2024 Economic Outlook and Survival Strategies for Beauty Supplies

It’s a new year in 2024. Many people start making New Year’s wishes and resolutions around this time. However, the beauty industry is not in the mood. Rather than talking about new goals and hopes for the future, beauty supply businesses across the country are facing the heavy question of how to survive. The beauty supply industry is trembling as many experts disagree on 2024 economic outlook. Will this be a brutal year that leaves many businesses stranded as many people fear? As you did in the pandemic, would you be able to to turn a crisis into an opportunity? We discuss the economic outlook for 2024 and how beauty supplies can survive.

Economic indicators

Every year end, various institutions publish numerous economic indicators. We’ve summarized the past year and looked at some of the metrics that will help us predict the year ahead in 2024.

Retail Sales and Consumer Price Index (CPI)

The retail sales index is the sum of personal consumption expenditures, excluding services. In other words, retail sales in the U.S. are the amount of money Americans spend at grocery stores, department stores, supermarkets, and so on, and more spending generally means a stronger U.S. economy. Over the past 30 years, the U.S. retail sales index has averaged 4.82% year-over-year, but in the wake of the pandemic, it has been more volatile than typical years. April 2020 saw a low of -19.80% and April 2021 saw a record high of 52.00%. However, from the beginning of 2022, retail sales went steadily downhill, falling below the average index in 2023.

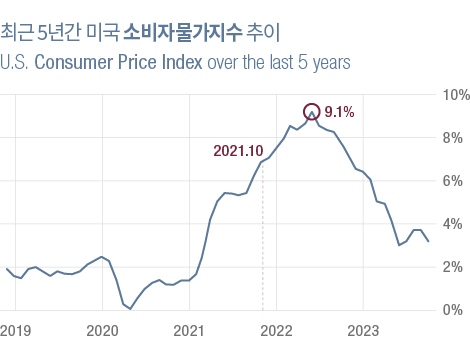

The U.S. Consumer Price Index began rising at a rapid pace in October 2021, peaking at a 40-year high of 9.1% in June 2022. After 12 consecutive months of decline, the rate has been around 3% since June 2023, leading many to believe that the U.S. is winning the battle against inflation. But everyone still feels the inflation, and even if it does subside, high interest rates and mounting debt remain a problem.

Unemployment rates and employment rates

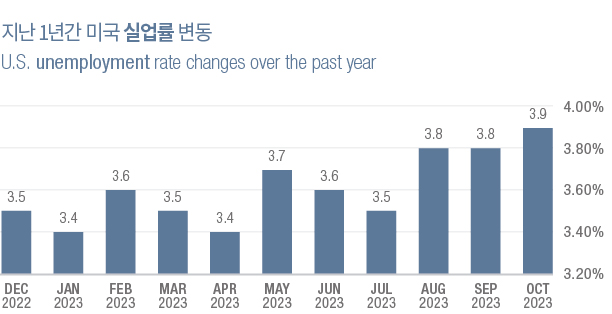

The U.S. unemployment rate has been steadily rising since the second half of 2023, reaching a two-year high of 3.9% in late October, but it is considered sound. In fact, an unemployment rate of around 4% is generally considered full employment. The Federal Open Market Committee’s projected 2024 U.S. unemployment rate is also well below the long-term average (5.7%), averaging around 4.1%. However, the U.S. labor market is actually experiencing a “recession with low unemployment,” an anomaly in which high numbers of job openings and layoffs are occurring at the same time.

The employment rate is the ratio of the number of employed people to the labor force, and has recently been used as a more reliable measure of employment than the unemployment rate. The U.S. employment rate decreased to 60.20% in October from 60.40% in September 2023. The decline in employment growth, which began in mid-2021 at the height of the pandemic, is expected to reach near zero in the first half of 2024. Companies will try to cut back hiring and reduce work hours as much as possible.

Average hourly earnings and minimum wage

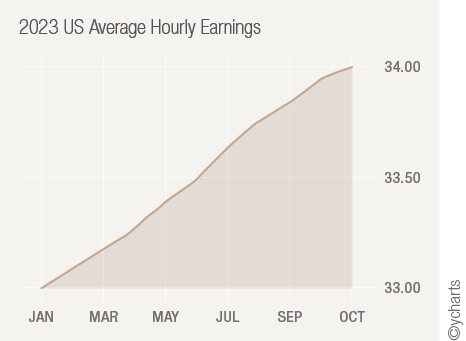

The average hourly wage is the number of dollars an average worker earns per hour in the United States. U.S. average hourly earnings were $34.00 at the end of October 2023, up 0.2% month-over-month and 4.1% year-over-year. Sustained wage growth is a major contributor to sustained inflation.

