In OTC market

2022 Best Sellers and 2023 Hopefuls

By Bora Chung

The beauty industry in the U.S. had a good year despite the pandemic and recession in 2022. However, inflation and a gloomy forecast for the economy cast some doubts in the long run of 2023. The silver lining is that women’s spending was not significantly affected by the Covid-19 and recession, from sheds light on a positive outlook.

We analyzed a consumer survey conducted by a consumer research firm, the Benchmarking Company, in our effort to provide some guidance in your beauty product buying in 2023. The following data is not limited to the beauty supply segment but a survey of the entire beauty market in the U.S. It mainly deals with skin care and nail products excluding hair such as wigs and braids. Therefore, you should take into account your consumer’s regional and demographic characteristics.

The survey is conducted from March to October in 2022 and based on responses from buyers and editors in the beauty industry. They were asked about newly released products that were noticeable in 2022 and anticipated for 2023.

Beauty supplies were not immune from supply chain disruption in 2019, and many retail businesses struggled to procure enough quantity in time to meet consumer demands. Some of the consumers who could not find their usual products went on to find a new product. In fact, for many consumers, trying a new brand or product can be a challenge. Some are allergic to certain ingredients or fragrances, and others have their peculiar preference. When it comes to beauty care products, consumers tend to be nit-picky because they are applied directly on their body.

What new products were picked up by the consumers this year? What products will be chosen by the consumers in 2023?

Beauty industry in 2022

Beauty marketers would agree that you need to launch an item that is not only innovative but also attractive, and before consumers lose their interest in newly launch items, you need to continually keep up.

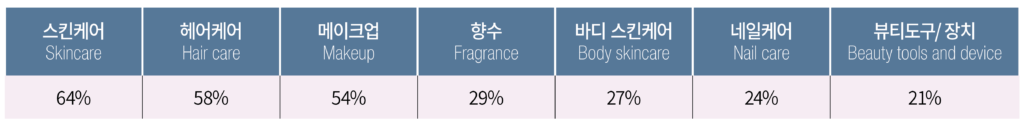

71% of the respondents reported that they have tried a new beauty or personal care product in 2022. The list of categories in the order of most tried new products is as follows:

Consumers are increasingly demanding more diversity in beauty products, and products must fulfill their desire for repeat purchases. Personal preference and desire need to be considered in every product to open their purses.

We will take a closer look at the three top categories for 2022.

Facial skincare

The largest number of people tried products in the facial skincare category, and a wide range of products were included in this category. Face masks including sheet and peel types made the top list with 17%, retinol products 15%, vitamin C 12% and CBD 8% followed in the order. In 2022, 56% of the consumers have shown interest in repurchasing the newly tried facial skincare product, and only 3% reported dissatisfaction for them.

Hair care

Quite many consumers tried a new hair care product. After trying new products, the largest proportion of consumers reported satisfaction with their new product choice in hair masks (25%), followed by leave-in conditioners and dry shampoos (each 14%) and hair oils (12%). In addition, at-home colors, hair growth products and others made up 10% of consumers who tried a new product, and scalp treatment, serum, and shampoo bars made the highly satisfied list thanks to environmentally conscious consumers.

52% of all consumers who tried new hair care products in 2022 said they would purchase the new product again, and 34% said they would consider re-purchasing the item. 3% of consumers were dissatisfied by the new product they tried.

Makeup

Lip plumping products made up 16%, eyelash extensions and faux eyelashes 15%, skin-friendly foundation, especially stick foundation, 13%, eye liners and eyebrow stickers and stamps 11%, and eye brow pomades 10% in the 2022 newly tried product list.

Also frequently mentioned categories included highlighters 9%, glitter shadows 9%, contour blushers, cream shadows, brow waxes, which did not make the cut.

51% of the respondents indicated their plan to repurchase the makeup products, 30% showed interest in repurchasing, and only 4% reported no interest in repurchasing.

Prospect for 2023

According to the respondents who are representative of the general consumers, facial skincare, hair and makeup products will be the most spent categories for next year. In the additional comments, many respondents said they were looking forward to a product that is superior and more effective compared to the products they were using.

