Winter Beauty Haul 2025

What Beauty Supply Shoppers Want This Season

As winter approaches, beauty routines are set for a seasonal shift. Shoppers are planning their cold-weather essentials with a focus on hydration, protection, and holiday-ready beauty. Our latest survey of over 100 beauty supply consumers across the U.S. reveals the products that will fill baskets this winter — and the strategies store owners can use to meet demand.

Top Categories of Winter Interest: Hydration & Protection Take Center Stage

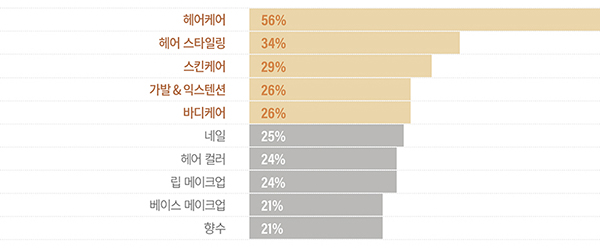

When asked which categories they are most interested in this winter, shoppers highlighted: Hair Care (56%) > Hair Styling (34%) > Skincare (29%) > Wigs & Extensions (26%) > Body Care (26%). By contrast, categories that shine in summer — like bold makeup, perfumes, and suncare — slip down the list. This season, the focus is firmly on dryness defense and barrier care.

|

Section 1: Top 5 Categories Consumers Want This winter

This winter’s Essentials: Where Demand is Hottest

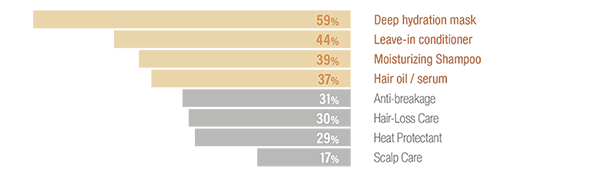

1. Haircare: The Season’s Anchor

Hair care stands out as the top priority. Within the category, shoppers lean toward deep hydration masks (59%), leave-in conditioners (44%), moisturizing shampoos (39%), and nourishing oils (37%) to fight winter dryness. Compared to summer’s frizz control, the spotlight has shifted to hydration and protection.

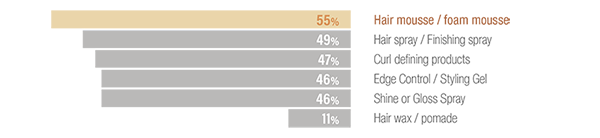

2. Hair styling: Sleek Control in Cold Weather

Styling comes second (34%), with demand strongest for mousse (55%), finishing sprays (49%), and curl definers (47%). Consumers want polished, long-lasting styles that withstand hats, scarves, and dry air — sleekness over variety.

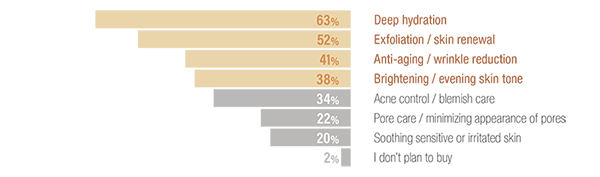

3. Skincare: Hydration Above All

Skincare (29%) is defined by hydration (63%), exfoliation (52%), and anti-aging (41%). Top products include face moisturizers (64%) and cleansers (55%). Interest in suncare drops notably: 20% don’t plan to buy at all this winter. The emphasis is on barrier protection and long-lasting moisture.

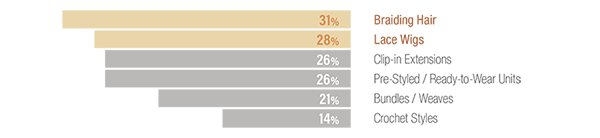

4. Wigs& Extensions: Protective Style for the Season

Wigs and extensions remain steady, led by braiding hair (31%) and lace wigs (28%). These protective styles shield natural hair from dryness and friction while keeping looks versatile and low maintenance.

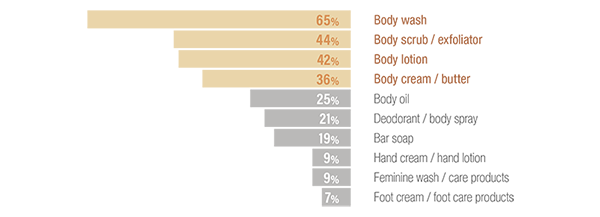

5. Body Care: Everyday Hydration Becomes Essential

Body care (26%) focuses on comfort and moisture. Body wash (65%) dominates, followed by scrubs (44%), lotions (42%), and butters (36%). Richer, hydration-driven routines are clearly taking hold.

6. Color Makeup, Perfumes, Sun care: Seasonal Decline

Categories that usually shine in summer are down this winter: lip makeup (24%), perfumes (21%), eye makeup (13%), and hair color (24%). Suncare also slips, with fewer shoppers prioritizing SPF. The shift is clear: hydration and protection are in, while bold expression and experimentation take a backseat.