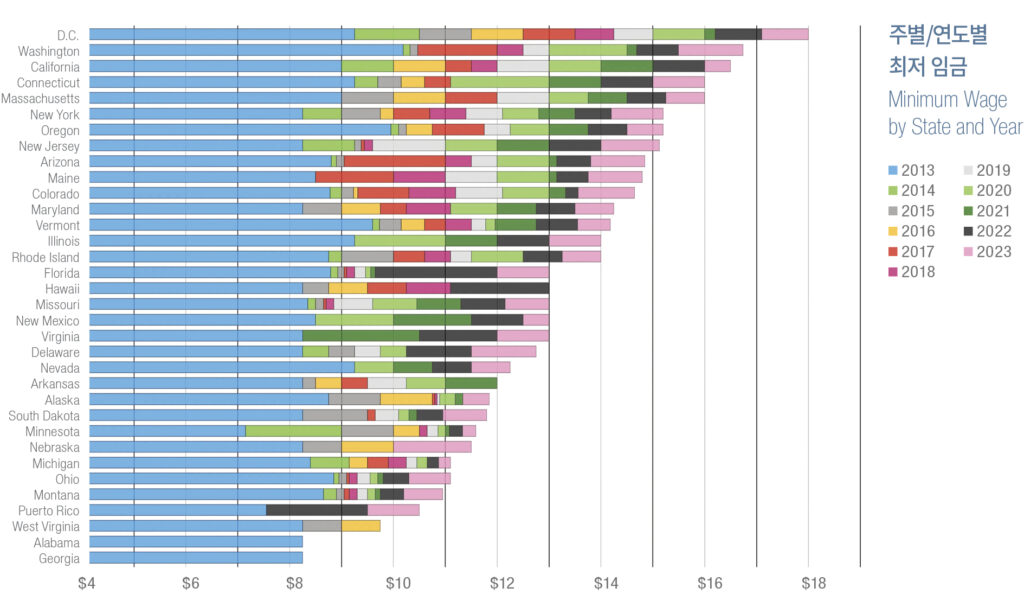

It’s the minimum wage that really puts the burden on employers. The federal government has not raised the minimum wage rate ($7.25 per hour) since 2009. However, many states have raised the state minimum wage over the years to combat the high cost of living and inflation, and employers are required to pay the highest minimum wage applicable in the locality. Delaware, Hawaii, Illinois, Maryland, Michigan, Missouri, New Jersey, Nebraska, Rhode Island, and Washington state have increased their minimum wage as of January 1, 2024. Notably, Washington state increased the minimum wage from $15.74 to $16.28 per hour, which makes it the highest in the country.

Experts speak of ‘temporary’ downturn

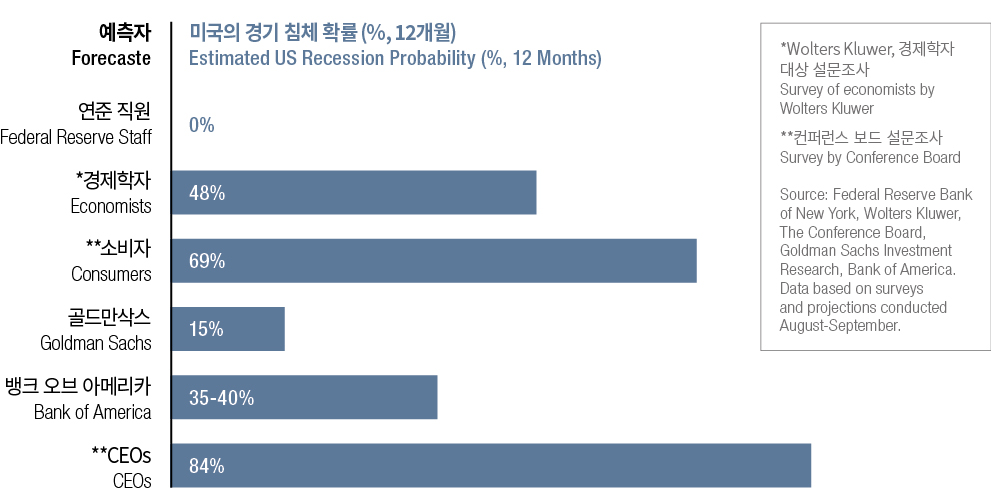

Statistics are open to interpretation as “it’s all in the eye of the beholder.” Experts disagree on whether the U.S. economy will be in recession in 2024.

