Penny Phase-Out:

How Beauty Supply Stores Can Prepare

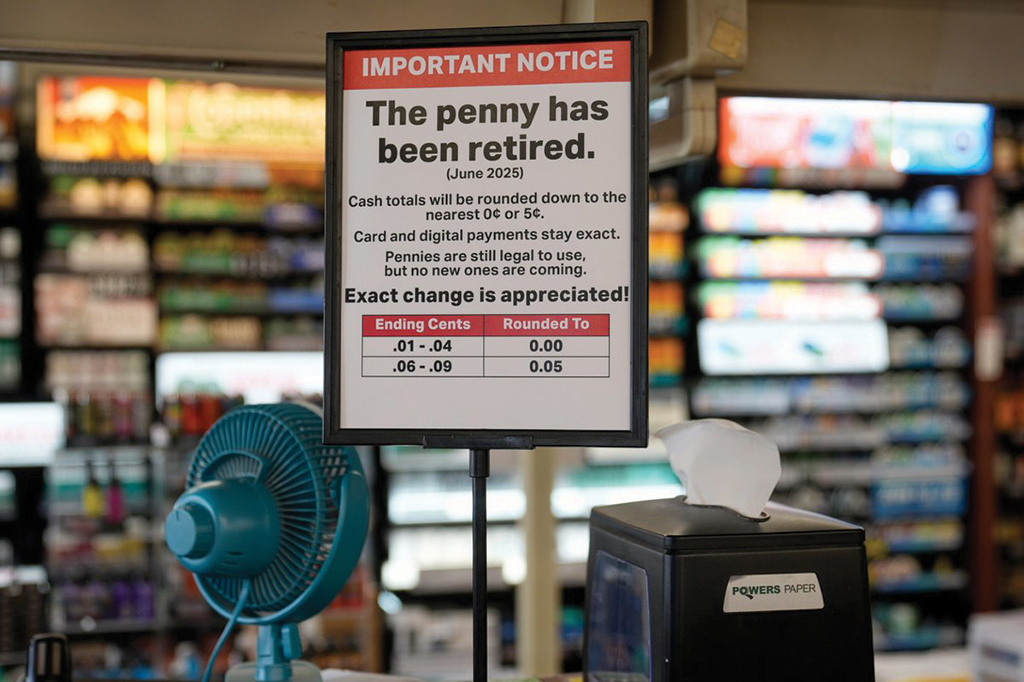

The U.S. one-cent coin ‘penny’ was officially discontinued on November 12, 2025, with the final minting at the Philadelphia Mint. Producing a penny costs about 3.7 cents, and the Treasury expects annual savings of $56 million. Experts say the impact on the broader economy will be limited since existing pennies remain in circulation. However, retail operations will face practical changes, including securing change, adjusting price displays, and handling cash payments. Some states and cities have rules on ‘cash payments,’ ‘anti-cash discrimination,’ and ‘cash discount notices,’ raising the potential for confusion between local regulations and store operations. Beauty supply stores should review key operational adjustments in response.

Implementing ‘Rounding Rules’ for Cash Transactions: Key Precautions

©www.dailypress.net

Some fast-food and grocery chains, including McDonald’s, already round cash payments to the ‘nearest five cents.’ For example, a total of $10.22 is rounded down to $10.20, while $10.23 is rounded up to $10.25. As a result, cash customers may pay slightly more or less than the exact total. The challenge is that this approach can conflict with state and local laws, making it essential to check regional regulations. At the federal level, the ‘Common Cents Act’ is being considered to establish a nationwide rounding standard. Until it passes, businesses should review local rules, clearly communicate policies, and document procedures to minimize legal risk.

- Potential Conflicts Between Cash Acceptance Laws and Rounding Rules

Even with penny production halted, existing pennies remain legal tender. Federal law does not require businesses to ‘accept cash,’ but with the rise of cashless stores, some states and cities have enacted ‘laws banning cash refusal.’

Examples of regions with cash acceptance requirements:

- States: Massachusetts, New Jersey, Rhode Island, Colorado

- Cities: New York City, Philadelphia

In these areas, refusing cash or structuring prices so cash customers pay more can be problematic. For example, a $10.03 card payment rounded to $10.05 in cash could be seen as “disadvantaging cash customers,” potentially triggering investigations or penalties for unfair trade under state law.