Section 2: The Winter Shopping Mindset

Where, When, and How Shoppers Splurge in This Winter

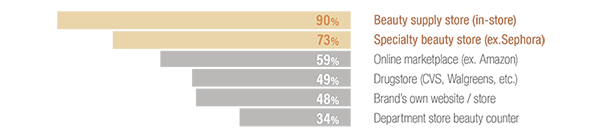

1. Where Consumers Splurge: Channel Preference

Beauty Supply stores dominate as the top splurge channel (90%), with specialty retailers like Sephora and Ulta (73%) also strong. Shoppers prioritize better prices (77%), wider assortments (56%), and brands they trust (54%), while the ability to test in-person (50%) keeps physical stores relevant.

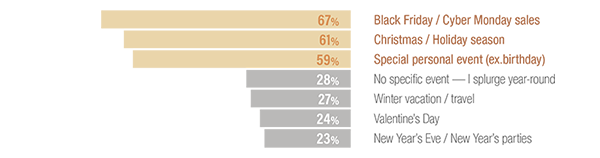

2. When Consumers Splurge: Holiday Peaks Drive Spending

Spending peaks around Black Friday, Cyber Monday, and the Christmas season, with birthdays and anniversaries also driving splurges. Promotions tied to these moments remain the most powerful sales driver.

3. How Consumers Splurge: Balancing Favorites with Experimentation

Are you planning to repurchase the same products you’ve used before, or try new ones this winter?

- I’ll try some new products, but also repurchase some favorites (69.51%)

- I’ll mostly repurchase the same products (15.85%)

- I want to try completely new products (10.98%)

- I haven’t decided yet (3.66%)

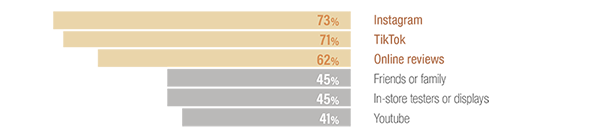

Most shoppers (70%) will repurchase favorites while also trying new products. Social media fuels this curiosity: Instagram (73%) and TikTok (71%) dominate as inspiration hubs, alongside online reviews (62%). For stores, balancing trusted staples with exciting new launches is key.

For those planning to experiment with new products this winter, social media is the clear source of influence. Instagram (73%) and TikTok (71%) dominate as the top platforms where shoppers find inspiration, followed closely by online reviews (62%). These channels highlight how digital content and peer opinions play a decisive role in shaping purchase decisions.

Section 3: Implications for Beauty Supply Owners

How to Turn Winter Shopper Insights into Action

| · Win with Price Competitiveness Better prices and promotions are the #1 reason shoppers choose a channel (77%). Use targeted discounts and loyalty offers to draw peak-season traffic into Beauty Supply stores. |

· Anchor Promotions Around Holiday Peaks

Black Friday, Cyber Monday, and Christmas are the key splurge moments. Plan inventory, gift sets, and promotions well in advance of these periods.

· Lean Into Hydration Across Categories

From hair masks to body butters, winter shoppers are prioritizing moisture and protection. Make hydration the central theme of merchandising and promotions.

· Restock Wigs and Protective Styles

Wig demand, which dipped in the hot summer, rebounds in winter. Restock braiding hair, lace wigs, and extensions to capture this renewed interest.

· Balance Staples With Newness

Nearly 70% of shoppers plan to repurchase favorites while also trying new products. Stock trusted basics alongside TikTok- and Instagram-driven launches to satisfy both comfort and curiosity.

· Social media fuels discovery

highlight trending products on Instagram and TikTok, then close the sale in-store.

This winter, beauty supply shoppers are guided by practicality and protection: hydration, barrier care, and protective styling define their priorities. While summer favorites like perfumes and bold makeup take a backseat, haircare, skincare, and body care will drive baskets. For store owners, success lies in delivering price value, stocking hydration heroes, and aligning promotions with holiday peaks — ensuring shelves match the season’s cold-weather mindset.

Ivy Beauty에서 개발한 Roundtable은 브랜드와 소비자를 연결하여 더 나은 제품을 함께 만들어가는 데 도움을 주는 혁신적인 소비자 조사 플랫폼입니다. Ivy Beauty는 실시간 데이터 분석을 통해 소비자의 니즈를 반영한 데이터 기반 의사 결정을 내리고 있습니다.

Ivy Beauty에서 개발한 Roundtable은 브랜드와 소비자를 연결하여 더 나은 제품을 함께 만들어가는 데 도움을 주는 혁신적인 소비자 조사 플랫폼입니다. Ivy Beauty는 실시간 데이터 분석을 통해 소비자의 니즈를 반영한 데이터 기반 의사 결정을 내리고 있습니다.