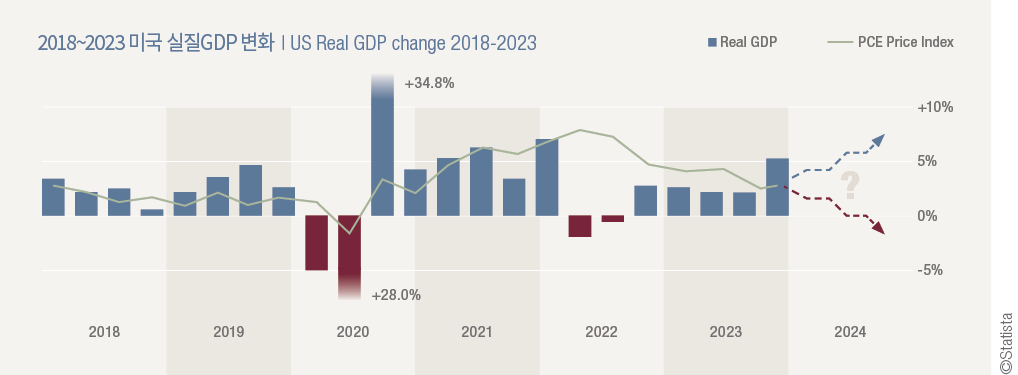

The U.S. Federal Reserve is confident of a soft landing* despite the projected GDP growth slowing to 1.5% in 2024. Several private economic research institutes have left open the possibility of a “temporary” recession in the first half of the year, with the Conference Board forecasting U.S. GDP growth of just 0.8% for the full year of 2024, including a shallow downturn in the first half. On the other side, some economists are skeptical that the U.S. can sustain economic growth with such a high interest rate.

*Soft landing: a gentle contraction in the economy. In a time of economic contraction, the main objective for governments and central banks is to soft land the economy with appropriate fiscal and monetary policies.

Here’s what prominent people are saying about the likelihood of a recession in 2024.

A standout among the 2024 economic forecasts is Goldman Sachs’ “Macro Outlook 2024” report, published on November 9, 2023. It is optimistic about the economy in the new year, saying that “the toughest times are behind us.” It cited four reasons:

1) Inflation is easing: The upward trend in inflation is slowing, the labor market is strengthening, and real disposable income is increasing. While it will be slower than the record-breaking real income growth in the U.S. in 2023, still enough to support GDP growth.

2) The GDP hit from a rate hike has passed its peak: the impact of monetary tightening on GDP growth lasts two quarters at most. In 2024, the impact of tighter monetary policy is likely to have lower impact than in 2023.

3) A recovery in manufacturing: The manufacturing industry has been weak since 2022 due to a slowing inventory cycle caused by overcapacity, a weaker-than-expected rebound in Chinese manufacturing, and the European energy crisis, but most of that should fade this year and recover in the long run.

4) Likelihood of rate cuts: if the U.S. Personal Consumption Expenditures Price Index (PCE) falls below 2.5%, the Fed will begin lowering rates in the fourth quarter of 2024, to somewhere between 3.5% and 3.75% in mid-2025.

Beauty industry speaks of existential threat

The problem is that the retail market for African American consumers plays slightly differently than the mainstream. While the U.S. retail industry was hyped about the last holiday season due to the revived holiday spending and record-breaking online sales on Black Friday, beauty supply retailers saw lower sales than a typical holiday season or during the pandemic. If the mood doesn’t change around the tax return season, many say we should tighten our belts for the rest of the year.

Unfortunately, there are no economists or statistics that can give an objective forecast for the beauty supply industry in 2024. We asked a number of wholesalers and retailers how they expect the beauty industry to perform this year and how they are preparing.

**We planned to include either the initials of the company or the region, but we decided not to do so because many respondents asked for anonymity.

Wholesalers

“The African American market has definitely slowed down, and even the Caucasian market is slowing down. This year, we’re avoiding launching new products and focusing on maintaining and enhancing the ones that are selling well.”

“Hair companies are in worse shape than ever. Many factories shut down in China, which will lead to supply shortages and higher prices in the future. If the production site goes down, you have nowhere to turn.”

“Many wholesalers are expanding their offerings beyond hair to include chemicals and general merchandise, and the competition is getting fierce. It’s hard for small hair wholesalers to deal with a different category.”

“I don’t expect the market to improve within the year. There’s been cautious talk of restructuring the company.”

“The biggest problem is that the bank has closed the vault door. In an era of high interest rates, who wants to pay for things with borrowed money? We’re willing to take a chance when the prospect is bright, but no company is going to take a chance in a time like this.”

