Summer 2025: BS Consumer Purchase Forecast

– Ivy Beauty Research

Top Categories, Emerging Trends & Store Recommendations Based on a Consumer Survey

As temperatures rise and seasonal routines shift, what are Beauty Supply (BS) customers planning to buy in the summer of 2025? To explore purchasing intent and uncover seasonal trends, we conducted a comprehensive survey with 220 beauty supply consumers. The results provide a clear snapshot of rising interest in personal care and makeup essentials—many of which reflect deeper changes in consumer mindset and lifestyle.

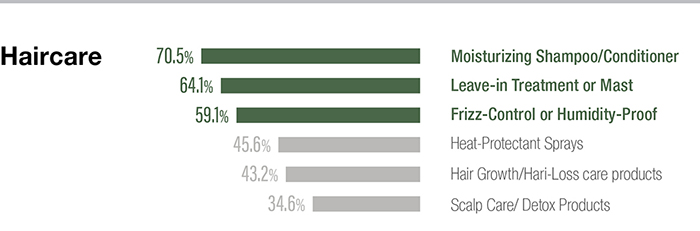

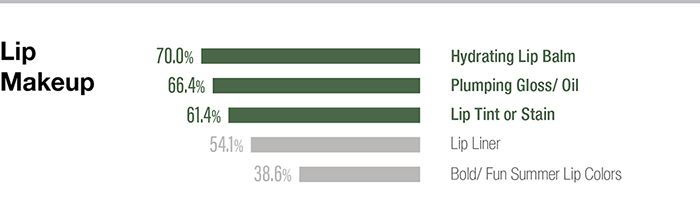

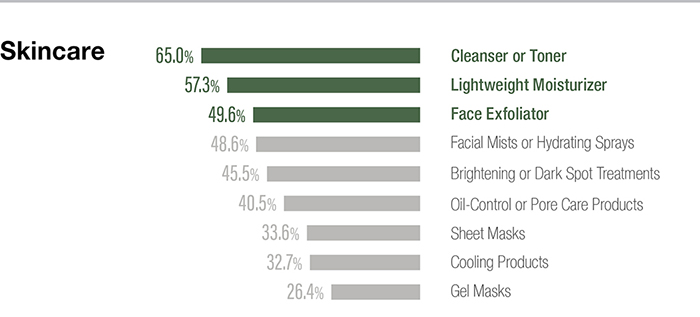

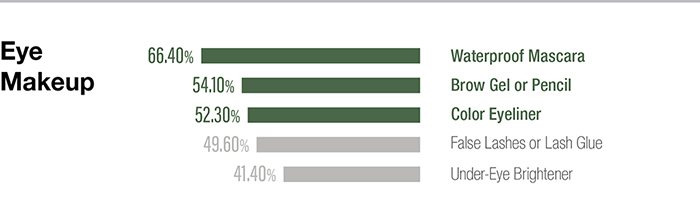

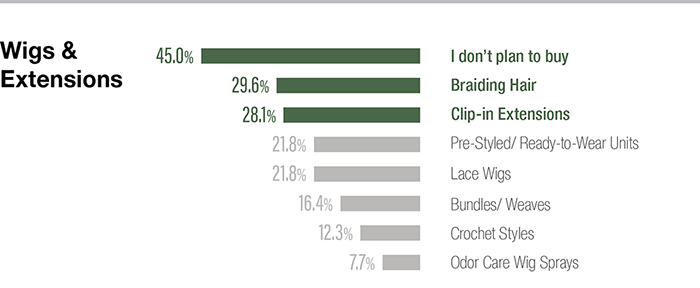

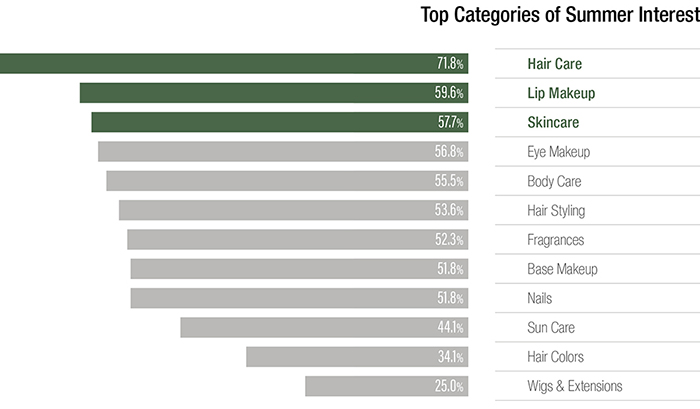

According to respondents, the top categories they are most interested in purchasing this summer are: Haircare (71.82%), followed by Lip Makeup (59.55%), Skincare (57.73%), Eye Makeup (56.82%), and Body Care (55.45%). Hair Styling, Fragrances, Base Makeup, Nail Products, Sun Care, Hair Color, and Wigs & Extensions followed in descending order. A key takeaway is the dominance of haircare, even above skincare—a strong reflection of the growing “skinification” trend in hair, where scalp and hair health are treated with the same attention as facial skin.