to increase.

Contraction in consumer spending due to inflation brings fewer customers, the hot labor market raises wages, and as a result, running a business is getting tougher while the financial burden on the household is increasing due to interest rate hikes. Should tightening your budget be an answer? What can you do to wisely weather the tough time? Let’s find an answer in a report published by a business management consulting company.

Global business management consulting firm Bain & Company in Boston, Massachusetts proposed the following strategies.

1. Improve business efficiency

©yahoo.com

Economic recession will lead to reduced demand and revenue, and therefore, you should reduce operating expenses for increased profit margin while securing demand. Operating expenses include all spending related to primary business activities such as cost, sales fees, and maintenance fees.

Operating expense is the single most influential factor in business profitability. In fact, your profit is calculated by deducting operating expenses from your revenue. However, if you simply increase the price of your product or service to increase profit, you risk losing customers and, in turn, profit. On the other hand, if you pay employees less, the quality of service can drop, resulting in business loss.

You need to reduce expenses by adopting new technology such as POS systems and service robots on the retail floor and strengthen the management of regular loyal customers who frequently visit your store to shop. Some retail stores are giving more award points to regular customers, offering special promotions for their birthdays and anniversaries, and running various events to attract potential loyal customers.

2. Optimize your price strategy

When consumer price rises and your business is slow, your first instinct is to raise the price. It is certainly an option for a retail business with reduced profit, but you need to be cautious when dealing with customers of today.

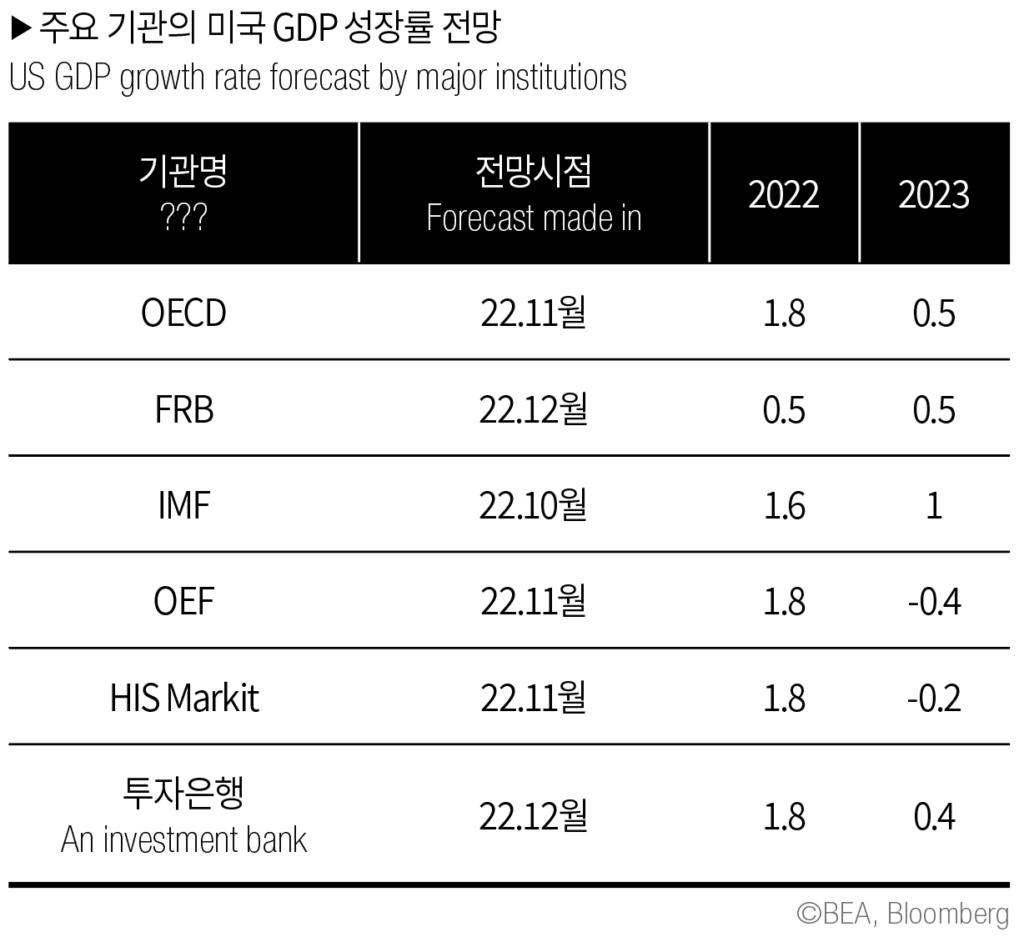

If you google Moroccanoil shampoo, you will have a list of retail stores nearby and the lowest prices.

Last year, BNB Magazine’s cover story “Good Review, Bad Review” discussed how to improve your retail business based on Google Review.

A review of a retail store read, “They’re charging 8.99 for 2.99 lashes.” As more people shop online and web search providers bring more information to consumers, you can simply google a product name to find out where you can buy it at the lowest price. If your product is not different from others, a higher price means losing the competition to other retailers. Also, customers will have a negative impression that you are charging more for the same product.

Unless you are dominating the market and, in a position, to decide the fair market price, you should always take your competitor’s pricing into account. Big retailers can run large-scale sales events or various discount benefits to earn customer loyalty, so you should keep monitoring them.

It may be helpful for pricing strategy to have a database of profitability per item. Beauty supplies carry so many items from hair products to chemicals, so it is not easy to itemize them. Nonetheless, once you create a database, you can simply update the product names and prices. When you spot a product with low profitability through statistics, you can stop carrying them.