“We’re looking at two years before the economy recovers. We need to have adequate inventory in place by then, but the high interest rates are frustrating.”

“Actually, the OTC market has been contracting for 20 years, except for a brief boom during the pandemic. We need to find long-term solutions such as diversifying our offerings.”

“Even though the online market has grown, beauty supplies are still strong because of hair. We’re trying to keep the range in wigs and bundles, but we’re approaching the limit as the orders slow down.”

Retail

“It was so quiet at the end of the year, and it looks like it’s going to be a rough start this year. How to prepare? We can cut back orders, but there’s really nothing we can do beyond that.”

“It’s about tax return season, but I’m not looking forward to it. People didn’t do much work last year, so they probably won’t get much refund this year. Speaking of the economy, hmm, maybe it will get better after the election.”

“We usually average $20 to $25 purchase per customer, but it’s been like $10 lately. Customers don’t buy anything expensive. Adjusting prices is the main thing we do in the store these days.”

“This year, it’s about surviving. Cut back on orders, new products, recycling existing inventory…”

“For younger owners, this year is both a crisis and an opportunity. It’s a good time to buy because there are a lot of stores that were listed for sale during the Covid-19 boom.”

“We’re actually back to where we were before the Covid-19 boom, but some things are more obvious. Inventory is usually at maximum capacity because retailers have been stockpiling during the pandemic. “

“It’s a vicious circle, because we need new products to attract customers, but the products from last year are still there. We’ve been having clearance sales since the beginning of the year, but I don’t know if we can clear them out by the end of the year.”

“Economy is one thing, but I think beauty supply business will become less and less profitable because of online retail. Young customers walk into the store and check prices on their phones. I get frustrated when they ask for price matching.”

Beauty industry’s path to survival

We had crises before. In the more than half-century of beauty supply’s existence in the U.S., we’ve weathered many crises. Here comes what we found during our search for indicators of hope and a way out of the recession.

Beauty supply customer base is solid

The customer base of beauty supplies is expanding to include Caucasians, but it’s still predominantly African Americans followed by Hispanics. Nielsen Report clearly shows that Black and Hispanic consumers spend more on beauty than other ethnicity. Hispanic consumers spend 13% more than the average consumer on beauty and personal care, and purchase 1.4 times more false nails and lipsticks. African American consumers are 2.4 times more likely to purchase hair care products and 1.9 times more likely to purchase hair styling products.As the core of beauty supply is hair, it is necessary to take a closer look at the lives of African Americans.

-According to 2022 Census Bureau data, the African-American population in the United States is 50.1 million, making up 15% of the total population and growing. In addition, the Black population is relatively younger. As of 2021, the average age of African Americans was 33, five years younger than the U.S. population average of 38.

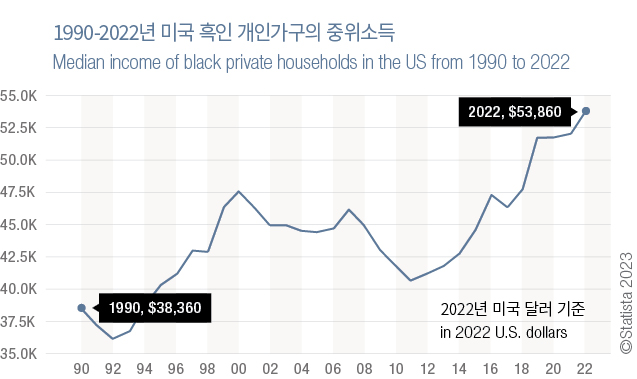

-the median income of Black households has been rising steadily since 2011. In 2022, the median household income was $52,860, showing a modest increase even after the COVID-19 pandemic.

-While racial wealth disparities remain large, studies have shown that the net asset of African American families has increased more than any other racial group since COVID-19.(Pew Research) Low mortgage rates have led to increased home ownership among African Americans during the pandemic, and the property value of African Americans’ real estate has increased by more than 70% compared to the pre-pandemic levels. African Americans have less exposure to the stock market, so their asset values didn’t change much during the wild swings on Wall Street in 2022.

