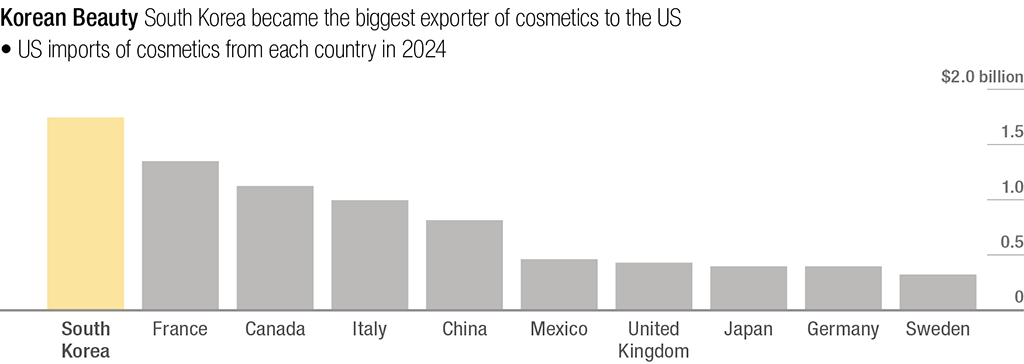

Last year, K-beauty surpassed longtime leader France to claim the top spot in the U.S. market for imported cosmetics, reaching $1.71 billion in sales. As China—formerly dominant in manufacturing, distribution, and online commerce—grapples with tariffs and policy uncertainty, K-beauty has emerged as a strong alternative in the U.S. market. Its products are already proven globally and enjoy high favorability among consumers on social media. Even with looming tariff hikes, K-beauty continues to hold a strong pricing advantage, as key competitors grapple with equal or higher cost pressures. If wigs once marked the beginning of Korean exports to the U.S., K-beauty is now poised to lead the next wave of growth. Beauty supply stores across the U.S. could become the perfect stage for K-beauty to shine offline. This is a key moment to shift consumer perception: “K-beauty isn’t online—it’s found at the local beauty supply store.”

K-Beauty in the U.S. Market: By the Numbers

1. South Korea: No. 1 in U.S. cosmetics imports

©Bloomberg

According to the U.S. International Trade Commission (USITC), the value of Korean cosmetics imported into the U.S. market in 2024 reached $1.71 billion (approximately KRW 2.5 trillion), securing the top position by a significant margin. France followed in second place with $1.263 billion (approximately KRW 1.8 trillion), and Canada ranked third with $1.022 billion (approximately KRW 1.5 trillion). These figures highlight K-beauty’s emergence as a structural powerhouse in the industry.

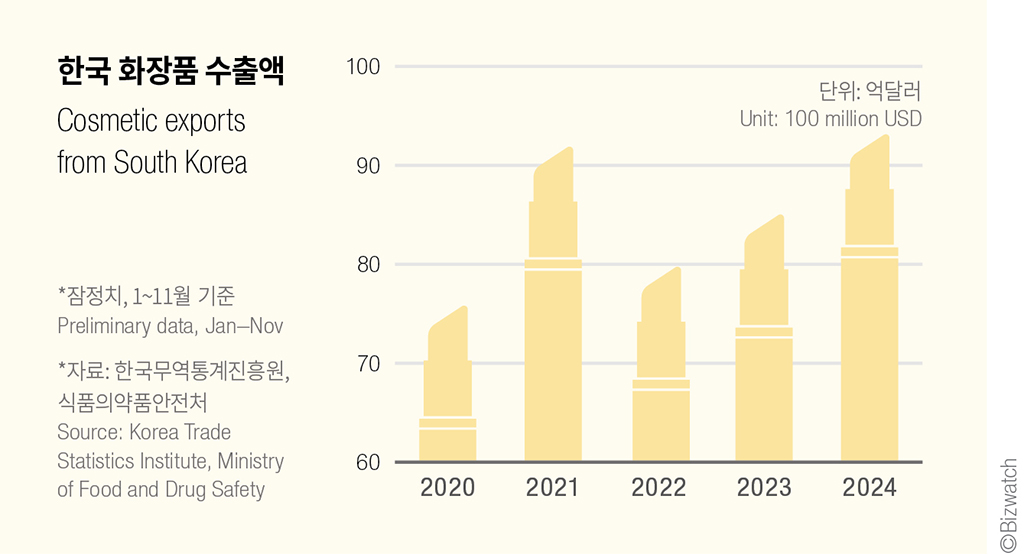

2. Global export recovery: strong rebound after the pandemic

According to data from the Korea Trade Statistics Institute (KTSPI), global exports of K-beauty products have followed this trajectory:

- 2021: $9.2 billion (with the highest export volume to China)

- 2022: $8.0 billion (–13.0% year-on-year)

- 2023: $8.5 billion (+6.3% year-on-year)

- 2024 (January–November): $9.3 billion (surpassing the total export value of 2021)

China’s share of K-beauty exports has gradually declined from its peak of 52.8% in 2021, while exports to the U.S. and Japan have steadily increased. After a brief downturn following the pandemic and global economic challenges, the industry is rebounding quickly and setting new records—signaling that a more sustainable export structure is now in place.

