Economic recovery from the second half of 2023 positively impacted Beauty Supply!

Many economists expect the economic situation to improve slightly this year compared to previous years. However, tight monetary policy, Europe’s financial crisis, war, high energy prices, and a strong dollar may amplify the economic crisis. Still, economic indicators are expected to slowly rise from the first half of this year due to consumers’ desire to spend on travel and shopping since late last year. As the economic forecast of global investment bank Evercore® is also hopeful that the economy will improve after next year than this year, I forecast the financial situation in the second half of the year to see how the domestic economy will affect beauty supply stores.

The COVID-19 pandemic has calmed down to some extent, but the economic recession that continued three years ago seems to be recovering a little from the first half of this year. Of course, despite indicators that inflation has declined. Labor markets remain robust and actual depreciation has slowed. Although sales of beauty supply stores have fallen less, some experts and pessimists predict that the economy has entered a prolonged recession due to substantial wage cuts, large companies’ workforce cuts, and record low consumer confidence. The US government is closely monitoring various economic indicators to avoid such a recession.

Then, let’s present what the US domestic economy will be like in the second half of this year and some general factors and trends that may affect the US economy, and predict the economy of beauty supply stores accordingly.

Key Economic Indicators

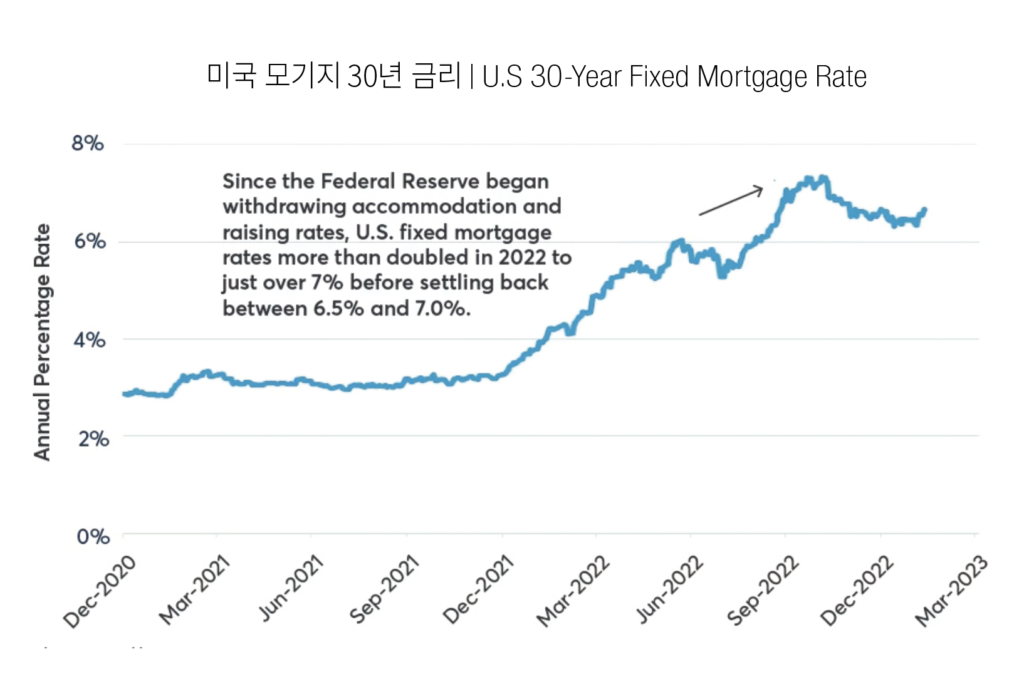

♦ Monetary Policy: Federal Reserve interest rate and monetary policy decisions are crucial in shaping economic indicators. For example, it could slow economic growth if the Federal Reserve tightens its policy in response to inflationary pressure.

US Secretary of the Treasury Janet Ellen predicted that there would be no further rate hike, saying that consumers are already under pressure due to the recent bankruptcy of large banks and that the Federal Reserve kept it at zero level to boost the US economy, which has been stagnant since the COVID-19 crisis began.

However, inflation has accelerated due to the increase in the amount of money released on the market and the vertical rise in energy prices such as crude oil due to the influence of the Russia-Ukraine war. Still, the Fed reiterates that inflation is ‘temporary’ Only belatedly did it turn to austerity measures through interest rate hikes.

♦ Fiscal policy: Government spending, tax policy, and stimulus measures are also expected to impact the economy significantly. If the government implements new infrastructure or social programs, it may boost economic growth, but there is a risk of increasing national debt. Nouriel Roubini, a professor at the Stern School of Business at NYU (New York University), pointed out, “The financial and monetary policy of COVID-19 had a problem of over-expansion (too much),” and pointed out, “In the case of over-supporting, people lose their jobs and reduce their income, but over-supporting also causes problems such as unemployment and inflation.” He pointed out that the government may be unable to decide on economic stimulus measures quickly. In addition, it also warned that “POLYCRISIS,” or inflation and economic recession, could come at the same time in the second half of this year.