3. Improve procurement and supply chain management

©linnworks

The spread of Covid-19 has caused supply chain disruption, and logistic costs soared while deliveries were delayed. Different retail stores responded differently. Some had procured enough to prepare for the worst case of supply chain disruption while others postponed purchase orders to avoid high costs. Although the decision will be dependent upon the financial situation or management capability of a given business, from the business management strategic point of view, you should maintain inventory level and secure goods.

4. Converting cost structure and improving the operational structure

The rising cost of labor due to the aforementioned imbalance in the labor market is affecting business profitability. However, if you simply try to reduce the operating cost, the service quality suffers. You can flex employees’ work hours per their needs to reduce labor cost, and you should diagnose if your business is hemorrhaging money.

If you have especially busy hours or slow hours, you can adjust the store hours. You may cut down unnecessary services or use of devices. For an advanced cost structure, you should keep tracking your assets, monthly utility bills, and so on.

#Know new federal, state and tax laws and regulations

While federal laws exist, state laws may provide more rights or privileges than federal counterparts. Therefore, you need to learn state laws about labor regulation and misdemeanor crimes. If you fail to provide employee benefits that are legally required by ignorance or discriminate employees verbally or by action, it may impact your business.

You want to review new tax regulations, too. The IRS announces them through public notices such as the new regulation on reporting payment transactions via mobile apps such as PayPal and Venmo. Now, if the total transaction throughout the year exceeds $600, you will receive Form 1099-K starting tax year 2023. Until then, Form 1099-K is issued when you have more than 200 transactions that amount to more than $20,000 in total. You should be aware of new regulations to avoid penalties such as fines, and you can visit IRS.gov or learn them from various media coverage.

#Companies that transformed crisis

In Korea, there is an often-quoted phrase, “luck in the form of misfortune.” When you work hard to overcome a difficulty, it might result in something good. For a small business owner, sluggish economics can be a tough obstacle, but it can be a good opportunity to reexamine your business structure. Here comes examples of U.S. companies that overcame crises through new business strategies.

1. Bed Bath & Beyond

©nbcnews

Bed Bath & Beyond is a household goods retail company leading the market segment in North America. However, since 2015, its business declined drastically, and in 2019, operating profit plummeted to a level that raised concern. In response, it closed 200 stores, reduced its physical footprint to save money, and restructure finance in favor of more flexibility. It also transformed its sales tactics from multi-channel to omnichannel.

*Multi-channel: centered around a product or service, the business reaches customers via more than one contact to promote participation, including online and offline channels

*Omni-channel: centered around a customer, it tries to address the customer’s hidden needs.

2. Pandora

©pandora

Jewelry brand Pandora had a great year in 2016, generating $3 billion in annual revenue, but its revenue started to decline in 2019, prompting business management innovation. It created a digital division in the headquarter to build an online presence and increased online transaction. With remote shopping helpers, store pick-up for online purchases, and refunds at the store, it focused on boosting customer satisfaction. It spent more on media advertisement and started a personalized email campaign in order to increase the number of loyal customers. In 2020, its online sales surpassed offline for the first time, and its stock price more than doubled.

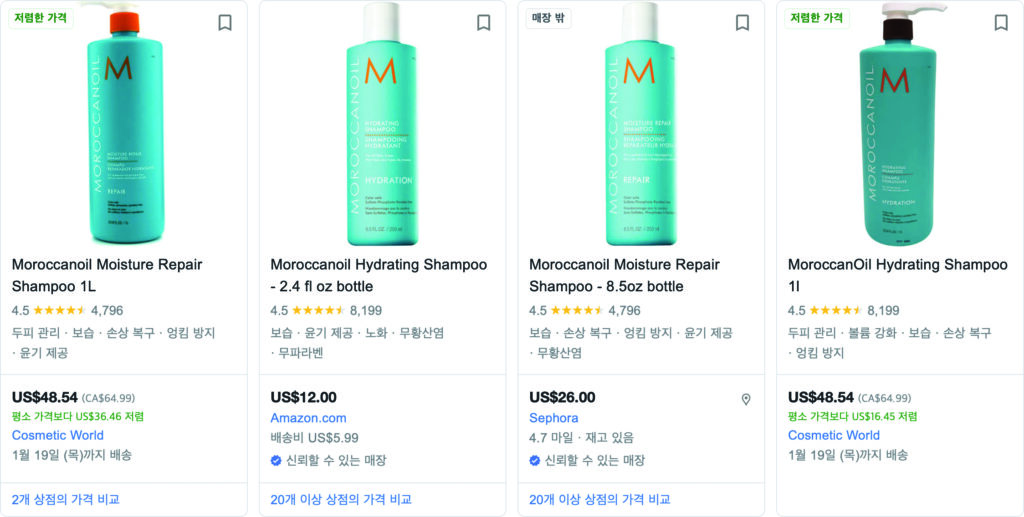

3. AVIS Car Rental

After trailing behind Hertz for many years, AVIS turned the second-place status around by appealing to consumers that they try harder because they are No. 2. For 13 years AVIS Car Rental had been losing money, but after the advertisement, the revenue soared by $4 million. To customers, AVIS made a deep impression that “you get faster customer service at AVIS Car Rental”, and the company is leading the market to date.

The above business management strategies and examples may not apply to all retail stores. However, you need a strategy to survive the upcoming economic downturn. Most retail business owners who run the business and manage the store at the same time, they have very little time to examine their financial structure. But let’s realize that your effort can make a big difference, look back at what you have done wrong for the past years in business management, and think about what to improve for a more progressive profit structure.