Facial skincare:

age-defying, anti-aging products, exfoliants, masks, moisturizers, retinol or its alternatives, and serums made the list. Younger consumers showed interest in preventing skin aging, and older consumers in anti-aging and maintenance.

Hair care:

stray hair products, curl products, newer at-home curlers, hair growth products, hair masks, oils, conditioner and scalp treatments were among the listed.

Makeup:

eye makeup products in general, especially the innovative newer color pallet eyeshadow, products for longer, thicker, and fuller eyelashes, brow products especially stickers, contour, and skin-friendly foundation formulas made the list of most anticipated products.

The rising popularity of well-being products

One of the rising categories for the next year is well-being products. While hair, skin, and makeup led the pack, health supplements and vitamins are increasing in popularity.

Health concerns related to Covid-19 and increased interest in well-being will likely lead to bigger growth in the health supplement market. The beauty supplement market is anticipated to grow annually by more than 4.8% from 2022 to 2030.

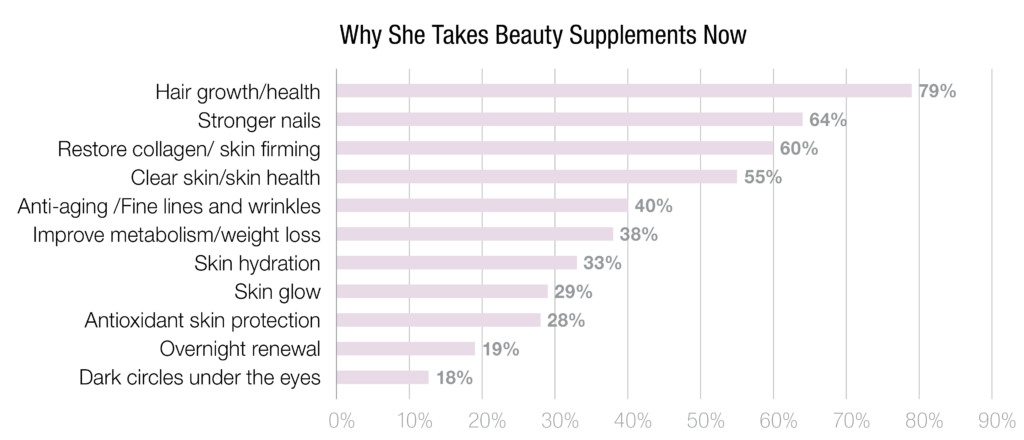

79% of the respondents disclosed that they buy vitamins for hair growth and health, and 64% for nail supplements. Also, 60% of the participating consumers are reportedly using collagen for youthful skin and regeneration, and clear complexion, improving fine wrinkles and lines, and moisturizing skin were their reasons for taking supplements.

©gcimagazine

76% of the survey respondents who are already taking beauty supplements pointed to anti-aging as their chosen reason, and promoting metabolism (73%), stress management (64%), and weight loss and healthy skin (each 63%) followed it.

As shown in the research data, supplements and vitamins are already one of the outstanding categories for beauty consumers, and their future in the market is very bright.

Vitamins for skin ©townandcountrymag

92% of the beauty product consumers said that the beauty skin and healthy hair could be achieved to the greatest extent only through caring both inside and outside of the body at the same time. In fact, beauty vitamins are located near the beauty and cosmetics aisles in retail stores like CVS, Walgreens, Target, and Walmart.

Experts predict that 76% of American beauty brands will offer health supplements for skincare, hair care, and body care, and 77% of the survey respondents reported the supplements and vitamins from beauty brands were substantially effective.

Nowadays, big box stores and chain stores are carrying a wide range of products targeting African American consumers. Although regional differences exist, in some cases, over 40% of the shelves were occupied by products appealing to African American consumers. These big stores are not likely to start carrying wigs and other hair products soon, they took away a large chunk of the general chemical market.

The advancement of online retail, the ease of price comparison online, and the convenience of one-stop shopping are making the importance of providing a wide variety of merchandise at beauty supplies greater than ever, and you can start preparing your procurement plan for 2023 with the consumer survey data to keep attracting consumers to your retail store.