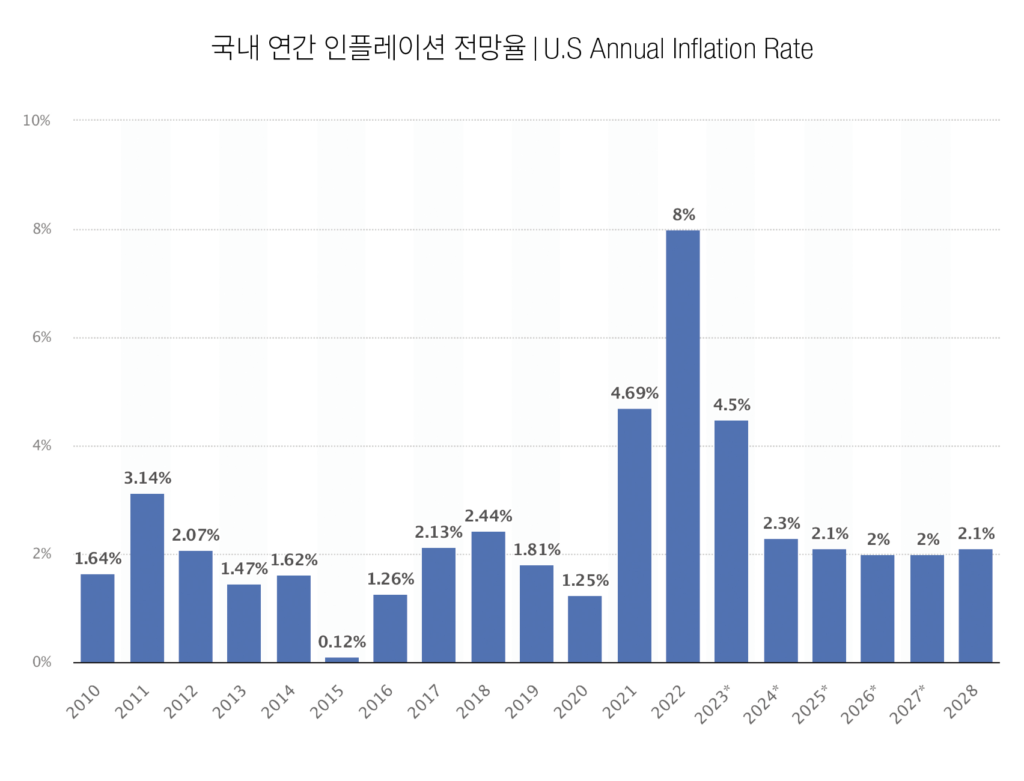

♦ Inflation: Inflationary pressures may continue to affect consumer spending, business investment, and overall economic growth. High inflation could induce the Federal Reserve Bank to take steps to control it, potentially slowing economic growth. However, compared to the 2022 figures, inflation is staying at 4-5% this year, so it is not expected to be pessimistic.

♦ COVID-19 PANDEMIC: The success of ongoing management and vaccination efforts against the COVID-19 pandemic will continue to impact the economy. As the transformed malignant virus is latent, variations and changes in public health measures can lead to the unpredictability of economic performance. Real GDP reached a pre-pandemic high in the second quarter of 2021, and quarterly figures are volatile, but modest economic growth continues. In the spring of 2020, 22 million jobs were lost, and more than 22 million jobs were recovered by the end of 2022.

♦ Labor market: Employment levels, wages and labor force, and unemployment are essential key indicators of the economy. This is because tight labor markets can raise wages and support consumer spending, while high unemployment can undermine economic growth. According to the US Bureau of Labor Statistics (BLS) job openings and job loss statistics, the hopeful mood for the labor market will continue through 2022 and 2023. In addition, in its own survey, 22.1% of consumers said they expected more jobs to be offered in the next six months.

♦ Housing and Consumer Spending and Reliability: Home price growth forecasts for the second half of this year are expected to average 1.2%. The sales market is expected to slow, but some are optimistic that the annual average growth rate will reach 4% between 2024 and 2027.Consumer spending is an essential driver of the US economy. High consumer confidence can lead to increased spending, while low confidence can lead to lower spending and slowing economic growth, which could affect retail stores like Beauty Supply.

