2025 BS Customer Satisfaction Report

What 2026 BS Stores Must Do to Win Loyalty,

Wallet Share, and Trust?

Beauty Supply stores sit at the intersection of necessity and aspiration, serving millions of consumers who rely on them for daily haircare, makeup, and self-expression. But as competitive pressures increase—from big-box retailers to social-led commerce—BS stores can no longer rely on convenience alone. The latest 2025 customer satisfaction findings reveal a pivotal moment: shoppers still love their Beauty Supply stores, but they are becoming more vocal, more selective, and far more demanding. As we enter 2026, the question is no longer whether BS stores will evolve—it’s how quickly they can adapt to a new era of value, service, and digital expectations.

SETCION 1 — THE NEW REALITY OF BS SHOPPERS

A Strong Year — But Shoppers Expect More in 2026

Do you think your BS experience was better this year than last year?

The 2025 Beauty Supply (BS) Customer Satisfaction Survey reveals an encouraging trend: 85.5% of shoppers say their BS experience improved compared to last year. They credit this largely to better product variety, improved inventory availability, and an increase in new product offerings.

1) What BS Shoppers bought in 2025?

Haircare (76%), makeup (56%), nail (51%), and accessories (47%) are their most frequently purchased categories. Beauty Supply stores are still the heart of everyday beauty routines—especially for haircare, protective styles, and high-frequency categories like nails, lashes, and accessories.

1) Why Shoppers Visit BS Stores — The Top Drivers

Consumers ranked their primary motivations clearly:

- Wide product variety (rank #1)

- Affordable prices (rank #2)

- New product exploration (rank #3)

This reinforces the BS store’s competitive advantage: curation and discovery. Shoppers rely on BS stores not only for staples but also for inspiration, trends, and niche products that may not appear in big-box retail. But success in 2026 will require elevating the experience as much as the assortment.

Product quality satisfaction

How satisfied are you with the quality of products you typically buy at BS stores?

BS customers generally showed a high level of satisfaction(52.1%) with product quality. Across all categories, they felt that product quality remained consistent with last year. Notably, in haircare, skincare, and makeup, many perceived improvements compared to the previous year. This indicates that the quality of chemical products sold in BS stores continues to advance year over year.

| Category |

Worse |

Same |

Improved |

| Lash products |

3.8% |

53.8% |

42.5% |

| Nail products |

3.8% |

51.3% |

45.0% |

| Haircare |

7.5% |

38.8% |

53.8% |

| Wigs/Weaves/Extensions |

7.5% |

56.3% |

36.3% |

| Hair tools |

7.5% |

51.3% |

41.3% |

| Men’s grooming |

2.5% |

72.5% |

25.0% |

| Skincare |

5.0% |

43.8% |

51.3% |

| Make up |

5.0% |

41.3% |

53.8% |

| Apparel |

8.8% |

60.0% |

31.3% |

| Accessories |

3.8% |

52.5% |

43.8% |

| Total |

5.5% |

52.1% |

42.4% |

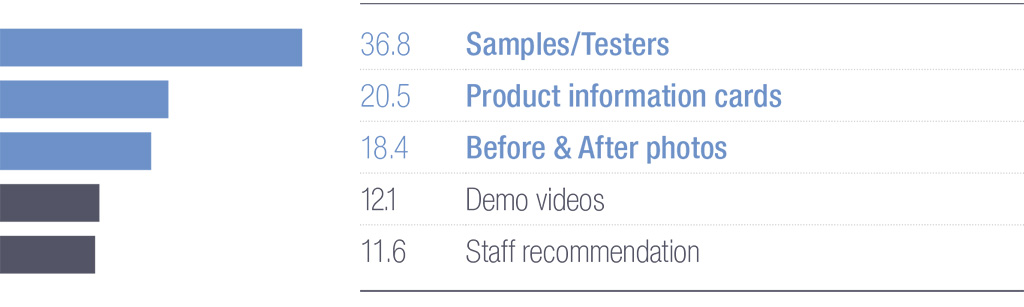

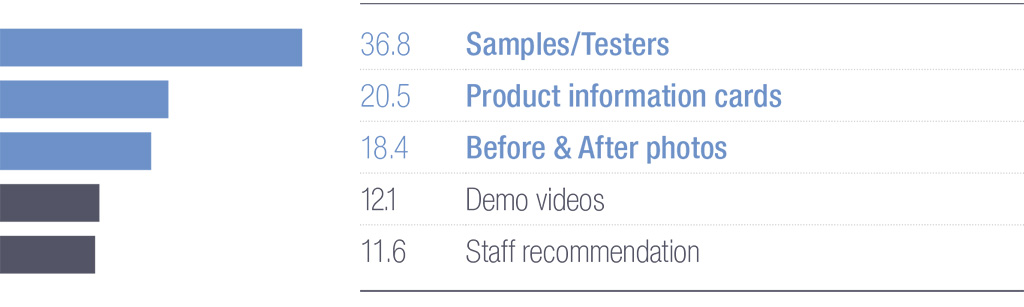

Helpful product information format

Customers preferred hands-on formats—such as samples/testers—as the most helpful type of shopping information. This was followed by product information cards, before-and-after photos, demo videos, and staff recommendations.