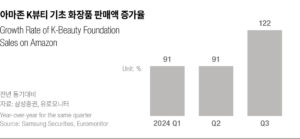

3. Overwhelming growth in the U.S. e-commerce market

In the third quarter of 2023, sales of Korean-made basic cosmetics on Amazon in the U.S. surged by 122% year-on-year, according to data from Samsung Securities.

- Amazon’s overall basic cosmetics market grew by 29% during the same period.

- K-beauty grew more than four times faster than the overall market.

- Growth rate of Korean-made cosmetics across U.S. e-commerce: 79%

- Overall average growth rate: 14% (K-beauty was more than five times higher)

These numbers reflect a surge driven by strong consumer confidence and repeat purchases.

4. “Hot” in the global M&A market

K-beauty is rapidly emerging as a promising M&A target for global beauty companies and private equity firms.

For instance, L’Oréal, the world’s largest cosmetics company, recently acquired the Korean skincare brand Dr.G. “Private equity interest in Korean cosmetics is surging and given the growth of Korean exports to the U.S., the M&A boom is expected to continue this year,” said an MMP official.

Three Competitive Advantages That Have Captivated the U.S. Market

Why K-beauty has become the standard: competitive pricing, innovative technology, and a strong digital presence

1. Prices remain competitive despite the planned tariff hike

K-beauty products remain reasonably priced compared to traditional French and Italian cosmetics. While the upcoming tariff increase will inevitably impact prices, competitors such as France and Canada face similar or even higher tariff rates than South Korea, preserving K-beauty’s relative price competitiveness.

Moreover, K-beauty companies are reinforcing their localization strategies by securing local production facilities and establishing distribution networks in the United States, rather than relying solely on exports. This approach helps mitigate tariff risks in the long term and builds a more sustainable presence in the market.

2. World-class indie brands fueled by flexible production and demanding consumers

Many of the most popular K-beauty brands in the U.S. are indie brands*, not conglomerates. The rise of indie brands to global competitiveness has been driven by demanding Korean consumers. To meet their high expectations, quality standards across the market have risen and naturally filtered down to the brands that satisfy consumers in a variety of ways. Behind this is an ODM* system with a sophisticated manufacturing infrastructure. They can produce small batches, have fast sampling and feedback loops, and are able to react quickly to changing trends. As the first ODM company in the cosmetics industry, Kolmar Korea has grown its customer base by more than 50%, from approximately 2,500 in 2022 to about 3,800 in 2024. Beauty of Joseon, which created the K-sunscreen phenomenon on Amazon, and d’Alba, which gained popularity for its high-performance foundation, are also customers of Kolmar Korea.

* Indie Brand is short for “Independent Brand” and refers to a brand that is not affiliated with a conglomerate or large distribution network and operates independently.

* ODM stands for Original Design Manufacturing, which means that the manufacturer, rather than the brand, is responsible for the design, development, and production of the product.

3. K-Beauty’s digital edge accelerates with TikTok

K-beauty is also demonstrating global competitiveness through content and marketing — with TikTok emerging as a key driver of its explosive growth.

- Number of TikTok users in the U.S.: Over 170 million

- ‘Korean skincare’ content views: 180% year-over-year growth (2024)

- Hashtag #kbeautymakeup views: Over 85% increase

- 6 out of the top 10 most popular beauty brands on TikTok are K-beauty brands

(Source: www.cosmeticsdesign.com)

(출처: www.cosmeticsdesign.com)

Unfamiliar no more, naturally embraced — The current K-beauty presence

K-beauty has not yet fully taken root in the U.S., particularly in small and mid-sized cities, where it remains more of a curiosity — something consumers might be intrigued to try. And curiosity often leads to action — people are quick to spend on things that intrigue them.

Today, Korean culture has become an integral part of American life, influencing everything from music and TV dramas to food, fashion, and beauty. Under the broader umbrella of “K-culture,” South Korea is no longer seen as unfamiliar. Instead, it is increasingly recognized as a brand worth exploring, a culture that invites curiosity, and a country that inspires fascination — and this is precisely where the opportunity for K-beauty lies.

The same applies to beauty supply retailers across the United States. They need a strategy that integrates K-beauty seamlessly into their existing distribution networks and customer relationships. The key is to position it as an addition, not a replacement. The perception that “beauty supply equals Korean” is actually a strength. It’s essential to cultivate consumer trust by reinforcing the idea that this store carries leading K-beauty trends and offers reliable products.

In fact, K-beauty gained traction in the U.S. market several times before, particularly in the 2010s. However, back then, the distribution structure was disorganized, shipping was slow, prices were high, and purchasing process was inconvenient. Today, the landscape has changed. Online retailers like Amazon have made K-beauty products more accessible, the formulations are gentle yet effective, and prices remain competitive. Sunscreens and foundations, in particular, have received strong responses through social media and word of mouth. Some K-beauty items have already become everyday staples among American consumers, with comments like, “You can’t have a summer without Korean sunscreen.” K-beauty is no longer a fleeting trend — it’s making a lasting impression.