As Black Women’s Employment Falters,

Beauty Supply Stores Require ‘Realistic Strategies’

September’s employment report, delayed by the federal shutdown, showed a sharp drop in Black women’s employment. Data predates the shutdown, so the additional deterioration during that period is not reflected yet. When employment weakens for Black women, the core customer base for beauty supply stores, spending power naturally falls → shifts in priorities → changes in brand choices. Because these shifts directly affect store operations, it is important to review practical adjustments that can be applied on the sales floor right away.

Key Summary: Black Women and Black Mothers in the Labor Market

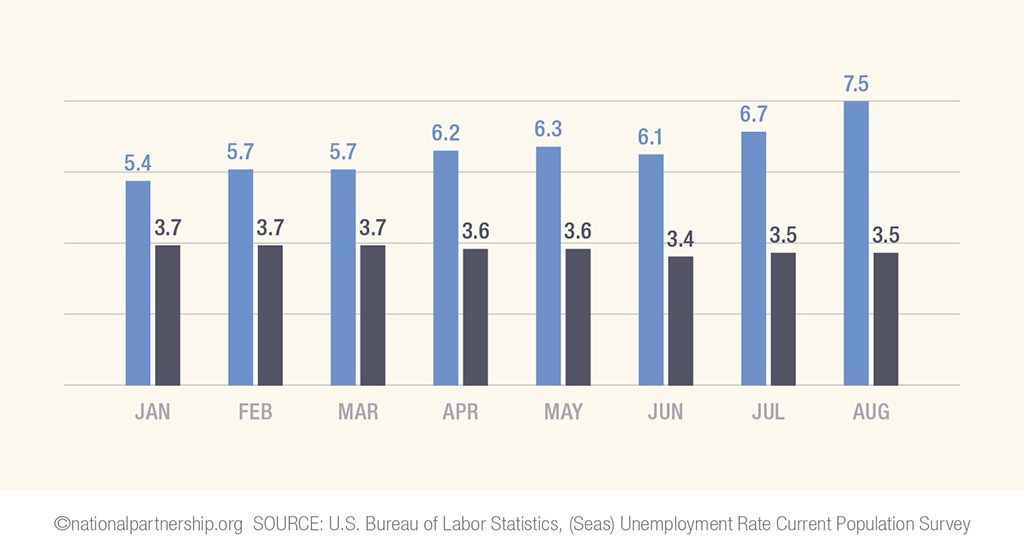

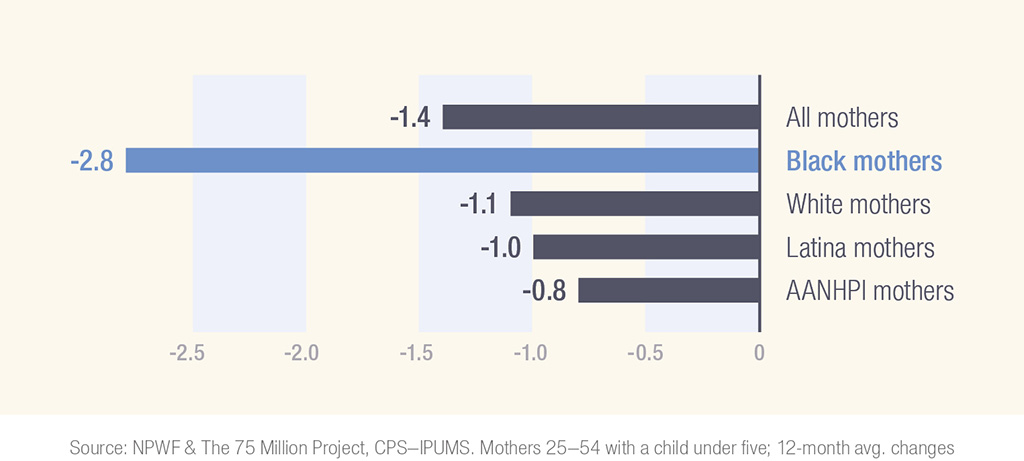

1. Sharp drop in labor force participation among Black mothers with young children

- Economic participation down 2.8% points since December 2023

- Larger decline than during the pandemic

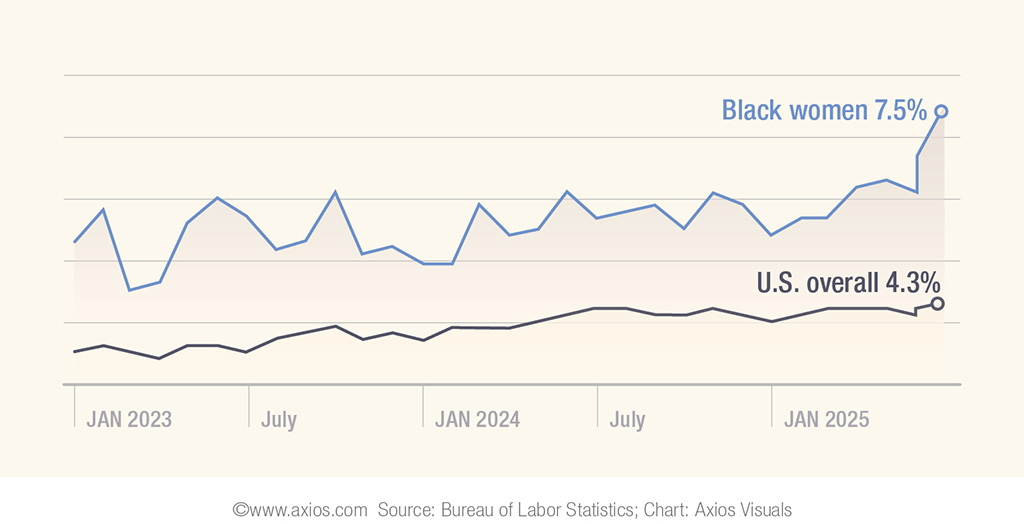

2. Unemployment among Black women rises sharply compared with other groups

- 5% in September 2025, the highest in about four years

- During the same period, White women’s unemployment rate 3.4% → Black women’s rate more than double

3. Accelerated exit of Black women from the workforce

- Estimated over 300,000 Black women left the labor market since early 2025

“Federal job cuts are hitting sectors where Black women make up a large share of the workforce. On top of that, tariff pressures are putting heavy strain on small businesses that employ many Black women. DEI(diversity, equity, and inclusion) is now viewed negatively, so hiring is slowing. All of these factors are happening at the same time.”

“Federal job cuts are hitting sectors where Black women make up a large share of the workforce. On top of that, tariff pressures are putting heavy strain on small businesses that employ many Black women. DEI(diversity, equity, and inclusion) is now viewed negatively, so hiring is slowing. All of these factors are happening at the same time.”

– Andre Perry, senior fellow at the Brookings Institution, in an interview with Bloomberg.

Realistic Strategies

① Shift in spending patterns: Focus moves to products with clear results