Potential for more government aids

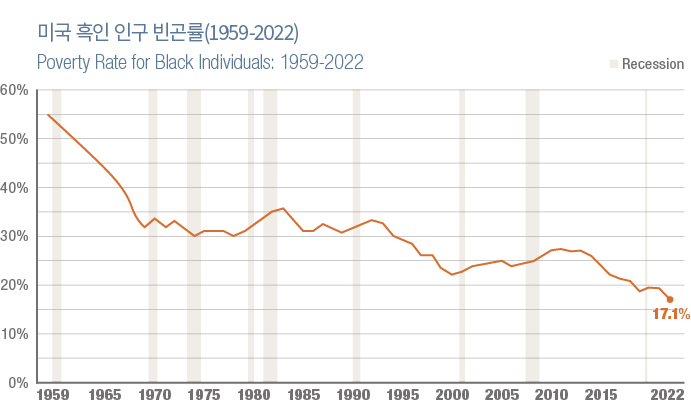

The official poverty rate for the U.S. black population hit an all-time low of 17.1% in 2022, according to the September 2023 report.

While we can expect this to decrease over time, there is still a high percentage of low-income customers who shop at beauty supplies. The end of the COVID-19 Emergency Assistance Program on March 1 of last year, which provided extra money to low-income food stamp (SNAP) recipients during the pandemic, also hit beauty supply sales hard. The good news is that SNAP benefits are increased slightly for fiscal year 2024, which started last October. The maximum monthly benefit for a family of four is $973, a 3.6% ($34) increase from the previous year. If you have a household of 8 or more, you’ll receive an additional $219 for each additional family member.

Though it varies over the regions, there are often outreach efforts before elections. This year, talks of some kind of benefit increase to African Americans are anticipated for the election season, especially since the African-American vote turned out to be a key factor in the 2022 midterm elections. If there is some fruit to the talks, it would generate extra cash flow into the beauty supply. President Biden’s fiscal year 2024 budget proposal also displayed the administration’s firm stand on the increase in social spending backed by so-called “wealth tax”.

Uptick in lipstick index

The well-known “lipstick index” is often used as a recession predictor, based on the common belief that sales of inexpensive luxury goods increase during recessions. According to Inmar Intelligence, consumers are spending more money on beauty in general, with more than one-third of survey respondents saying they spent more than $500 on beauty products in the past year. While not a bullet-proof economic theory, the lipstick index has proven its worth many times in times of economic uncertainty or hardship.

Still buying in person

According to the National Retail Federation, online shoppers outnumbered in-store shoppers during Black Friday sales in 2023, with Cyber Monday’s online shoppers outnumbering in-store shoppers by more than three to one. Online shopping is here to stay. However, one thing to note from this past Black Friday sale is that consumers clearly prefer in-store shopping over pickup. While curbside pickup was popular during the pandemic, the number of shoppers coming into the store to shop in person has increased dramatically since last year, when social activities fully resumed. Retail giants Walmart and Macy’s both reported significantly more in-store shoppers at the end of the year in 2023 compared to 2022, and RetailNext reported a 2.1% year-over-year increase in foot traffic for brick-and-mortar stores on Black Friday.

©PIX11

©NPR

A beauty editor says she prefers her local beauty supply store over stores like Sephora, Ulta, and chain drug stores, citing “lower prices, proximity, coupon policy, friendly staff, expert help, and tester products (if they don’t have them, you can ask at the register)”. Beauty supplies need to take advantage of the offline’s exclusive features.

2024. It’s clear that it’s going to be a challenging year for business. It calls for a different attitude.

A business owner who ran a successful beauty supply business for 30 years says, “If your business is slow, don’t wait for customers, go find them.” When business is slow, the business owner grabs a few small items and heads out. The idea is to give out products to people on the street or who are shopping at a grocery store while making small talk and promoting the business. “I can meet 20 to 30 people at a single mall. If you make a good impression on just one of them, that leads to ten or twenty new customers. So I’m always excited to meet new customers.”

When it comes to coping with the recession, he has a solid answer. “In business, there are always crises. A few years ago, I was told that beauty supplies were going out of business because manufacturing costs doubled in China, and I was fine after that. The early days of the pandemic were chaos, but I made it through. Everybody says this is the worst year ever, and it’s times like this that you have to keep your head up and think about what you can do differently. The recession is out of my control, so I don’t stress about it. I just try to think of what I can do. I would at least follow my passion.“

It can be a particularly tough year for hair business. It’s important to have a solid long-term goal even if it’s hard at the time. You should look beyond the low-end products. You know you should keep developing high-end products as well. There are already too many low-cost products online. It’s a good idea to keep producing high-quality human hair products that will draw customers to beauty supply stores, even if in smaller quantities. If the downturn is temporary as economists suggest, it won’t be long before you pick the fruits of your labor.

BNB will keep the door open for promoting products in various pages such as development stories, product reviews, and Hot & New of the month. Even in times of recession, when everyone else is shying away, there are companies that diligently knock on doors and say, “We’re small, but we’re confident in the quality of our products.” In the end, the power to turn the recession around lies within us.