Golden Key POS acquires card processing company TPS

You can expect more industry-specific POS and lower card processing fees.

Retail businesses including beauty supplies used to be considered cash businesses, but the proportion of credit card transactions is increasing over the years. Processing fees for credit or debit cards are usually proportional to the total transaction amount, and they vary depending on the credit card brand and your processing company.

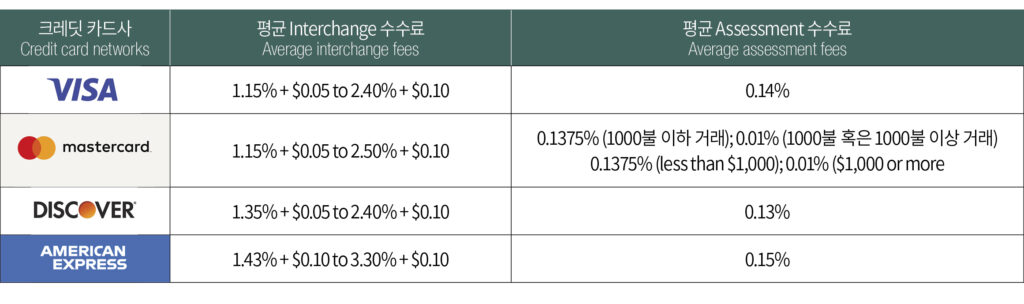

Credit card processing fees amount to 1% to 3% of the total transaction amount for credit cards and 0.5% to 1.5% for debit cards. The processing fees include payments to the credit card network, an issuing bank, and so on. Because of the processing fees, some retail businesses require their customers to pay the extra amount when they use a credit card instead of cash.

Also, when a customer wants to use a credit card brand associated with a higher processing fee, some retail business owners even outright refuse to accept the card. This is not great for a business reputation especially if the business relies on Google Review. As a result, many retail business owners want to find a way to reduce the processing fee instead of refusing credit card transactions.

What are the items included in the credit card processing fee?

- Interchange Fees

Interchange fees are paid to the issuing bank or company for a credit card transaction. The fees vary depending on the card brand, transaction amount, and industry, and some credit card companies impose higher fees for online purchases.

- Payment Processor Fees

Credit card processors, not the credit card networks, charge these fees in return for facilitating credit card transactions. They often come in monthly fees, per transaction fees, equipment leases, and invoicing fees.

- Assessment Fees

These fees are paid directly to credit card networks (or brands) of credit cards, and they are based on monthly sales instead of the transaction amount. With the interchange fees, it constitutes credit card transactional fees.

American Express charges relatively higher transaction fees, so some merchants do not accept the card brand altogether, but globally, the American Express network is growing in influence, making it hard to reject card members.

How can you reduce credit card processing fees? Different credit card processors have different fee structures. Some processors have higher fees per transaction while providing free equipment, and others have lower fees with an equipment lease. In addition, retail business owners should pay attention to the per transaction fees and monthly fees.

Golden Key POS, loved by many beauty supplies for its simple and efficient POS, made a remarkable announcement. Its M&A with credit card processing company TPS took place recently.

Through the M&A, Golden Key POS acquired a major credit card processor First Data and TSYS processor’s wholesale ISO license and is expected to provide more affordable fees through expert analysis.

Golden Key POS has been delivering a premium all-in-one service to the beauty supply industry including the lowest card processing fees, industry-specific tailored POS programs, website building and design, digital marketing, and social media solutions while TPS has been servicing more than 1,000 accounts nationwide for the past 25 years in Georgia, New Jersey, New York, and Alabama, making the M&A a significant event with a great potential for generating synergy.

CEO Eric Kim of Golden Key POS says, “because of this M&A, Golden Key POS changed its name to “Golden Key TPS,”and its 50-person workforce will provide quicker and pin-pointed customer service to business owners nationwide with a foundation of low service fees and stable system.

Golden Key TPS | 888-992-1715 | info@goldenkeypos.com