©www.shapeshiftermedia.com

As job insecurity and disposable income decline, consumers tend to favor products with clear benefits. Items addressing scalp issues, braiding maintenance, or dark spots should be prioritized, and in-store displays reorganized to highlight ‘effectiveness.’ Categories with too many similar products can hinder choice, so narrowing the lineup around core SKUs can be an effective strategy.

② Rising price sensitivity: Value lines take on greater importance

©Youtube@Adanna Madueke “BEST AFFORDABLE Natural 4C Hair Products”

Even as customers cut spending, they still look for a sense of reassurance. Products priced between $3 ~ $8 meet this need and maintain steady sales in uncertain conditions. This price tier also helps keep customers in the store, serving as a ‘buffer.’ What matters is not cheap goods but a clear sub lineup that offers reliable quality for the price. It serves as a practical way to give customers workable options during periods of price fluctuation.

③ Decline in salon demand: Growth potential for home care products

Young black woman working at home and making afro braids to young black men

As economic stress rises, salon visits naturally decrease, creating space for home and self-care products. Stores can focus on products that allow consumers to perform treatments at home that were once considered ‘salon-only,’ bundling and highlighting them as a key growth category.

④ Small, continuous promotions outperform large sales

©easternloveaffair.com

Recent consumer trends show greater sensitivity to ongoing, modest incentives than to major discounts. Targeted weekday deals, mini-size gifts with minimum purchases, or weekly promotions on 1 ~ 2 SKUs ease ‘buying decisions’ and reduce inventory pressure.

⑤ Recession trait: Heightened sensitivity to service experience

When spending cautiously, customers pay closer attention to the store experience. Tidy displays, store scent, and checkout speed strongly influence purchases. Immediate alternative options when a desired product is unavailable also play a key role in customer satisfaction.

Shopping Bag Satisfaction Scale with Emoji Ratings on Purple Background Vector Illustration