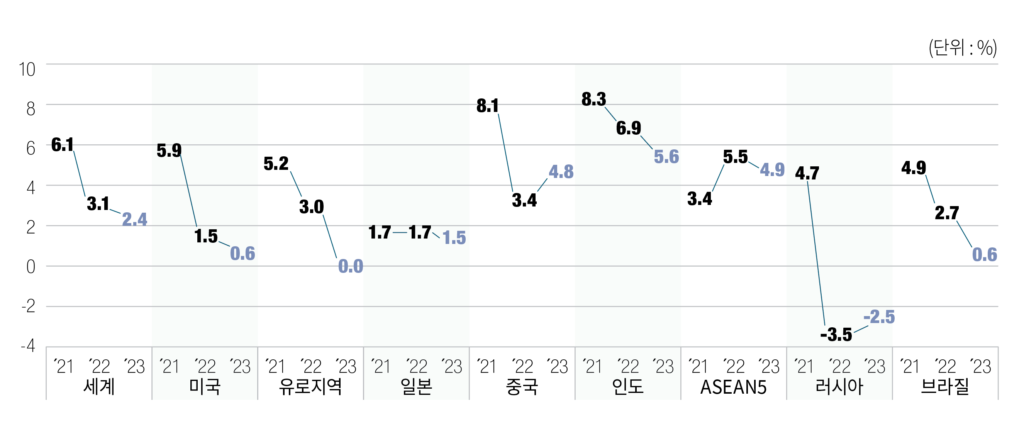

♦ Global economic trends: The performance of other major economies such as the European Union (EU), China and Japan will also affect the US economy. Geopolitical events, such as global economic growth, trade relations, wars and conflicts, can also significantly impact the US economy. After registering an annual growth rate of 5.3% in 2021, the EU economy continued to grow at 3.5% in 2022. GDP is expected to grow by 0.8% this year and 1.6% in 2024.

♦ Advances in AI technology are not helpful for beauty supply: According to a recent “Global AI Index” report published by Stanford University’s AI Research Institute last month, the number of AI-related job posts (job disclosures) posted across the US last year reached 795,624. This is double the 404,76 in 2022, a year ago. Moreover, as each company invested in AI, related jobs also increased. By state, California had the most significant number of 142,154, up 77.1% from 82,238 a year ago to 61,916 in the first half of the year alone. California is home to big tech companies such as Apple, Google, and Meta, while Open AI, a generative AI chat GPT developer, is also in San Francisco. California was followed by Texas (66,624) and New York (43,899). However, while rapid technological development and adopting new technologies can boost productivity and economic growth, they can also lead to increased unemployment and social disruption due to job displacement.

These factors mentioned above are key indicators that can affect the US economy in the second half of the year, and actual economic performance can change at will due to the interaction of these factors and other unexpected circumstances.

Impact on Beauty Supply Stores

Then, how will the domestic economic situation affect the beauty supply stores in the second half of the year? The financial crisis in the year’s second half is directly related to the sales of beauty supply stores because it affects consumers’ spending. If consumers feel their financial situation is sufficient, they will likely spend on random items such as hair and beauty products. As the industry develops, the continued growth of existing e-commerce and digital sales channels can have a negative impact on existing offline beauty supply retailers. Offline retailers are likelier to increase sales only when they adapt to the changing environment through online sales and active SNS promotion strategies.

In addition, the beauty industry is constantly changing with the frequent emergence of new products and new trends, so hair wholesalers must identify the latest trends and promptly provide innovative products to retailers to win-win each other as retail sales increase. As consumers’ perceptions of eco-friendly products and interest in health and well-being increase, the types of beauty products that consumers seek are also changing. Products that promote overall well-being, such as skincare and clean beauty products containing natural ingredients, are constantly loved by consumers.

It is lastly, knowing how consumer tendencies such as age, cultural preferences, and the characteristics and demographics of beauty supply regions change will be a positive factor for sales. A beauty supply that meets the needs and preferences of various customers is inevitably advantageous in retaining regular customers and attracting new ones.

Recently, the number of beauty supply stores has steadily increased, regardless of large or small cities. Independent retailers and significant chains fiercely compete for market share in the beauty industry. Price competition, product selection and customer service seem to be thoroughly prepared as they can directly affect all beauty supply store’s sales.

*TIP* 5 Tips to Increase Beauty Supply Store Sales –

- Price: Provide competitive prices by occasionally checking online market prices, such as beauty supply sites and Amazon.

- Products: Customers can touch the hair, smell the chemical, and let the customer experience the noise and heating speed after use.

- Service: Learn professional knowledge, discuss the pros and cons of products honestly, and recommend suitable products to customers.

- Understanding local customers’ tendencies: Even popular products often do not sell well at local beauty supplies. Keep in mind that no matter how hot or popular a product is, there are products that customers in your area want.

- Social media promotion: Be friendly with customers. Solve customers’ needs individually through Google reviews or social media promotion strategies.