- Card Surcharges vs. Cash Discounts: Key Differences and Precautions

Some states forbid adding a surcharge for card payments, but offering a cash discount is generally allowed under federal and most state laws. However, disclosure requirements can be strict depending on the state. (Example: Connecticut requires clear notice across all sales channels, including in-store, online, and phone orders.)

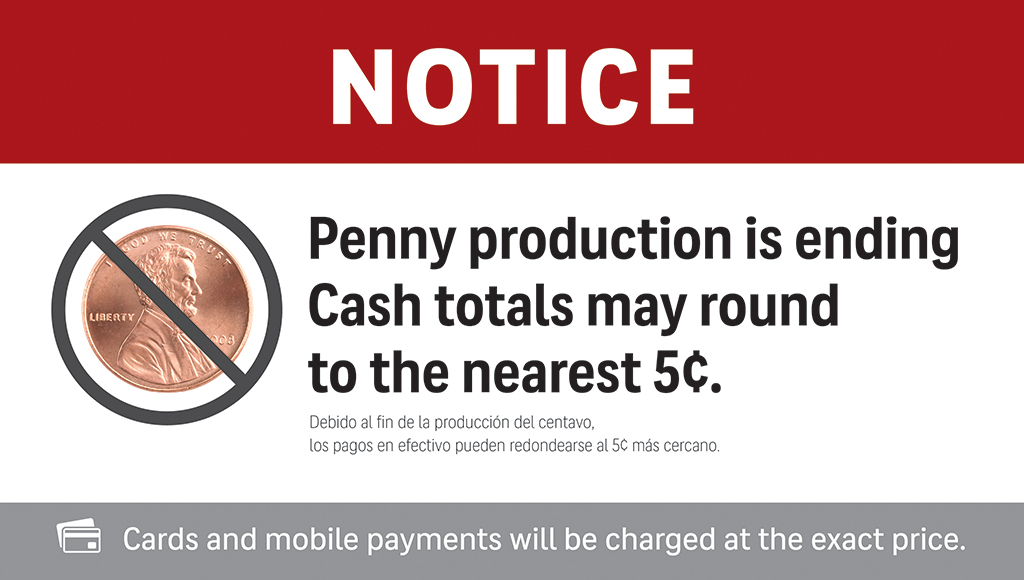

“Rounding down cash payments(↓)” creates a ‘de facto cash discount.’ Stores must clearly communicate this on signs, POS screens, or at the counter.

(Recommended notice: “Cash payments are rounded to the nearest five cents.”)

- Employee wages — must be paid accurately without exception

Employers paying wages in cash are legally required to pay the exact amount, so any form of “rounding down” is not allowed.

Key Points for Immediate In-Store Review

- Review POS and change systems

Check whether POS systems support rounding. Anticipate increased use of nickels and dimes and ensure adequate coin inventory. Review cash drawer setups at each register to enable fast and accurate change during transactions.

- Staff training: Key to minimizing customer complaints

Employees should understand why and when pennies were discontinued, the purpose of rounding rules, and how transactions are calculated. Emphasize repeatedly that “card and mobile payments are unaffected” to prevent unnecessary customer confusion.

- Customer notices: Transparency builds trust

Beauty supply stores with frequent cash transactions should proactively inform customers of the changes. Place notices at store entrances, near registers, and on POS screens where customers are sure to see them.

Finding Opportunity Amid Confusion

©www.cantonrep.com

The large grocery chain ‘Giant Eagle’ ran a promotion converting pennies brought in by customers at double face value onto store gift cards. The campaign collected over 100 million pennies. It not only addressed coin shortages proactively but also encouraged future visits through gift cards, making it a standout example of driving customer traffic, repeat visits, and brand goodwill simultaneously.

Optimal timing to increase digital payments

Rounding rules apply only to cash, making this a good opportunity to gradually encourage electronic payments. Stores can guide customers by:

- Clearly displaying all available digital payment options, such as Zelle, Cash App, and Apple Pay, at entrances and counters

- Posting notices like “No Rounding for Digital Payments” alongside the options