Pricing perception

When customers described their positive experiences at BS stores, the most frequently mentioned words were “staff” and “hair.” This indicates that knowledgeable and friendly employees significantly enhance the shopping experience. It also shows that, more than in any other category, customers rely heavily on store staff when trying to purchase products that match their specific hair needs and conditions.

Positive Experiences

In contrast, the most frequently mentioned disappointment when shopping at BS stores was ‘product out-of-stock’ issues. For customers who rely on BS stores due to their convenience and local accessibility, not being able to purchase the product they want—when they want it—became a major point of frustration.

This was followed by experiences where the ‘store layout felt cluttered or overwhelming’, making it difficult to locate desired items. Additionally, ‘high prices’ were mentioned several times as another source of dissatisfaction.

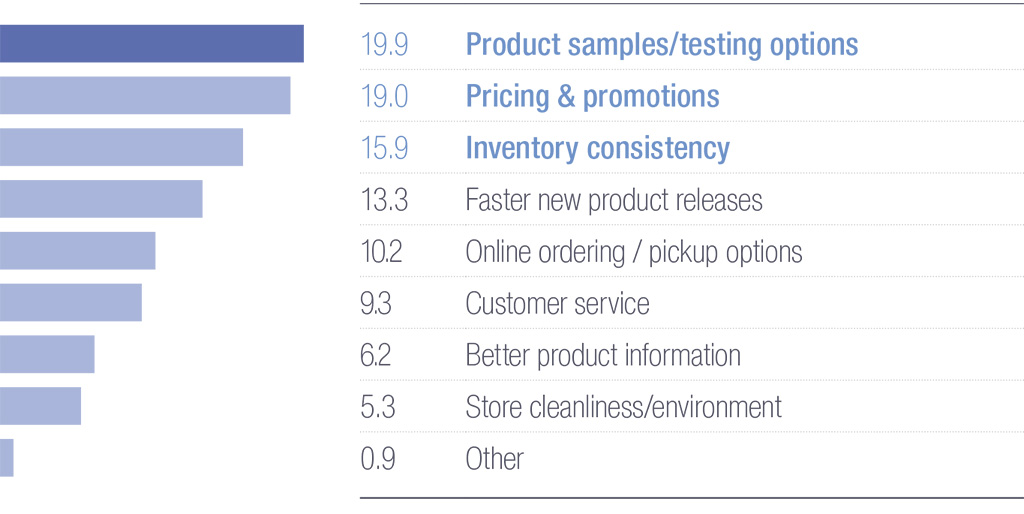

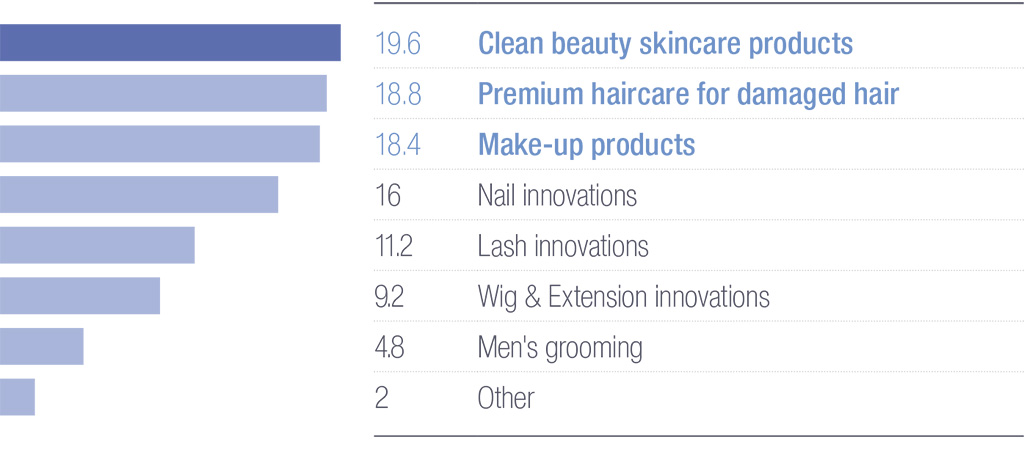

SECTION 2 — THE FUTURE OF BS STORES

What Customers Say Will Define Successful Stores Next Year

CONCLUSION: The 2026 Blueprint for Beauty Supply Success

Based on the 2025 data, the winning BS stores in 2026 will:

▶ Strengthen pricing transparency and promotional value

▶ Ensure consistent inventory across top-selling categories

▶ Increase sampling, testers, and product education

▶ Train staff regularly to improve knowledge & customer care

▶ Enhance store ambience, organization, and overall vibe

▶ Expand experiential services and high-touch consultations

▶ Bring in more premium, clean, and trendy beauty brands

The message from shoppers is consistent and loud:

“We love Beauty Supply stores—but we are ready for the next level.”

Beauty Supply is evolving. The retailers who evolve with it will lead the market in 2026 and beyond.

Thank you!